Income Tax

You have to pay it, but don’t pay more than you need to. Up-to-date strategies for maximizing the money you get to keep after Uncle Sam gets his cut.

:max_bytes(150000):strip_icc()/tax_refund-5c79483946e0fb00011bf2ca.jpg)

Outside-the-Box Ideas for This Year's Tax Refund

The best ways to use your tax refund might not be what you think.

-

The 5 Countries Without Income Taxes

-

Standard Deduction Definition

-

Income Tax

-

The Difference Between Income Tax vs. Capital Gains Tax

-

The Difference Between Write-Offs vs. Write-Downs

-

Is Cyprus Considered a Tax Haven?

-

What tax breaks are afforded to a qualifying widow?

-

When to File an IRS Schedule F Form

-

Modified Adjusted Gross Income (MAGI)

-

Tax Return

-

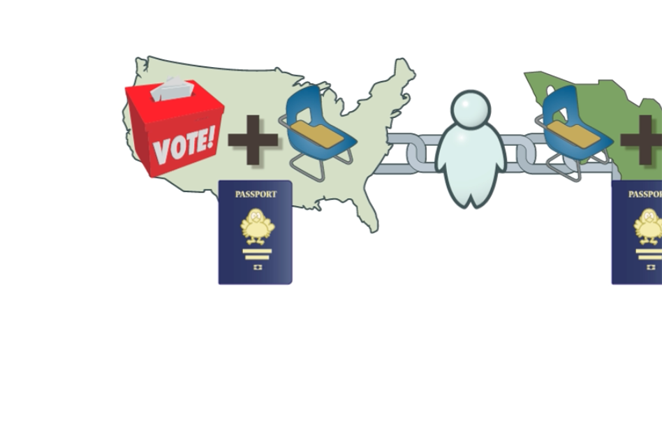

Advantages And Disadvantages Of Dual Citizenship

-

W-2 Form

-

Do I need to file an income tax return every year?

-

Deferred Income Tax

-

Form 1099-B Overview

-

W-4 Form Definition

-

What are some examples of a deferred tax liability?

-

Income Tax Payable

-

Understanding State Income Tax vs. Federal Income Tax

-

Take-Home Pay

-

Filing Extension

-

Unearned Income

-

Deductible

-

How 401(k) Withdrawals Work When You're Unemployed

-

Ordinary Income

-

Why is Monaco considered a tax haven?

-

Incidental Expenses

-

Form 1040EZ: Income Tax Return for Single and Joint Filers with No Dependents Explanation

-

Exempt Income

-

Personal Exemption

-

Section 1031

-

1040 Form

-

Qualifying Widow/Widower

-

Federal Income Tax

-

10 Things You Should Know About 1099s

-

Can a Limited Liability Company (LLC) issue stock?

-

Form 1065: U.S. Return of Partnership Income Definition

-

Income in Respect of a Decedent (IRD) Definition

-

Short-Term Gain

-

Material Participation Tests

-

Why Your Taxes Are Due on April 17 This Year

-

Annualized Income Installment Method

-

Section 1245

-

Negative Income Tax (NIT)

-

Future Income Taxes

-

What is an adjusted cost basis and how is it calculated?

-

When would I have to fill out a Schedule D IRS form?

-

7 States With No Income Tax

-

1040A Form

-

7 Reasons You Haven’t Received Your Tax Refund

-

Notice Of Deficiency

-

Dependent

-

Consolidated Tax Return

-

State Income Tax

-

Hobby Loss

-

Individual Tax Return

-

Taxable Wage Base

-

IRS Publication 970 : Tax Benefits for Education Definition

-

Head Of Household

-

Capital Gains Treatment

:max_bytes(150000):strip_icc()/w-9_118877047-5bfc344146e0fb00517d8bd0.jpg)

:max_bytes(150000):strip_icc()/tax_returns_-5bfc317846e0fb005145ed87.jpg)

:max_bytes(150000):strip_icc()/w42018.cropped-5bfc2e8e46e0fb00265c78e6.jpg)

:max_bytes(150000):strip_icc()/shutterstock_225357550-5bfc361ec9e77c0026b6fc7a.jpg)

:max_bytes(150000):strip_icc()/ap675784005308-5bfc32dfc9e77c0026b65b37.jpg)

:max_bytes(150000):strip_icc()/virtual_goods-5bfc2b8a46e0fb00517bdfe5.jpg)

