|

The first step in determining economic profit is to calculate net operating profit after taxes (NOPAT). In order to do so, we’ll adjust an accrual-based income statement number into a cash-based profit number through a series of steps. There are three primary steps in this process, but there is no single given method for determining the final profit number.

Different methods of calculation yield different levels of precision in the profit number. For those with a lot of time or a desire for high levels of precision, as many as 150 adjustments may be necessary. In other cases, a reasonable answer can be found after 10 or fewer adjustments. After a small handful of calculations, further adjustments are only fine-tuning the NOPAT number, meaning that they’re largely unnecessary. In fact, because consistency and comparability are the most important factors, it’s better to ensure that the method of calculation is consistent from year to year and across different companies than it is to determine economic profit with near-100% precision.

The Three Stages of the NOPAT Process

Determining NOPAT requires three basic steps:

1. Start with earnings before interest and taxes (EBIT).

2. Make key adjustments according to these principles:

a. Eliminate accounting distortions (convert accrual to cash).

b. Reclassify certain expenses as investments (capitalize them to the balance sheet).

3. Subtract cash operating taxes.

In the list above, the substeps 2a and 2b correspond to the first two underlying ideas in the previous chapter.

1. Start With EBIT (Or Get Close To It)

In this tutorial, we’ll use a real-life, backwards-looking example as a means of calculating economic profit. This will reflect the 2004 10-K filing (the annual report) from the Walt Disney Company (DIS). The fact that these figures are taken from an annual report from many years ago does not impact our calculation; rather, it allows for readers to go back and look at subsequent figures for this company if they wish to see how the predictions played out over time.

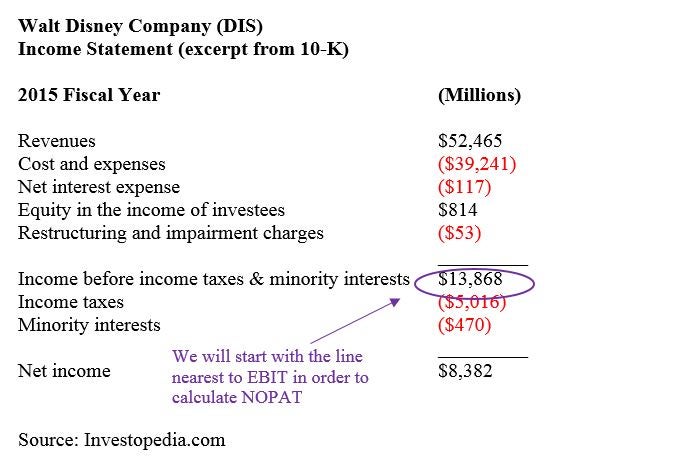

Fig. 1 (numbers are in millions)

Although it can make our calculations more complicated, GAAP does not mandate any specific presentation for the income statement. Thus, analysts must pay careful attention to line items when deducing economic profit. Because Disney did not disclose EBIT on this income statement, our first step requires a bit more work. Instead of showing EBIT, Disney included “income before income taxes & minority interests,” which is an after (or net) interest-expense figure.

In order to get from here to EBIT, then, we must add interest expense back in, “moving it above” the interest expense. By doing this, we can be sure that our NOPAT figure has not been reduced by interest paid, thus making it deleveraged. We want to ensure that NOPAT captures the profits that accrue for all capital holders, including lenders.

Figure 2 below shows a summary of the calculation that moves us from “income before income taxes & minority interest” on the income statement to our NOPAT figure. We’ll break this summary down and explore the calculations within it below.

2. Make Key Adjustments: Translate Accrual to Cash, and Capitalize Investments

In the previous chapter, we explore how adjusting EBIT requires two steps. First, it involves the conversion of accrual-based EBIT to a cash-based profit number, and second, it includes the capitalization of expenses that ought to be treated as investments over the long term. “Capitalizing” expenses means moving them to the balance sheet where they will be treated as long-term assets instead of short-term expenses.

Keep in mind that a capitalizing adjustment changes both NOPAT as well as invested capital. The process of capitalizing an expense must be reflected in two ways, then: we must match each income statement adjustment with a balance sheet adjustment.

According to Figure 2, our key adjustments together realize an addition of $308 million to EBIT. This gives us our net operating profit (NOP). From this figure we can subtract cash operating taxes in the subsequent step in order to attain NOPAT.

Figure 3 includes a breakdown of the key adjustments.

Fig. 3 (numbers are in millions)

Key Adjustments

Convert Accrual to Cash:

Add: Increase in the LIFO Reserve N/A

Add: Increase in Allowance for Bad Debt 157

Capitalize Debt/Equity Equivalents:

Add: Implied Interest on operating leases 151

Key Adjustments (Total) 308

Source: Investopedia.com

The LIFO reserve adjustment is pertinent only for companies utilizing LIFO inventory accounting. Because Disney does not use LIFO, we do not need to make an adjustment here. For companies using LIFO, if the price of inventory is rising, then cost of goods sold (COGS) is pushed up as well, because it is considered a reflection of the cost of the more expensive inventory. Adding the increase in the LIFO reserve allows us to convert the cost of goods to what it would be under FIFO accounting. This more closely approaches actual cash flows.

Pay particular attention to the allowance for bad debt. Increasing this account does not reflect a reduction in cash. Rather, it shows a decision to acknowledge additional expenses in anticipation of future cash losses. Another way to think of this is as a portion of receivables which are not collected. As an increase in this area represents a paper reduction in profits (although not an actual reduction in cash), we must add it back in as a way of determining our NOPAT figure.

