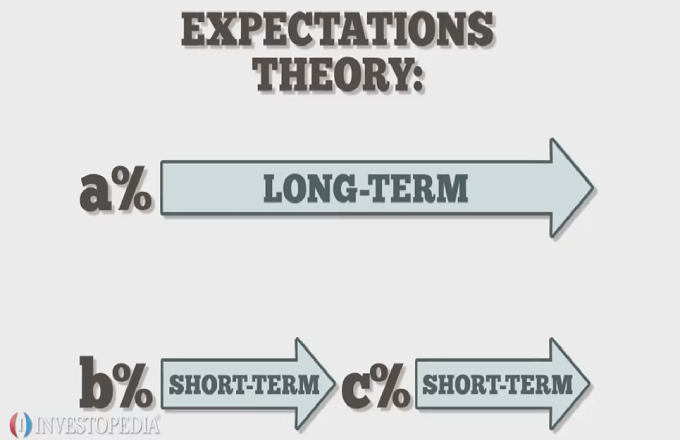

Treasury yield refers to the return on an investment in a U.S. government debt obligation, such as a bill, note or bond.Think of it as the interest rate the government pays to borrow money for different lengths of time. For example, say an investor buys a $10,000 Treasury bond with a three percent yield. It will provide a $300 annual return on investment. Treasuries are considered a low-risk investment because they’re backed by the U.S. government. But that low risk typically means smaller returns compared to other investments. Treasury yield is important because it affects the interest rates individuals and businesses pay to borrow money and buy real estate, vehicles and equipment. Also, the 10-year U.S. Treasury bond can help gauge investor sentiment. High investor confidence means falling prices and demand for the 10-year Treasury, and therefore a higher yield, because investors are confident they can find other investments with better returns. Prices rise and its yield decreases when confidence is low as there’s more demand for this safe investment. U.S. Treasuries come in bills, notes and bonds, and their maturities range from one month to 30 years. Each has a different yield, but longer-term Treasury securities usually have higher yields than short-term Treasuries.