|

Not sure which ETF to invest in given the underlying asset or industry you’re interested in? This guide introduces the leading ETFs by assets under management (AUM), broken down by market category.

Before diving in to discover the top ETFs, it’s helpful to review what ETFs are and what makes them interesting investments.

What Are ETFs?

An exchange-traded fund (ETF) is an investment fund that tracks an index, specific asset or basket of assets – including stocks, bonds, currencies, real estate and commodities. Because ETFs can cover a broad range of assets, they offer investors diversification within a single investment. When you purchase ETF shares, you buy shares of a portfolio that tracks the yield and performance of its underlying asset(s). Like stocks, ETFs can be bought on margin and sold short, and prices fluctuate throughout each trading session as shares are bought and sold on the various exchanges. (For related reading, see: Guide to ETF Providers.)

In some ways, ETFs might appear comparable to mutual funds – both involve a pool of assets, after all. But these two types of funds operate quite differently. Unlike a mutual fund that has its net asset value (NAV) calculated at the end of each trading day, the prices of ETFs fluctuate with supply and demand during the regular stock market trading session. In addition, when compared to mutual funds, ETFs tend to have lower operating expenses, lower investment minimums and greater tax efficiency. (For more, see: Mutual Fund Vs ETF: Which is Right for You?)

Learn more about Investopedia Academy's online course Investing for Beginners.

Origins of ETFs

ETFs were originally created to track various market indexes. The first attempt at something like an ETF was the launch of Index Participation Shares, introduced in 1989 and aimed to track the S&P 500. While there was sufficient investor interest, a federal court in Chicago ruled that the fund worked like a futures contract – so ETFs would have to wait.

The next attempt at the modern ETF was the launch of Toronto 35 Index Participation Units (TIPs 35), introduced by the Toronto Stock Exchange (TSX) in March 1990. These were a warehouse, receipt-based product that tracked the TSE-35 Index. The product was followed by HIPs, another ETF-type product that tracked the Toronto 100 Index.

In 1993, the first true ETF was born when State Street Global Advisors introduced the SPDR S&P 500 ETF, which corresponds to the price and yield performance of the S&P 500 Index. The ETF launched with just $6.5 million in assets. Today, celebrating its 25th anniversary, SPY is the largest ETF and the world, with nearly $300 billion in assets under management. (See also: A Brief History of Exchange-Traded Funds.)

