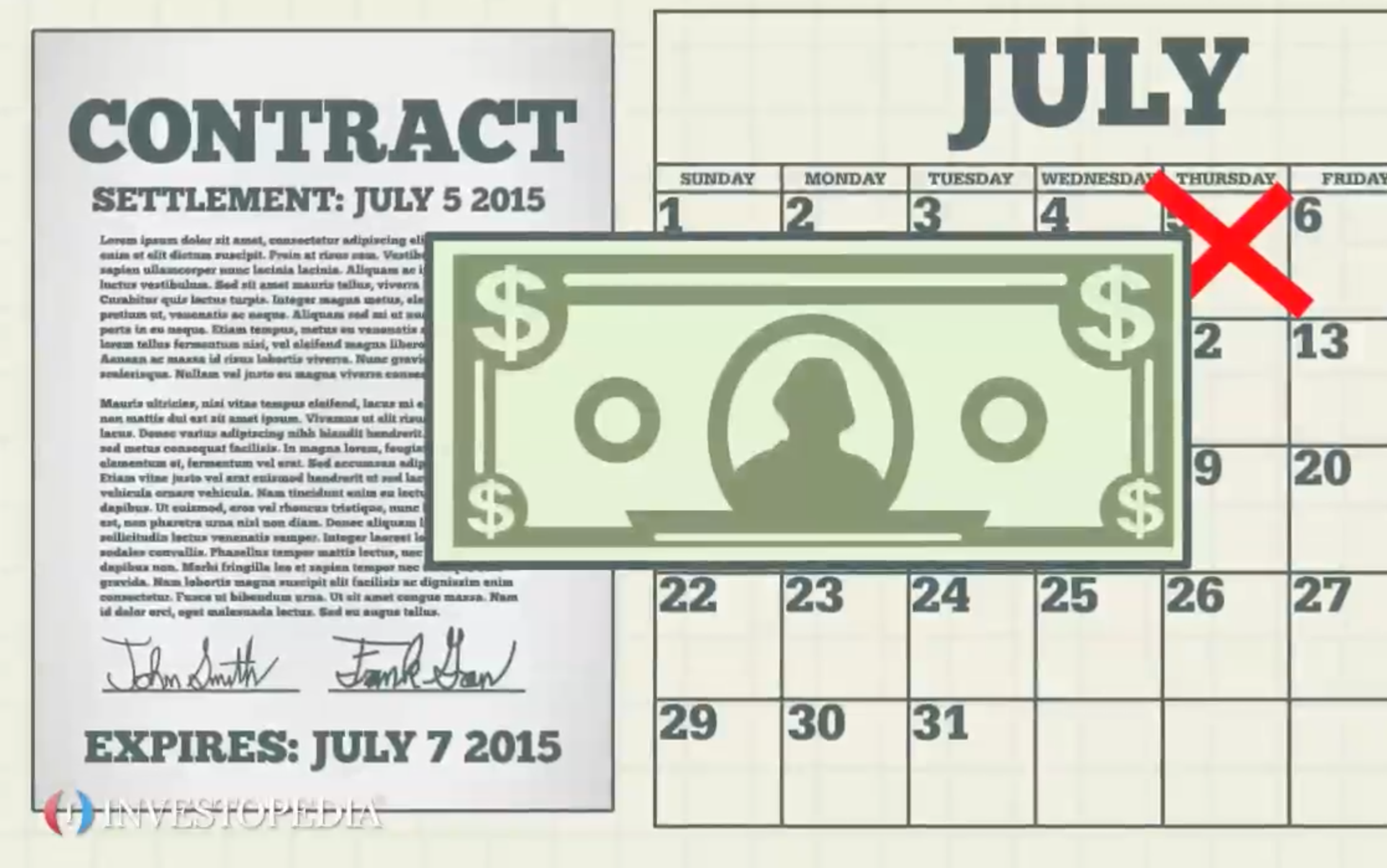

A forward contract is an agreement between a buyer and seller to buy and sell an asset at a future date. The price for the asset is fixed at the time the contract is executed. Forward contracts are highly customizable and thus allow great flexibility. Large corporations and institutions use forward contracts to hedge currency and interest rates. In addition, many of the world’s commodities are subject to forward contracts.A forward contract is similar to a futures contract with some significant differences. Forward contracts don’t trade on an exchange, whereas futures contracts do. Forward contracts settle at the end of the contract term, while futures contracts settle day by day. Finally, speculators betting on changes in asset prices mainly use futures contracts, while parties who want to hedge the volatility inherent in the underlying asset use forward contracts. Bruno’s Burgers is a worldwide hamburger franchise. Bruno’s has been losing money on French fries sales due to fluctuating potato prices. To insure a stable price, Bruno’s enters into a forward contract with a large potato farmer, buying one million bushels of potatoes at $5.00 per bushel to be delivered in six months with a cash settlement. If the market price of potatoes at the delivery time is under $5, the farmer makes more profit. If it is over, then the farmer loses profit. For Bruno’s, $5.00 per bushel locks in a healthy profit margin, and allows it to set future retail prices for its French fries.