|

Profitable Patterns Number Four and Five

Double and Triple Bottoms and Tops: Reversals upon reversals

When you see a W or M pattern forming, you may have just discovered a money-making double bottom or double top pattern. These patterns are common reversal patterns used to suggest the current stock trend may be likely to shift.

But don’t panic if your double bottom or double top patterns do not develop as you had originally thought. You haven’t lost your chance to profit. If your W or M pattern reverses for a fourth time, you could now be working with the profitable triple bottom or triple top.

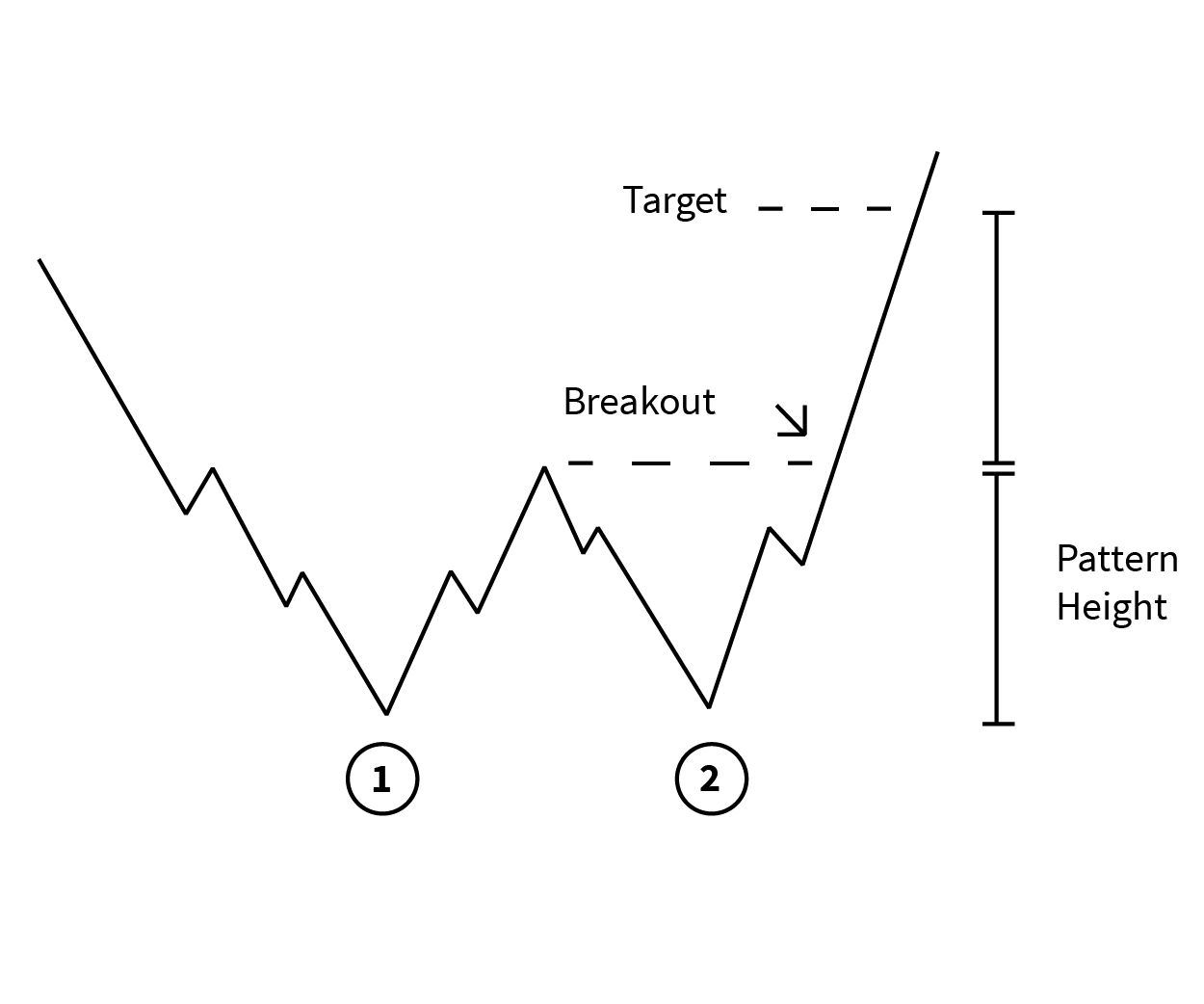

Double Bottom Pattern

Double Bottom Pattern - A small peak is surrounded by two equal troughs.

Purchase When:

- The price exceeds the middle-peak price.

Watch For:

- A price increase of 10% to 20% from the first trough to the middle peak.

- Two equal lows, not to differ by more than 3% or 4%.

Set Your Target Price:

For the double bottom pattern, sell your stock at a target price of:

- Entry price plus the pattern’s height (distance from the peak to the bottom of the lowest trough).

