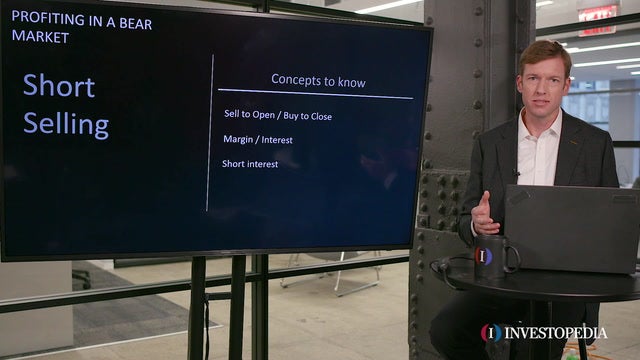

Stocks are owned in a long position and owed in a short position.An investor who owns 100 shares of XYZ is said to be long 100 shares. The investor has paid for the stocks in full. This is a bullish position—the investor expects the stocks’ price to rise. If the investor has sold 100 shares of XYZ without owning them, he is short 100 shares. This is a bearish position—he expects the stock’s value to fall. Typically, when an investor shorts a stock, he borrows the shares in a margin account from a brokerage firm and sells them. At settlement, the short investor must purchase shares in the market, at what he hopes is a lower price, to pay back the brokerage. Buying or holding a call or put option is a long position. The investor owns the right to buy or sell the security from the writer at the strike price. When an investor sells a call or put, he is short the position. He owes the holder the right to buy or sell the shares from him at the holder’s discretion. Often, an investor will simultaneously establish long and short positions to leverage or produce income.