Most small investors cringe at a bear market when it seems like all stocks are in a steady decline. There is, however, a technique to profit from falling stock prices called "selling short", or short selling. Essentially, short selling is a type of order in which an trader sells borrowed securities in anticipation of a price decline and is required to return an equal amount of shares at some point in the future.

Understanding a short sale may be difficult at first, so let's use a simplified example to help explain it. Suppose you believe that shares of Microsoft Corporation (Nasdaq: MSFT) are overpriced and are likely to decline in the future. In order to profit from this expected price drop, you'll need to short MSFT stock. To do so, you borrow shares from someone else (your brokerage facilitates this) and then immediately sell them on the open market. Suppose you short sell MSFT at $60 per share today, and in two weeks time it is trading at $50 per share. At this point, you "cover" your short position by purchasing MSFT shares and returning them to your lender (your brokerage). Since the stock's price fell, you will profit by $10.00 (not including transaction costs) for every share of MSFT you shorted (Read our Short Selling Tutorial for more details on short sale trades).

Short Selling on the Simulator

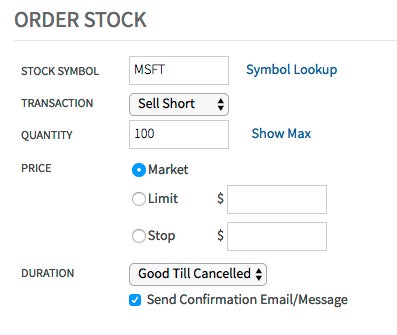

Let's walk through a short sale trade with the Stock Simulator. As usual, go to the Trading screen by clicking on the Trade Stock link. Enter the following trade details as shown:

As you can see, we want to make our Transaction type a Sell Short for 100 shares of MSFT at the current market price. In other words, we are telling our broker we wish to borrow 100 MSFT shares from them and sell them immediately at the current market price. Click on Preview Order and then Submit Order to confirm your short sale instructions.

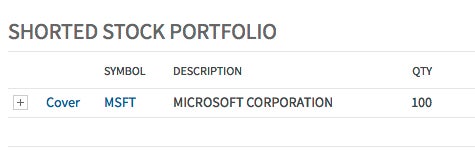

Once your trade goes through (it may be as soon as 20 minutes or the next business day depending when your order was submitted), you'll be able to see MSFT listed in the Shorted Stock Portfolio section of your Portfolio Summary as shown below:

Basically, your "shorted" stock holdings are reported in your Portfolio Summary in the same way as the stocks you own (your "long" positions), with the only difference being the gains and losses reported for your shorted stocks are opposite in nature to your long holdings. This means that as the price drops for a stock you have shorted, your gains will increase.

In our next section, we will explain the necessary steps on how to close or "cover" your short position.

Simulator How-To Guide: Covering Short Positions

-

Investing

InvestingWhy Short Sales Are Not For Sissies

Short selling has a number of risks that make it highly unsuitable for the novice investor. -

Investing

InvestingRules and Strategies For Profitable Short Selling

Short sales work well in bull and bear markets but strict entry and risk management rules are required to overcome the threat of short squeezes. -

Investing

InvestingHow To Short Amazon Stock

With the stock reaching all-time highs and the company gambling on several new business lines, many investors may feel it's a good time to short sell Amazon. -

Trading

TradingAn Overview Of Short Selling

Short selling is not as harmful as people think, and actually serves an important function in the market. -

Investing

InvestingShorting ETFs: Profit Or Peril?

Although more detail and attention may be needed, ETFs can be shorted - and at a great profit. -

Investing

InvestingBest Performing Short Stocks of 2018 YTD

Based on short interest, Snap, Tesla, AT&T take the top 3 spots for best returns to short sellers. -

Personal Finance

Personal FinanceShort Selling: Making The Ban

Short selling has been around as long as the stock market, and it hasn't always been looked on favorably. -

Trading

Know When To Hold, Know When To Fold A Short Sale

Consider making a short sale in the following circumstances: Bearish trend is developing rapidly, fundamentals are deteriorating, technical indicators are signaling "Sell," and there is an abrupt ... -

Investing

InvestingWhat Is a Short-Sale Property & How Does It Work?

A short sale is an alternative to foreclosure whereby indebted owners get permission from a bank to sell their house for less than amount of the mortgage.