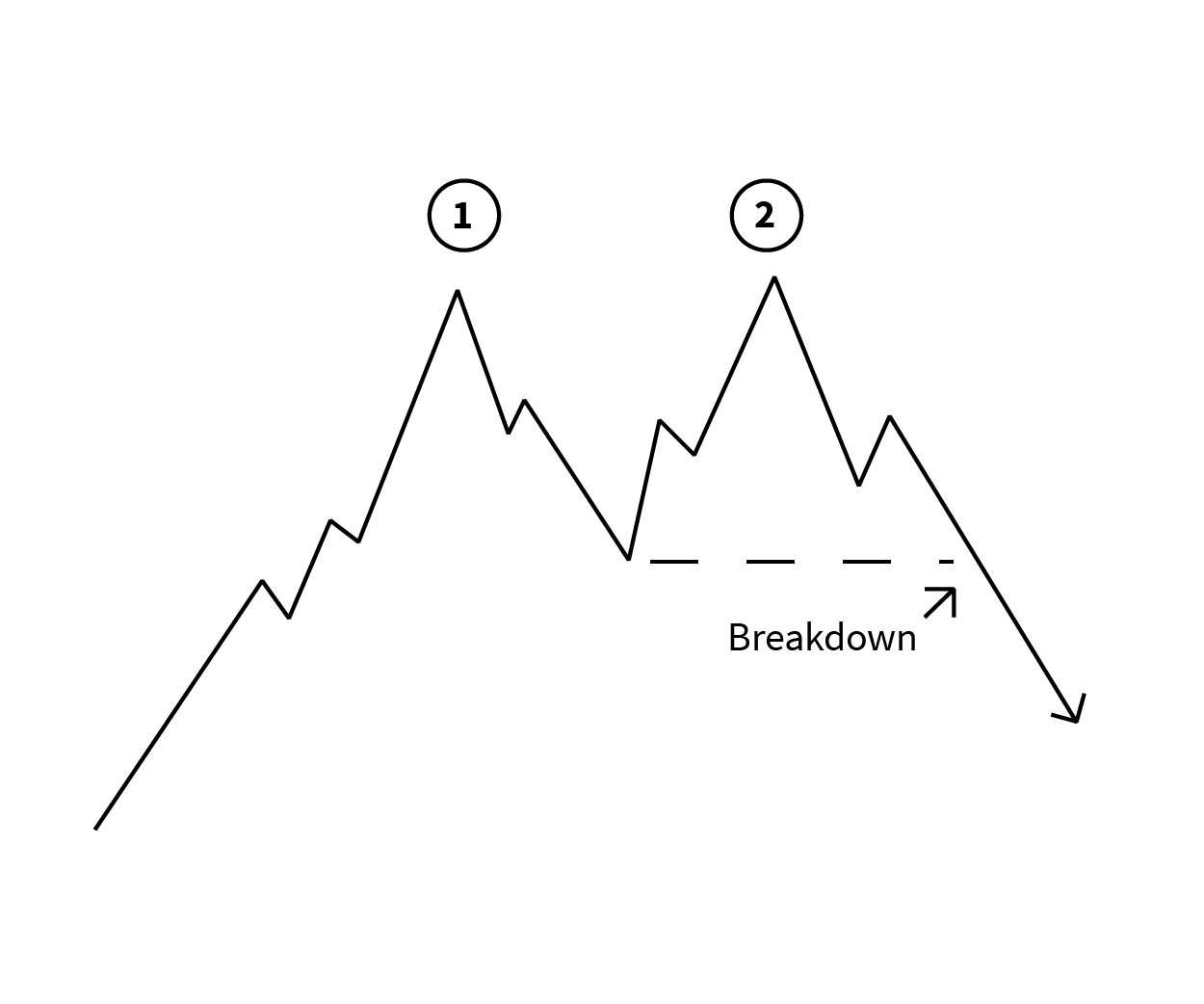

Double Top Pattern

Double Top Pattern - A small trough is surrounded by two equal peaks.

Short Sell When:

- The price drops below the middle-trough price.

Watch For:

- A price decrease of 10% to 20% from the first peak to the middle trough.

- Two equal highs, not to differ by more than 3% or 4%.

Set Your Target Price:

For the double top pattern, buy shares at a target price of:

- Entry price minus the pattern’s height (distance from the trough to the top of the highest peak).

