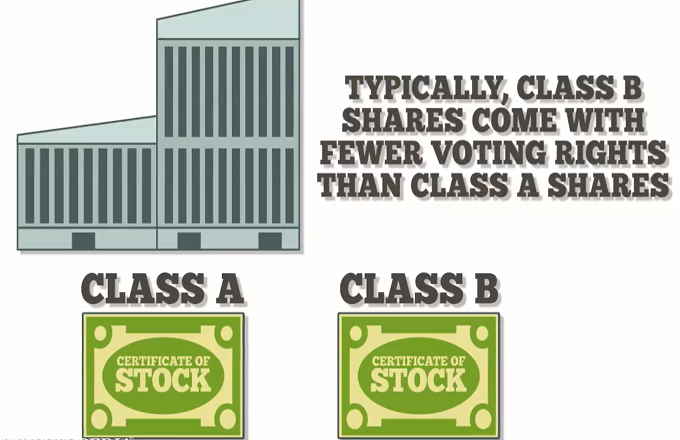

The share premium account is an equity account found on a company’s balance sheet. The amount in the account represents the additional amount shareholders paid for their issued shares that was in excess of the par value of those shares. For instance, if ABC Corporation issues 1 million shares with a par value of $1, but the actual purchase price is $10 per share, then ABC’s share premium account will have a $9 million balance. (($10 purchase price - $1 par value) x 1 million shares) Note that share premium only occurs when the company issues and sells shares above the par value of the stock. A shareholder selling his shares above par value in a secondary market does not affect the share premium account. The share premium account is often referred to as a restricted account, because corporate bylaws and government business regulations limit how it can be used. For instance, dividends cannot be paid out of the share premium account. In addition, this account may not be used to offset operating losses. However, corporations may use the share premium account to record the issuance of bonus shares and write off expenses associated with equity-related transactions like investment banking underwriting fees.