Growth of the ETF Market

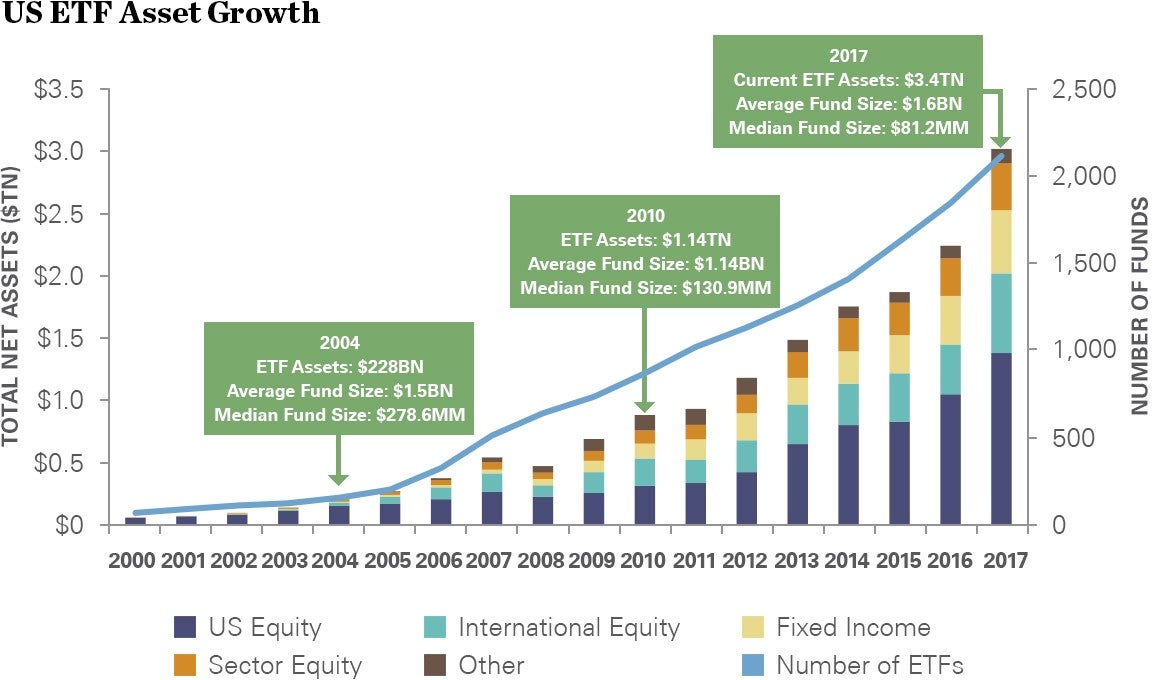

The popularity and variety of ETFs available have grown tremendously over the past 25 years since SPY was introduced. U.S. investors can now choose from more than 2,100 ETFs, covering many areas of the market including stock indexes, stock market sectors, commodities, currencies, bonds and even instruments that track the volatility of the stock market. Current ETF assets in the U.S. total $3.4 trillion; by comparison, ETF assets were $1.14 trillion in 2010 and just $228 billion in 2004.

Advantages of ETFs

- Lower Costs: Annual management expenses for ETFs are typically substantially lower than those of mutual funds. ETFs are also free of loads, the entry and exit fees that some mutual funds charge. Many mutual funds fail to beat benchmark indexes such as the S&P 500; however, the fact that ETFs can inexpensively and effectively track these indexes highlights their potential appeal to investors. Why pay high fees to enter a mutual fund that may fail to beat an index such as the S&P 500 when you can buy an ETF that efficiently tracks the benchmark index with a very low management fee? Finally, many brokers offer access to dozens or even hundreds of commission-free ETFs, further lowering costs.

- Tax Efficiency: Due to low turnover and the way they are structured, ETFs are typically more tax efficient than comparable mutual funds. (For more, see: How Tax Treatments of ETFs Work.)

- Diversification: ETFs allow investors to invest in a broad array of markets they may not otherwise have had access to. For example, prior to the advent of ETFs, investors would have needed access to the futures markets to trade commodities such as gold. The ability to easily allocate assets into a diverse range of markets empowers investors to better manage their risk against adverse moves in the market.

- Versatility: ETFs are traded throughout the day in the same way as stocks, with their prices fluctuating with supply and demand in the market. Investors can sell ETFs short and use all the various order types used with stocks to enter and exit the market. ETFs normally have the same commissions as stocks and can be traded on margin. Additionally, the barriers to entry are low, as an investor can purchase as few as one share of an ETF. (See also: Introduction to Order Types.)

- Transparency: Unlike mutual funds, the holdings of an indexed ETF are readily visible, either in their prospectus or on the provider’s website – so you’ll always know what you own. While mutual funds are only required to disclose their portfolios on a quarterly or semiannual basis, by law all actively managed ETFs must disclose their full portfolios every day. Active management refers to the use of a discretionary element, where management actively decides which assets to include in a fund.

Top ETFs and What They Track: Global And Emerging Market ETFs

-

Investing

InvestingS&P 500 Vs. Russell 2000 ETF: Which Should You Get?

We look at the differences of investing in a S&P 500 vs. the Russell 2000 exchange-traded fund, and when to choose the one over the other. -

Investing

Investing5 Popular U.S. Equity ETFs for 2016 (SPY, AAPL)

Discover 5 ETFs that investors might use to obtain exposure to portions of the U.S. stock market. -

Investing

InvestingThe Top 7 ETFs For Day Trading

ETFs that offer cost efficiency with high liquidity are ideal for day trading. Here are some of the top ETFs for day trading. -

Investing

Investing4 Ways to Evaluate ETFs Before Buying

Learn four areas to evaluate ETF investments to assure a clear understanding of security purchase. -

Investing

InvestingETF Investing (SPY): Main Attractions

As the popularity of ETFs soar, here's a look at the main benefits of these investment vehicles. -

Investing

InvestingPGF Vs. KBE: Comparing Financials ETFs

Compare two financial sector ETFs that offer a specific banking industry focus: the PowerShares Financial Preferred ETF and the SPDR S&P Bank ETF. -

Investing

InvestingThe 5 Cheapest iShares ETFs to Date in 2016 (ITOT, IVV)

Learn about BlackRock's iShares family of exchange-traded funds and discover which of the company's ETFs carry the lowest expense ratios.