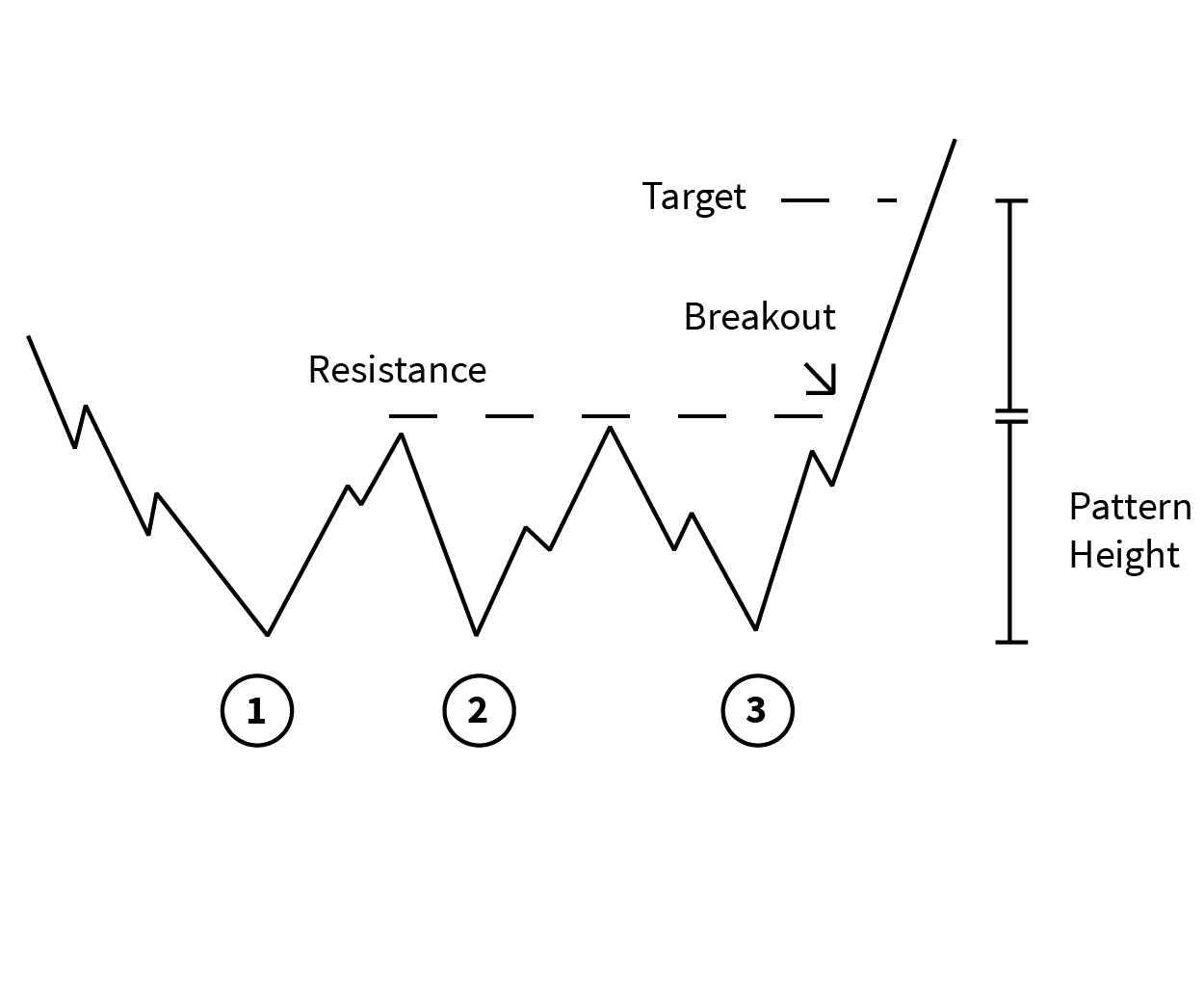

Triple Bottom Pattern

Triple Bottom Pattern - Three equal troughs amid a series of peaks.

Purchase When:

- The price exceeds the resistance established by the prior peaks.

Watch For:

- A series of three identical troughs at the end of a prolonged downtrend.

Set Your Target Price:

For triple bottom patterns, sell your stock at a target price of:

- Entry price plus the pattern’s height (distance from the resistance to the bottom of the lowest trough).

