When it comes to saving or spending, a number of concepts include a cash flow each year, or period in question. An annuity formula best summarizes how to address these matters in Excel. (Related: What Is An Annuity? - Video )

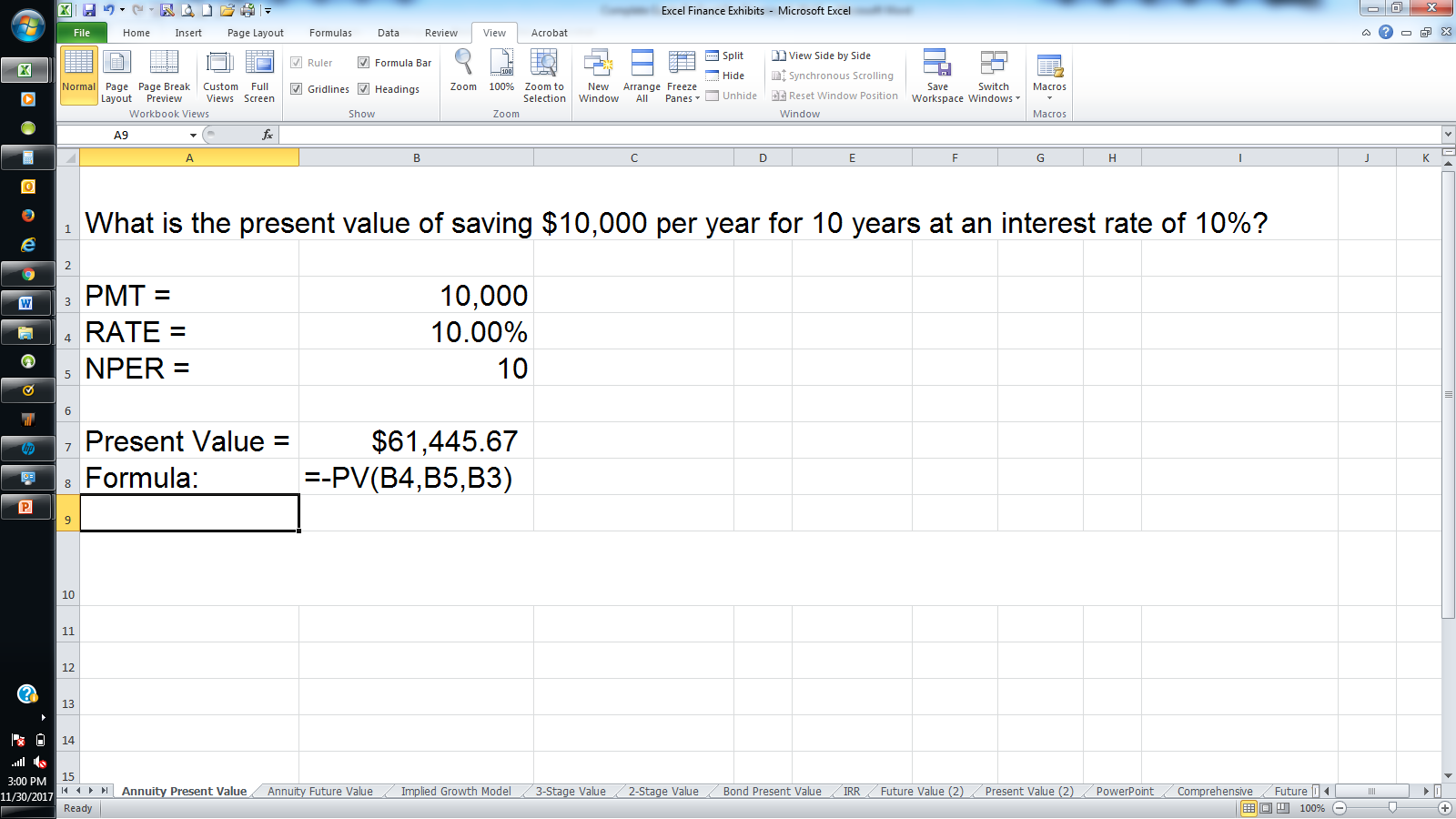

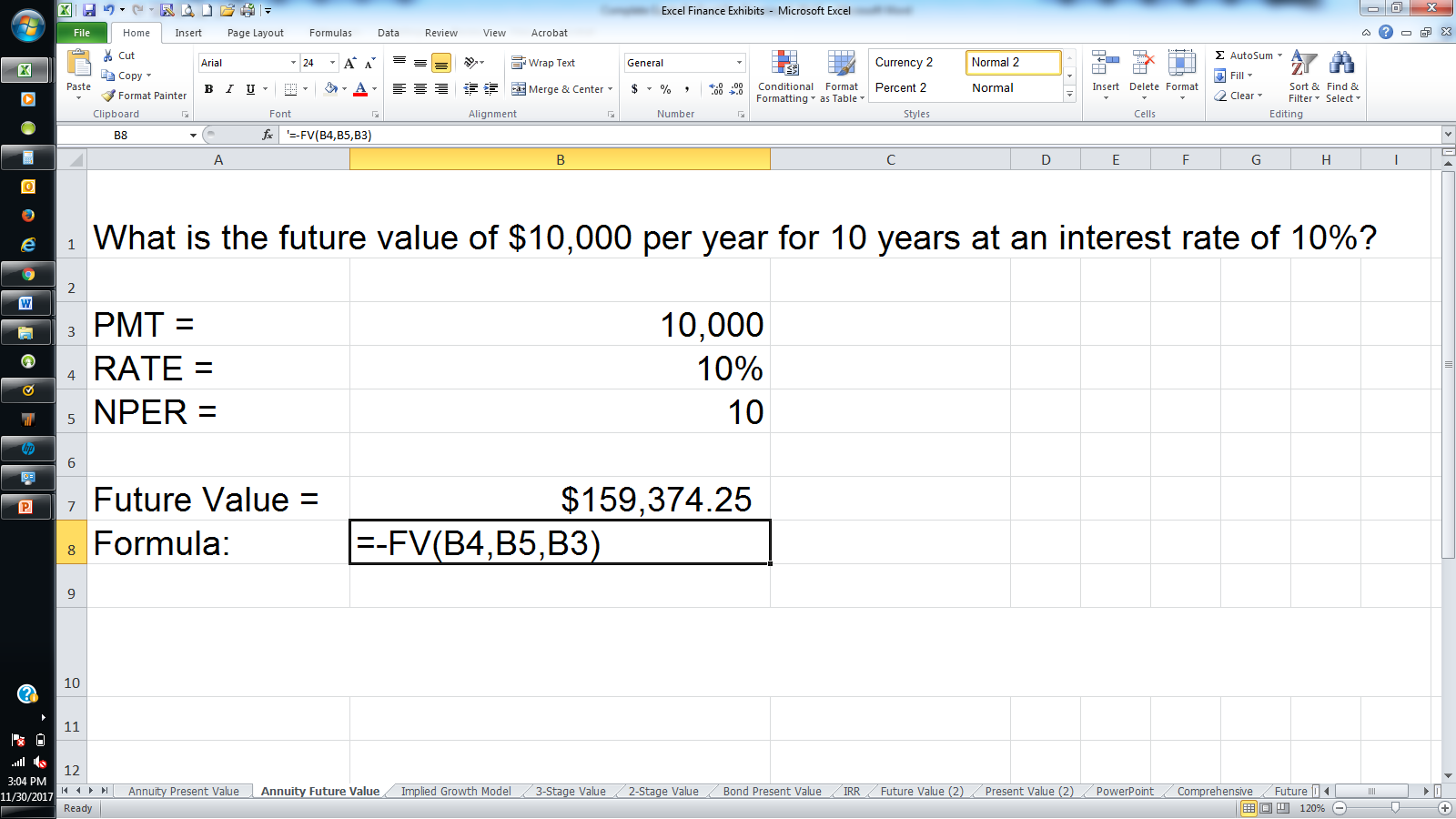

Here is both a present and future value formula for an annuity:

PV = C((1 - 1 / (1 + r)t / r)

In the below example, an individual is able to save $10,000 per year for 10 years in the stock market and earn an estimate 10% per year. The present value of that savings program is $61,445.

The future value of that savings program is $159,374. At the end of that 10 year program, the savings will have grown to nearly $160,000.

Guide To Excel For Finance: Valuation Methods

Related Articles

-

Retirement

RetirementPresent and Future Value of Annuities

Do you want to invest in annuities that get you a series of payments over a period of time. Here's everything you need to account for when calculating the present and future value of annuities. -

Retirement

RetirementAnnuities: How To Find The Right One For You

Fixed, variable and indexed annuities offer different features. Find out which one fits your needs. -

Retirement

RetirementWho Benefits From Retirement Annuities

Annuities guarantee some degree of fixed income in retirement. But is the security worth the fees and less favorable tax treatment? How to decide. -

Financial Advisor

Financial AdvisorAnnuities: A Good Option in Turbulent Times?

Annuities can be an enticing option as Americans near retirement, but there are several reasons to be wary of them. -

Investing

InvestingAn Overview of Annuities

As part of your overall investment strategy, annuities may add value to your retirement in more ways than you think. Here's how they work. -

Retirement

RetirementHow a Fixed Annuity Works After Retirement

These popular investments can provide a steady stream of income during your retirement years. Here are the details. -

Investing

InvestingWhat Do You Need to Know About Annuities?

There are varying views on annuities. Use this basic information to draw your own conclusions. -

Investing

InvestingThe Many Benefits of Deferred Annuities

Having a deferred annuity can ensure income in retirement above and beyond Social Security. -

Retirement

RetirementGuaranteed Retirement Income in Any Market

By laddering annuities, you can be sure you'll have income no matter what the market does. -

Investing

InvestingDoes an Annuity Make More Money Than Direct Investing?

Whether an annuity or direct investing makes more financial sense depends on many factors.