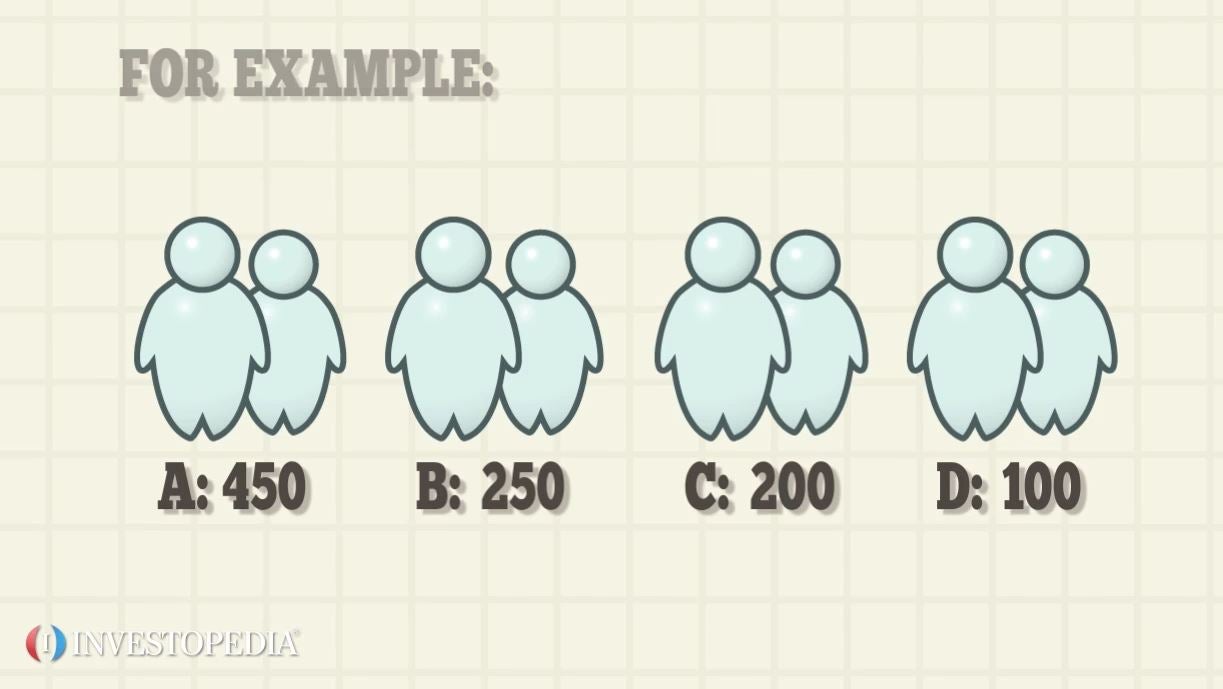

Expected return is the return an investor expects from an investment given the investment’s historical returns, or probable rates of return under different scenarios. To determine expected return based on historical data, an investor simply calculates an average of the investment’s historical return percentages and then uses that average as the expected return for the next investment period. To calculate an expected return based on probable returns under different scenarios, give each scenario a probability. The total of the probabilities must equal 100 percent. Multiply each scenario’s probability percentage by the investment’s return percentage under that scenario. Add the resulting amounts together to find the investment’s expected return. For example, an investment has the following expected returns, and probabilities of those returns, under four different scenarios: Scenario Probability Return 1 10% 50% 2 15% 40% 3 25% 30% 4 50% -20% The expected return of the investment is 8.5 percent, calculated as: .10(50%) + .15(40%) + .25(30%) + .5(-20%) A smart investor will consider risk in addition to the expected return. In the example given, there is a chance of large returns under scenarios 1, 2 and 3. However, there is a 50% chance that scenario 4 might happen and result in a negative return of 20%.