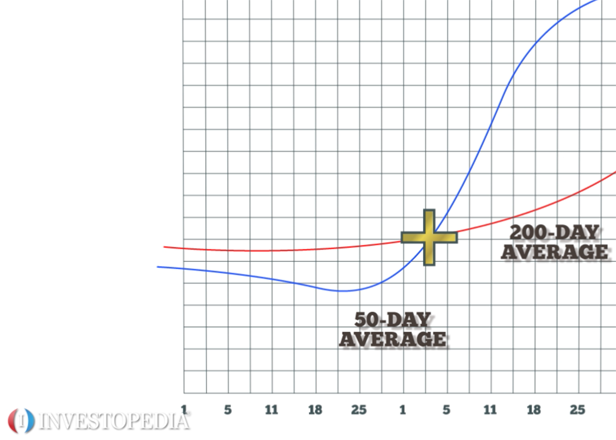

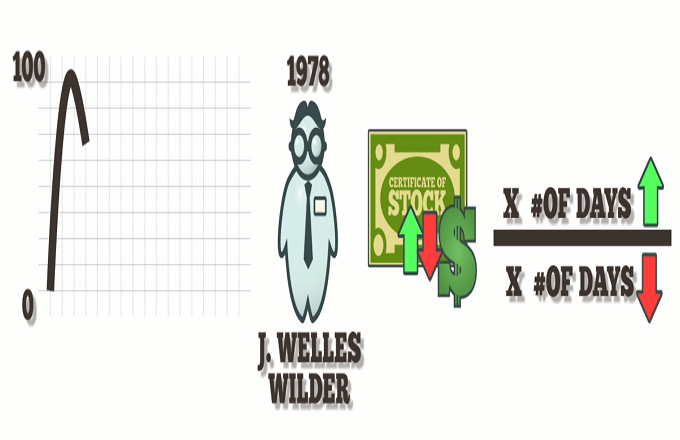

Swing traders use technical analysis to find stocks that are about to climb or decrease in value. Swing traders don’t consider a stock’s fundamental or intrinsic value; they’re only concerned with trends and patterns.For example, an investor has been studying the price and volume of ABC Corporation’s stock and has noticed its MACD has sharply risen above its signal line. She acts quickly, buying shares of ABC, unconcerned about the shares’ long-term prospects. The investor holds her ABC shares for four days, during which time their value climbs 10 percent. At the end of the fourth day, she sells her shares for a profit. Individuals tend to be the ones who engage in swing trading and take advantage of sudden stock movements. Institutional traders are usually too large to quickly move in and out of positions. Swing trading offers control and flexibility to time markets and take advantage of movements in either direction. But it can be risky. For example, if news breaks about ABC’s fraudulent efforts to conceal a product flaw, its stock could suddenly plummet. Swing trading requires careful monitoring to enter and exit a position at the right time.