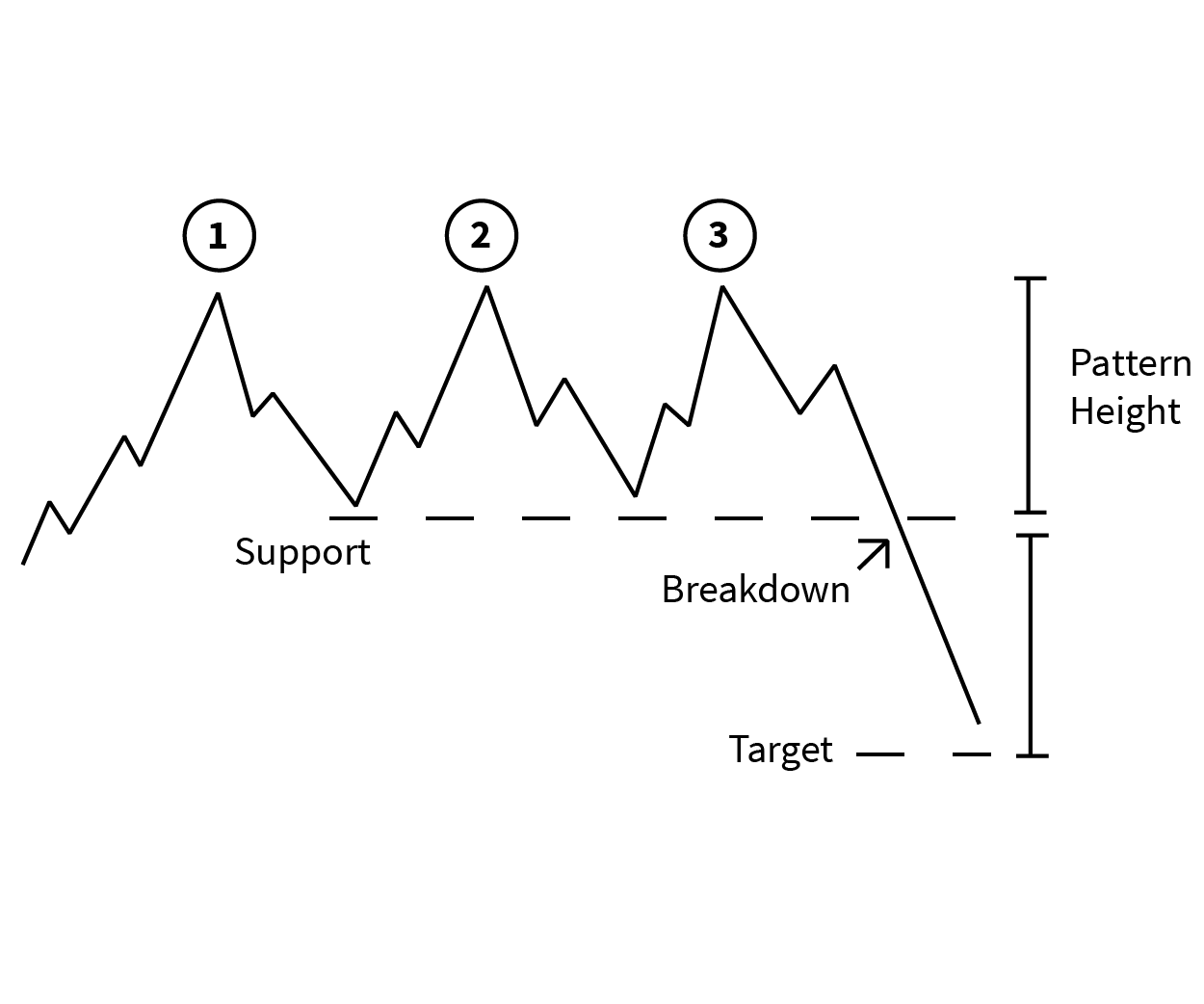

Triple Top Pattern

Triple Top Pattern - Three equal peaks amid a series of troughs.

Purchase When:

- The price falls below the support that formed from the prior troughs.

Watch For:

- A series of three peaks at relatively the same level.

Set Your Target Price:

For triple top patterns, buy shares at a target price of:

- Entry price minus the pattern’s height (distance from the support to the top of the highest peak).

Now You Know

The five most profitable stock patterns:

- Symmetrical triangle

- Ascending and descending triangles

- Head and shoulders

- Double top and double bottom

- Triple top and triple bottom

You’re halfway through assembling your toolbox. But you still need a couple more tools to ensure high-dollar profits in the market. Before you’re ready to invest, you’ll want to learn how best to cut your losses and maximize your returns. If you're ready to start seeing new charts every day, subscribe to our Chart Advisor newsletter.

Minimizing Risk

-

Trading

TradingContinuation Patterns: An Introduction

Learn the most common varieties of continuation patterns and how they work in market analysis. -

Trading

TradingInverse Head and Shoulders Patterns Breaking Out

Watch for higher prices if these stocks complete inverse head and shoulders patterns (a bottoming pattern). -

Trading

TradingThe Upward Potential for Hartford Financial Stock

Shares of Hartford Financial Services Group are at an inflection point. -

Trading

TradingHow to Trade the Head and Shoulders Pattern

The head and shoulders chart pattern is popular and easy to spot once traders are aware of what they are watching for. -

Trading

TradingHudson Pacific Properties Stock Set to Break Out

An ascending triangle chart pattern suggests upside potential for shares of the real estate investment trust. -

Trading

TradingDanaher Stock Is Ready to Jump 20%

An ascending triangle pattern forming on the chart suggests that Danaher shares could be poised for upside. -

Trading

TradingAnalyzing Chart Patterns

Learn how to evaluate a stock with a few easy-to-identify chart patterns.