:max_bytes(150000):strip_icc()/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

:max_bytes(150000):strip_icc()/accountingcalculating-5bfc317746e0fb0083c18f5f.jpg)

:max_bytes(150000):strip_icc()/thinkstockphotos_80410231-5bfc2b97c9e77c0026b4fb20.jpg)

:max_bytes(150000):strip_icc()/shutterstock_67023106-5bfc2b9846e0fb005144dd87.jpg)

:max_bytes(150000):strip_icc()/shutterstock_253136563-5bfc2b98c9e77c00519aa7a8.jpg)

:max_bytes(150000):strip_icc()/89794268-5bfc2b8bc9e77c005143f0cf.jpg)

:max_bytes(150000):strip_icc()/200270955-001-5bfc2b8bc9e77c00517fd20f.jpg)

:max_bytes(150000):strip_icc()/shutterstock_768064450.w-2.tax-5c881a2fc9e77c0001422fe3.jpg)

:max_bytes(150000):strip_icc()/rbv2_53-5bfc2b8ac9e77c0058770499.jpg)

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

:max_bytes(150000):strip_icc()/w4_form_147053946-5bfc32cfc9e77c002631bbad.jpg)

:max_bytes(150000):strip_icc()/taxes_calculating-5bfc316346e0fb0051beeb0f.jpg)

:max_bytes(150000):strip_icc()/tax_question_marks-5bfc317246e0fb00265d01ea.jpg)

:max_bytes(150000):strip_icc()/irs-5bfc2e7ec9e77c005877954e.jpg)

:max_bytes(150000):strip_icc()/148985994-5bfc2b8c46e0fb0083c07ba8.jpg)

:max_bytes(150000):strip_icc()/401k_clipboard_form-5bfc31724cedfd0026c22a74.jpg)

:max_bytes(150000):strip_icc()/shutterstock_9088786-5bfc32dfc9e77c005145499d.jpg)

:max_bytes(150000):strip_icc()/monacomontecarlo-5bfc317146e0fb00511ac101.jpg)

:max_bytes(150000):strip_icc()/153221908-5bfc2b8c4cedfd0026c118f2.jpg)

:max_bytes(150000):strip_icc()/101405194-5bfc2b8c46e0fb0051bddfc9.jpg)

:max_bytes(150000):strip_icc()/78036503-5bfc2b8b4cedfd0026c118ed.jpg)

:max_bytes(150000):strip_icc()/200275051-001-5bfc2b8b46e0fb0083c07b92.jpg)

:max_bytes(150000):strip_icc()/shutterstock_218434039-5bfc326fc9e77c00514535f3.jpg)

:max_bytes(150000):strip_icc()/161760094.1040.form.cropped-5bfc32ce46e0fb00517d440e.jpg)

:max_bytes(150000):strip_icc()/taxes-5bfc2ce146e0fb002601afc5.jpg)

:max_bytes(150000):strip_icc()/shutterstock_348633299-5bfc3d8d46e0fb0051806b47.jpg)

:max_bytes(150000):strip_icc()/whythewealthyshyawayfrominheritancetalk-ts-4ab62941368a435f9c5c2e8d6ab7cc61.jpg)

:max_bytes(150000):strip_icc()/stk128219rke-5bfc2b8a46e0fb005144db8f.jpg)

:max_bytes(150000):strip_icc()/shutterstock_9088786-5bfc3dcc46e0fb00260fa801.jpg)

:max_bytes(150000):strip_icc()/dv740090-5bfc2b8b46e0fb00265bea71.jpg)

:max_bytes(150000):strip_icc()/business_building_153697270-5bfc2b9846e0fb0083c07d69.jpg)

:max_bytes(150000):strip_icc()/WhenIsInflationAGoodThing-5bfc2cc14cedfd0026c150aa.jpg)

:max_bytes(150000):strip_icc()/istock144229773.cabania.tax_.refund.cropped-5bfc3c71c9e77c0026b94d33.jpg)

:max_bytes(150000):strip_icc()/aa014176-5bfc2b8bc9e77c002630643b.jpg)

:max_bytes(150000):strip_icc()/156416606-5bfc2b8b46e0fb00517bdff7.jpg)

:max_bytes(150000):strip_icc()/investing3-5bfc2b8e46e0fb0026016f32.jpg)

:max_bytes(150000):strip_icc()/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)