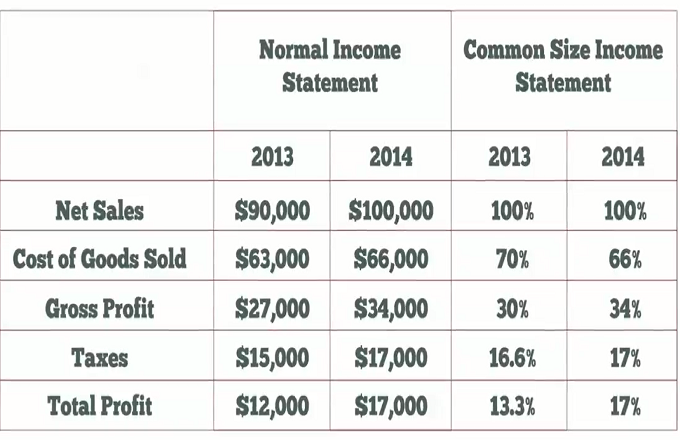

Sensitivity analysis is used in financial modeling to determine how one variable (the target variable) may be affected by changes in another variable (the input variable). One of the most obvious uses is the analysis of what variables affect a publicly traded company’s stock price. Input variables include the company’s earnings, the number of shares outstanding, balance sheet metrics like debt to equity ratios, and various industry metrics like the number of competitors in the industry. Assume Linda created a sensitivity analysis for the stock price of Beauty Products Inc. She used two input variables – net margin and number of industry competitors. Based on historical data, Linda determined that the stock price changed by 2% for every 1% change in net margin. Also, the stock price changed by 5% every time a competitor entered or left the industry. Based on Linda’s model, Beauty Products, Inc. can now make predictions about its stock price. Assume the stock price is currently $100 per share. If Beauty Products becomes more efficient and increases its net margin from 15% to 17%, the stock price should increase by 4% to $104. Or, if the net margin stays the same but another competitor enters the industry, Beauty Products’ stock price will likely fall by 5% to $95. By making different assumptions or adding different input variables, Linda can refine the sensitivity analysis and help management make better predictions about future stock prices.