Although we've used virtual cash so far in our How-To Guide, we've dealt with investing from the perspective of an investor trading stock with his/her own money. However, there's an important aspect of stock market investing everyone should know about - investing using borrowed money! In financial parlance, this is referred to as trading on margin.

We' re not going to spend too much time explaining the intricacies of margin accounts in this lesson; feel free to read our Margin Trading Tutorial for more information.

In simple terms, trading on margin is borrowing money to invest. Your brokerage provides the cash needed for the cost of the trade by providing a loan to your account that is secured against the assets you already hold within it. Of course, your brokerage will charge you interest on your loan. Your goal when making a trade on margin is to profit by more than the relatively small interest cost, thereby boosting the returns you can earn with the original savings you contributed to the account.

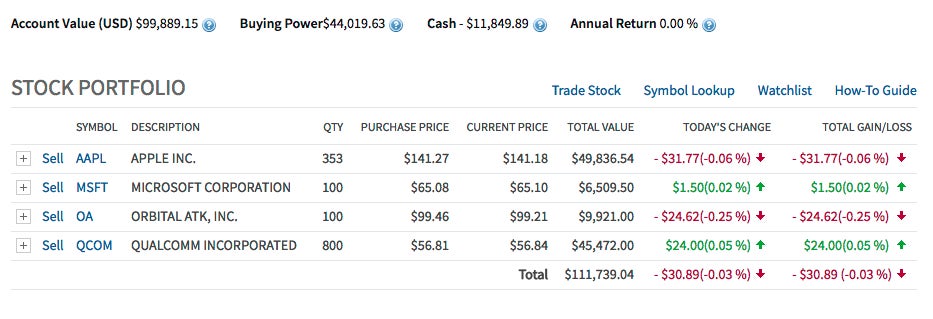

In the default Investopedia Game provided in our Simulator, players are allowed to trade on margin, meaning they can spend more money buying stock than they have cash in their account. This example portfolio shows an account trading heavily on margin:

As you can see, the total value of the equities purchased exceeds $100,000 and the cash value is negative $11,849, even though the Investopedia Game only provides players with $100,000 starting cash. The opportunities that margin trading provides can be easily seen with this example portfolio. Suppose the stocks picked by this investor all rise in value to push up the total value by 20% in one year. A respectable return for the portfolio, no doubt, but let's look at the investor's returns a little closer.

If this $111,739 portfolio increases in value by 20% (or $22,347), it'd now be roughly worth $134,086. The investor could then sell all of their stocks and have $134,086 in cash (less brokerage fees). Of course, $11,849 of that $134,086 is borrowed from the brokerage firm. Subtracting the brokerage's money from the $134,086 leaves the investor with $122,237. Thus, since the investor started with $100,000, they have profited by 22.24% ($22,237) - even though their portfolio only returned 20%. The brokerage firm's money they invested with on margin helped the investor earn extra returns for their own pocket! Keep in mind that in addition to the commission fees, there would have been interest paid to the brokerage firm that we have not included in our calculations.

Of course, this amplification of profits can also work against the investor, should their portfolio experience losses. Let's say, for example, that the $111,739 portfolio lost 20% of its value in the same one-year period. In this case, the investor's stocks would only be worth $89,392 ($111,739 - $22,347). Furthermore, the investor would still owe the initial $11,739 to the brokerage firm, so subtract that amount from the portfolio and the investor is left with only $77,653, which is an overall $22,347 loss. Had the investor not invested on margin, they would have been better off, as a 20% drop in the portfolio's value would have left them with $80,000.

As you can see, margin essentially acts as an amplifier by increasing the size of your trading account's gains and losses. For this very reason, margin trading may not be suitable for risk-averse investors. It is also important to consider the risk of receiving a margin call when your brokerage requires you to either contribute additional funds to your margin account or sell your investments to ensure you will not lose their money. Margin calls occur when your portfolio loses enough money to cause your equity value to be less than your brokerage's margin requirement, and if you don't have the extra money, you'll end up being forced to sell your stocks if they fall too much!

For the simulator, the amount of margin that you have available is incorporated in the "buying power" section of the portfolio summary page. Note that you don't tap into your margin in the simulator until you have used up your entire cash balance like the example portfolio shown above. Once you start buying via margin, your buying power value will start falling and your cash account value will drop into the negative values (to denote that you now owe money). Your debt will be repaid as you start selling/covering your positions and receive cash back.

Read about the margin call provisions applicable to your Simulator account by clicking here

Simulator How-To Guide: Buying Options

-

Managing Wealth

Managing WealthWhat’s a Good Profit Margin for a New Business?

Surprisingly, the younger your company is, the better its numbers may look when it comes to your profit margin. -

Trading

TradingMargin Trading

Find out what margin is, how margin calls work, the advantages of leverage and why using margin can be risky. -

Investing

InvestingFinding Your Margin Investment Sweet Spot

Borrowing to increase profits isn't for the faint of heart, but margin trading can mean big returns. -

Investing

InvestingIs Your Money Safer in the Market or Held as Cash?

When stock markets become volatile, investors get nervous. Learn if you should take your money out of the stock market or if its safer kept in the market.