“Implied interest on operating lease” can be a difficult adjustment to understand. Before studying the adjustment’s calculation, let’s explore how economic profit translates the operating lease into a capital lease. These two leases are similar from an economic perspective, although we must account for them with different means.

Companies are allowed to treat operating leases as expenses, so accounting for them places no liability on the balance sheet. This is different from our treatment of capital leases. Operating leases are a type of off-balance-sheet financing, so they must be put back on the balance sheet, however. Because of this, operating leases are treated as assets which are funded through debt-like obligations. NOPAT must be credited for the financing component of the lease expense in the same way that we added back in interest expenses to “income before income taxes & minority interest” in the first step.

How do we go about estimating the implied interest on an operating lease? Absolute precision is not necessary, unless you are dealing with a company with a large portion of assets. All companies are required to disclose their future stream of minimum obligations under operating leases, and this can serve as an estimate of the present value of the obligation after discounting. In a way, this is similar to solving the present value of a bond obligation when we know the cash flows and interest rate. Figure 4 shows the calculations of the present value of operating lease obligations.

Fig. 4 (numbers are in millions)

For this example, we’ve used a discount rate of 7.30% in order to convert the reported future obligations into a single value at present of $2,068 million. This will be the debt equivalent that we must put back on the balance sheet in the subsequent chapter of this tutorial. This illustration of present value makes use of a precise method, but we could have also used our own reasonable estimate.

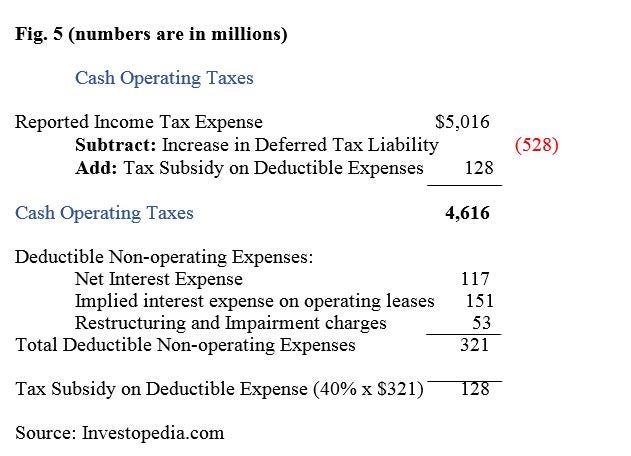

3. Deduct Cash Operating Taxes

The last step in determining NOPAT is to subtract out cash operating taxes (these are the taxes that a company would actually pay with cash) from net operating profits. We could substitute in reported taxes and still end up with a usable economic profit number, although purists would scoff at this practice. Still, it’s important to keep in mind that, as tax books are separate from financial statements, it’s possible that the amount a company pays in taxes may be different from the amount they record as tax expenses. Thus, by using cash taxes, we aim to capture a true cash return generated from actual cash investment. By subtracting an estimate of cash operating taxes, our NOPAT number won’t be thrown off by reported taxes which may differ.

Fig. 5 (numbers are in millions)

In Figure 5, we see details of the calculations which provided the $4,616 million figure subtracted back in Figure 2. The increase in deferred tax liability is added to the income-tax expense reported in the income statement. Next, the difference between the expense and actual taxes paid is treated as deferred tax liability, suggesting that it would be paid in the future. Thus, deferred tax liability increases when companies pay less in cash taxes than they happen to record on a balance sheet. This increase is paper, so we can subtract it to get closer to a figure representing actual cash taxes paid.

We add the tax subsidy on deductible expenses because we’re aiming for a number which captures tax expenses before accounting for obligations to debt and equity holders. The expenses from the income statement which are “above” pretax income get the benefit of a tax shield. They actually reduce the reported taxable income and, in turn, the income-tax expense. The reverse is true when the tax subsidy is added onto deductible expenses to the reported income-tax expense.

Summary

There are lots of details of the operating lease and cash operating tax calculations in this chapter of the tutorial, but the key process of calculating NOPAT is as follows: begin with EBIT, make a set of key adjustments to that figure, and then subtract an estimate of cash operating taxes that would have been paid under NOP.

Of course, this is not a comprehensive set of possible adjustments. They crucial factor is consistency across different calculations, though, making this a reasonable calculation of economic profit.

EVA: Calculating Invested Capital

-

Trading

TradingFind Quality Investments With ROIC

Return on invested capital is a great way to measure the true value produced by a company. Learn to use the ROIC metric and increase your chances of finding successful investments. -

Investing

InvestingUncovering Hidden Debt

Understand how financing through operating leases, synthetic leases, and securitizations affects companies' image of performance. -

Investing

InvestingIs Net Income The Same As Profit?

Net income and profit both deal with positive cash flow, but there are important differences between the two concepts. -

Investing

InvestingCash Flow From Operating Activities

Cash flow from operating activities is a section of the Statement of Cash Flows that is included in a company’s financial statements after the balance sheet and income statements. -

Taxes

TaxesDeferred Tax Asset

A Deferred Tax Asset is an asset on a company’s balance sheet that may be used to reduce taxable income. It is the opposite of a deferred tax liability, which describes something that will increase ... -

Investing

InvestingCorporate Cash Flow: Understanding the Essentials

Tune out the accounting noise and see whether a company is generating the stuff it needs to sustain itself. Learn how to read the cash flow statement. -

Investing

InvestingWhy LIFO Is Banned Under IFRS (XOM)

Here's why Last-In-First-Out is banned under IFRS.