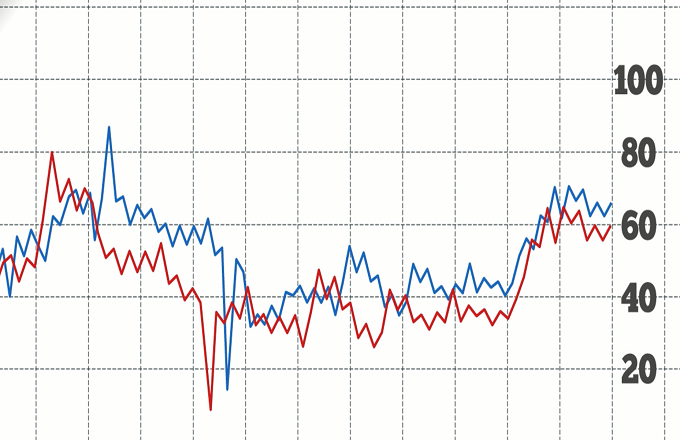

The success of a short sale hinges on the price of the shorted security falling in a small amount of time. Short sales work best in certain circumstances.For example, the best time to make a short sale is when a bearish trend is rapidly developing. A decline of even 10% in a broad index like the S&P 500 should set off alarm bells for most market participants. Another good time is when fundamentals are deteriorating. But be careful. If a company reports an unexpected loss in one quarter, it could stem from a one-time asset write-down that might be temporary. On the other hand, it could come from a big drop in sales that signals deteriorating fundamentals. Or when technical indicators signal “sell.” That could be when a short-term moving average crosses below the long-term average. More technical indicators that support the same bearish trend make for a stronger sell signal. Another potentially good time for short sales is when there’s an abrupt change in momentum or sentiment. The biggest bear markets develop after all-time highs have been reached, like the Nasdaq index from 2000 to 2002. Investor sentiment frequently does an about-face in the wake of a new peak. Unfortunately, spotting this sudden shift is not easy. Experienced traders might go short if only one condition is present. But the best chances for success emerge when all of these factors prevail.