|

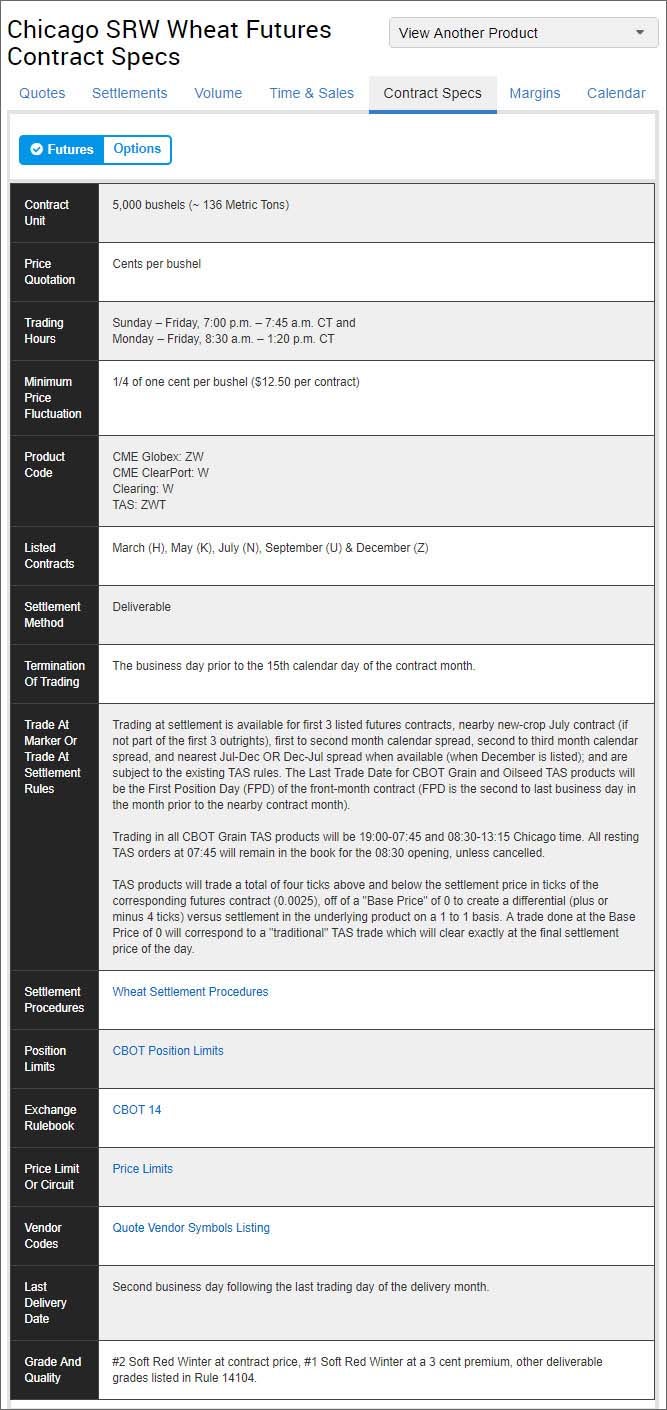

For every futures contract, specifications identify details pertaining to the contract, including the contract unit, specific price per unit, trading hours, minimum price fluctuation, settlement, method and months that the contract is traded. Specs for each contract are available on the relevant exchange’s website. Here’s an example for wheat futures from the CME Group:

Contract specifications for CME Group’s #2 soft red winter wheat futures contract.

Expiration Dates

It’s important to note that futures contracts have specific expiration dates, and if you don’t exit your position before that date – and it’s a physically deliverable contract – you’ll have to deliver the physical commodity (if you’re in a short position) or take delivery (if you’re long). This rarely happens: It’s estimated that only 2% of all futures contracts are actually delivered – that’s because most traders don’t want to store, insure and deliver such huge quantities of commodities.

If you do end up with a long position after expiration, you may be able to retender the delivery by establishing a short position on the business day following assignment and paying a retender fee – which might run several hundred dollars, plus a set fee (e.g., $30) per contract.

A contract month is the month the futures contract expires. Some contracts trade every month of the year, while others trade during certain months only. Each month is represented by a single letter, as shown here:

|

Month |

Code |

|

Month |

Code |

|

January |

F |

July |

N |

|

|

February |

G |

August |

Q |

|

|

March |

H |

September |

U |

|

|

April |

J |

October |

V |

|

|

May |

K |

November |

X |

|

|

June |

M |

December |

Z |

To avoid confusion, the contract always includes the ticker symbol, followed by the contract month and the two-digit year. The complete contract name for the December 2017 Wheat contract, for example, would be “ZWZ17”:

|

Ticker Symbol |

Contract Month |

Year |

|

ZW |

Z |

2017 |

|

ZWZ17 |

||

Margin

In the stock market, margin refers to borrowing money from your broker to buy a stock, using the investment as collateral against the loan. Investors and traders use margin to boost their purchasing power so they can enter larger positions – even if they can’t pay for it outright.

Margin works a bit differently in the futures market where it refers to an initial good faith deposit – essentially, a down payment on the full contract value. The exchanges set the minimum amount of money you must deposit into your account to trade futures – though your broker may require more to limit their risk exposure. This original deposit is called the initial margin, and it can change based on the risk of market volatility – during especially volatile periods, for example, margin rates may be higher.

In general, stock traders trade on up to 50% margin – if you have $50,000 in your account, for instance, you can trade up to $100,000 worth of stocks. Margin rates for futures contracts, however, tend to be much lower, and you may only have to deposit 5% to 15% of the total contract value to be able to trade. As such, active traders generally prefer trading futures since they need a smaller amount of capital to trade when compared to stocks. One wheat contract, for example, is valued at about $20,000 (5,000 bushels X $4), but you may only need $1,200 initial margin to trade. (For related reading, see What is the Difference Between Initial Margin and Maintenance Margin?)

