|

Profitable Pattern Number Three

Head and Shoulders: A Chart Advisor Staple

The head and shoulders pattern is a prevailing pattern among short sellers (investors who profit from downtrends). After three peaks, the stock plummets, offering a textbook, high-return opportunity to traders who catch the trend early.

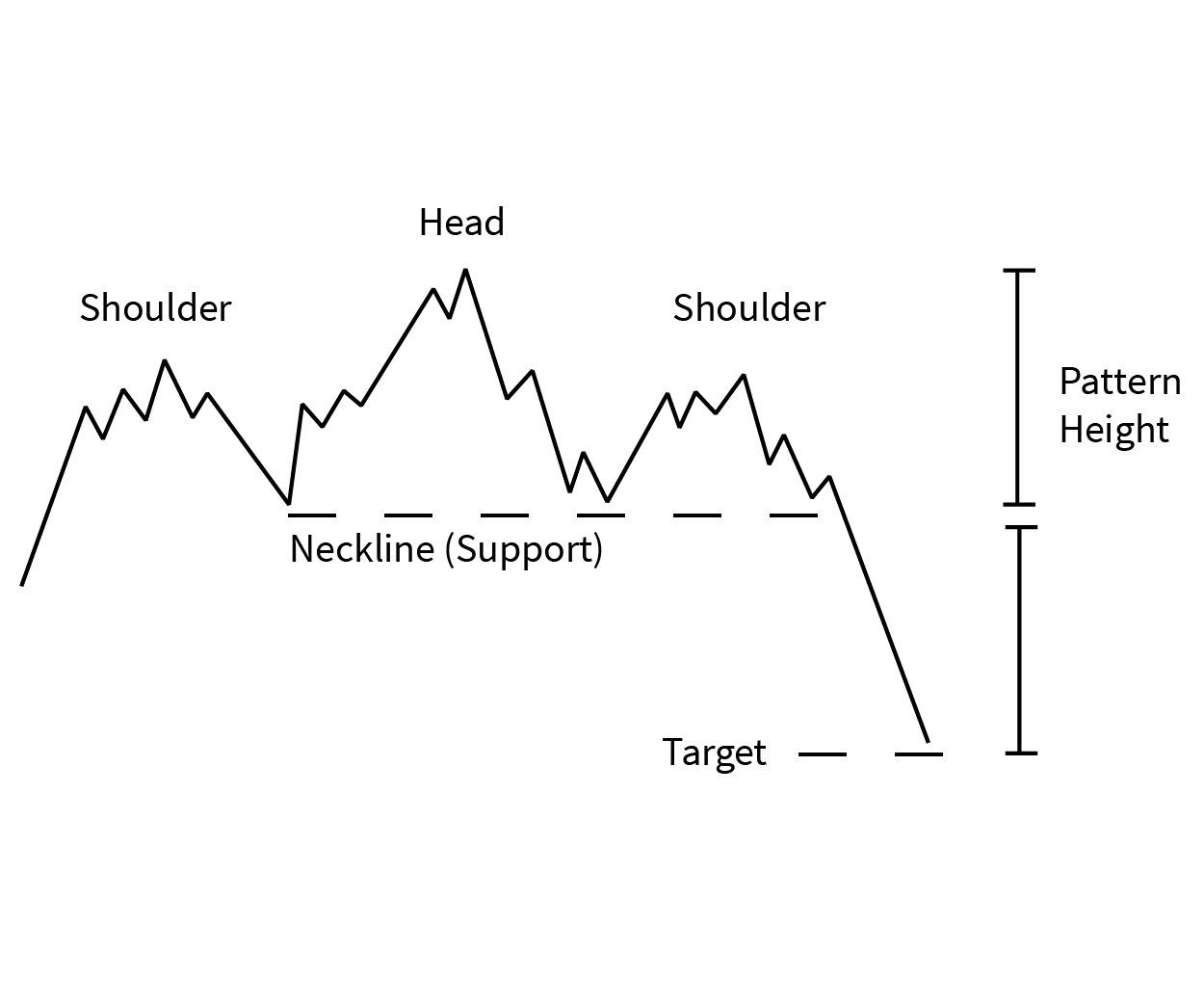

Head and Shoulders Pattern - Head and shoulder patterns are characterized by a large peak bordered on either side by two smaller peaks. Draw one trend line, called the neckline, connecting the bottom of the two troughs.

The first trough is a signal that buying demand is starting to weaken. Investors who believe the stock is undervalued respond with a buying frenzy, followed by a flood of selling when traders fear the stock has run too high. This decline is followed by another buying streak, which fizzles out early. Finally, the stock declines to its true value, below the original price.

How to Profit from the Head and Shoulders Pattern

Short sell as soon as the price moves below the neckline, after the descent from the right shoulder.

Set Your Target Price:

For the head and shoulders pattern, buy shares at a target price of:

- Entry price minus the pattern’s height (distance from the top of the head to the neckline).

Double/Triple - Bottom/Top

-

Investing

Investing4 Stocks With Bullish Head and Shoulders Patterns for 2016 (PG, ETR)

Discover analyses of the top four stocks with bullish head and shoulders patterns forming in 2016, and learn the prices at which they should be considered. -

Trading

TradingInverse Head and Shoulders Patterns Breaking Out

Watch for higher prices if these stocks complete inverse head and shoulders patterns (a bottoming pattern). -

Trading

TradingFacebook Stock May Complete Head and Shoulders Top

Facebook may succumb to growing controversy, completing the last stage of a head and shoulders breakdown that targets the $130s. -

Trading

TradingUnited Technologies Stock Nears Major Breakout

Dow component United Technologies could break 2015 resistance in coming weeks and head toward $160. -

Trading

TradingStock Chart Patterns to Keep an Eye On

Some of these stocks are exhibiting big chart patterns, so a breakout is likely to be significant. -

Trading

TradingMost Commonly Used Forex Chart Patterns

Greatly improve your forex trading by learning these commonly used forex chart patterns that provide entries, stops and profit targets. -

Trading

TradingIntroduction to Technical Analysis Price Patterns

How to recognize price patterns that are key to technical analysis. -

Trading

TradingChipotle Breaks Down From Head & Shoulders (CMG)

Chipotle shares broke down from a head and shoulders pattern that could put a halt to their rally this year. -

Trading

TradingGoldman Sachs Breaks Down from Head & Shoulders

Goldman Sachs recently broke down from its head and shoulders pattern, which could spell a larger fall for the iconic investment bank.