While initial margin is the minimum amount you need to enter a new futures contract, the maintenance margin is the lowest amount your account can reach before you need to add more money. It’s usually set just below the initial margin level to give your trade a small amount of leeway. If your account drops below that amount because of a series of losses, for example, your broker will give you a margin call to let you know your account has fallen below the maintenance requirement. When a margin call is made, you have to bring your account up to the maintenance level immediately. If you don’t, the brokerage has the right to liquidate your position completely to make up for any losses it may otherwise have incurred on your behalf. (For more, see What are My Options When I get a Margin Call?)

Leverage: A Double-Edged Sword

Leverage allows you to enter a futures position that’s worth much more than you are required to pay upfront. Futures positions are highly leveraged because the initial margins set by the exchanges are relatively small compared to the cash value of the contracts in question – which is part of the reason why the futures market is popular, but also very risky. (For more, see Leveraged Investment Showdown.)

Leverage is always represented as a ratio; for example, you might have access to 20:1 leverage, meaning that if you have $1,000 in your account, you could enter a position worth 20 times that amount, or $20,000. The smaller the margin in relation to the value of the futures contract, the greater the leverage.

With leverage, if prices up or down even slightly, the changes to your gains and losses will be large in comparison to the initial margin. Say you buy an e-mini S&P 500 (ES) stock index futures contract that’s trading at 2,600, with a margin deposit of $5,000. The value of that contract is $50 times the S&P 500 Index, or $130,000 in this example – and for every point gain or loss, you stand to gain or lose $50.

After some time, assume the ES rallies to 2,700 – for a gain of $5,000 (100 points X $50). Not bad for your initial $5,000 investment. But before you get too excited, think about what happens if the ES drops an equal amount in the wrong direction – to 2,500. In that case, you would have lost $5,000 (your entire investment). Even a small downward shift in price can lead to big losses with this leverage: If the ES lost just 10 points, you would lose $500 – or 10% of your original investment.

While leverage makes it possible to trade larger positions, it’s important to remember that leverage magnifies both profits and losses. Keep that in mind when you’re trading with leverage, and consider using a protective stop-loss order to limit your losses. (For related reading, see The Stop-Loss Order: Make Sure You Use It.)

Pricing and Limits

Future contract prices are quoted as they would be in the cash market: in dollars and cents or per unit – gold ounces, bushels, barrels, index points, percentages and so on.

Unlike stocks, which move in one cent increments, futures contracts have various minimum price fluctuations – in other words, the minimum amount they can move either up or down. These minimums are established by the futures exchanges and are known as ticks. The minimum price fluctuation for the ES contract, for example, is 0.25 index points – so the contract could move from 2,600.00 to 2,600.25. Each “tick” is worth $12.50, and, in the case of the ES, four ticks equal one point, or $50. (For related reading, see Beginner’s Guide to Trading the E-Mini Futures Contracts.)

Certain futures contracts have price limits that are intended to thwart panic buying and selling. Price limits are established by the exchanges and specify how far prices are permitted to move during a given trading session, or even during certain hours of the day – either as a set dollar amount or some percentage. Some contracts have upper and lower price limits, while others have limits only for downside price movements. They may be based on the previous day’s closing price or some other factor. The price limits for the E-mini S&P 500, for example, are based on the previous trading day’s volume-weighted Average Price (VWAP) of the lead month ES contract between 2:59:30 p.m. and 3:00 p.m. Central Time.

Here’s a price limit example. Say the price limit on corn is $0.25 a bushel and the previous day’s closing price was $3.48 (348’0 by exchange convention). Today's upper price boundary for corn, then, would be $3.73 and the lower boundary would be $3.23. If at any moment during the day the price of futures contracts for corn reaches either boundary, the exchange would halt corn trading for the day. The next day, the new boundaries are again calculated by adding and subtracting $0.25 to the previous day's close. Each day, corn could increase or decrease by $0.25 until an equilibrium price is found. Because trading shuts down if prices reach their daily limits, there may be occasions when you wouldn’t be able to liquidate an existing futures position. The following chart shows an example of price limits, set by CME Group for agricultural commodities on Nov. 7, 2017.

Agricultural commodity price limits set by CME Group during Nov. 2017.

The exchange can revise price limits as necessary. It's not uncommon for the exchange to abolish daily price limits in the month that the contract expires (delivery or spot month). This is because trading is often volatile during this month, as sellers and buyers try to obtain the best price possible before the expiration of the contract.

To avoid any unfair advantages, the CTFC and the futures exchanges also impose limits on the total number of contracts any single person can trade. These are known as position limits and they are intended to maintain fair and stable markets.

Futures Fundamentals: Strategies

-

Trading

TradingAn Introduction To Trading Forex Futures

We explain what forex futures are, where they are traded, and the tools you need to successfully trade these derivatives. -

Investing

InvestingInvesting in Crude Oil Futures: The Risks and Rewards

Learn about the risks and rewards of trading oil futures contracts. Read about a few strategies to limit the risk in trading oil futures contracts. -

Trading

TradingThe Difference Between Forwards and Futures

Both forward and futures contracts allow investors to buy or sell an asset at a specific time and price. -

Trading

TradingAdvantages Of Trading Futures Over Stocks (APPL)

We look at the top eight advantages of trading futures over stocks. -

Investing

Investing3 Reasons to Use ETF Options Over Futures (SPY, QQQ)

Learn about exchange-traded fund (ETF) options and index futures, and why it might be a better decision to use ETF options instead of futures. -

Investing

InvestingWhat is a Forward Contract?

A forward contract is a customized contract between two parties to buy or sell an asset at a specified price on a future date.