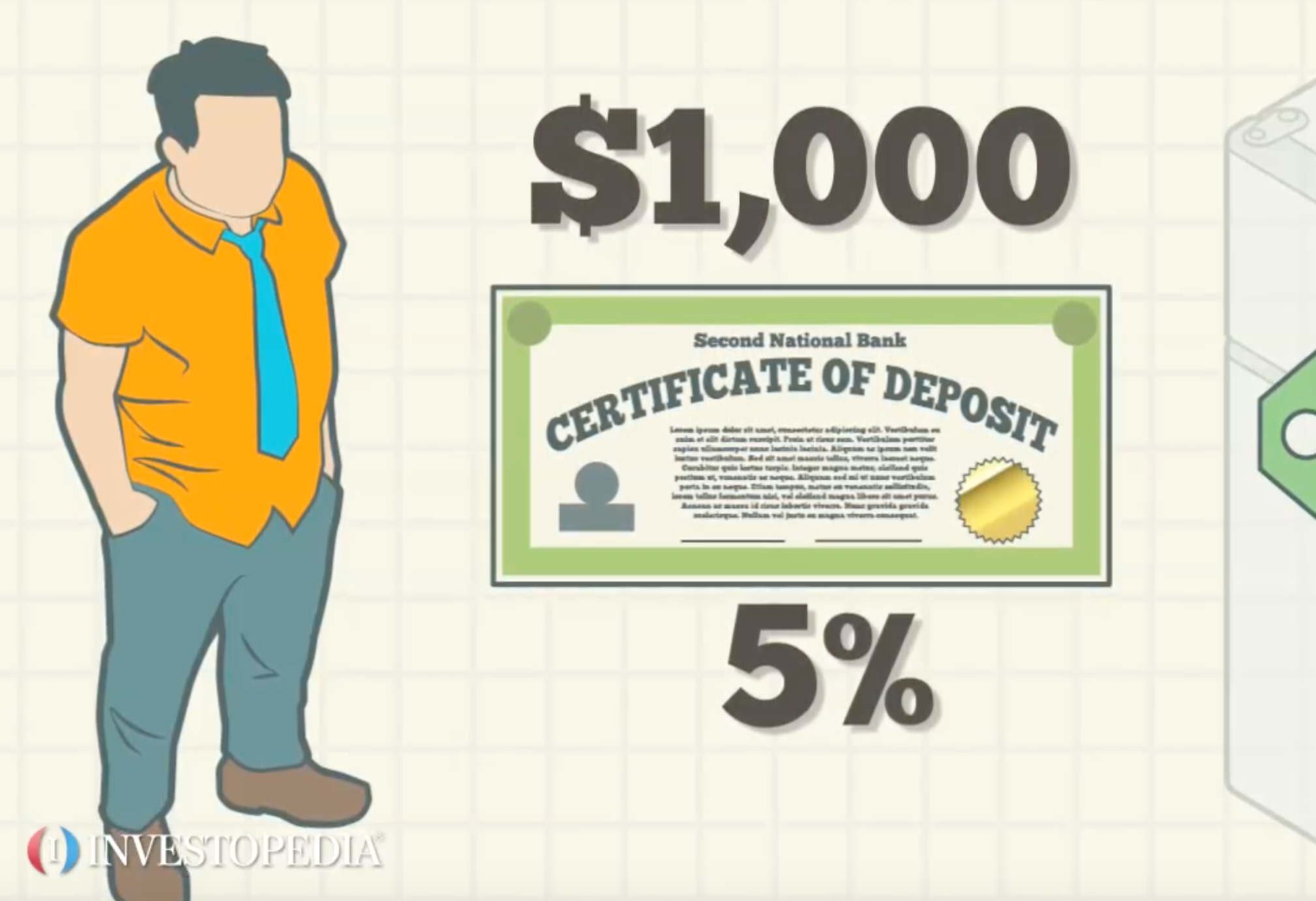

The effective annual interest rate is a way of restating the annual interest rate so that it takes into account the effects of compounding. The formula is: R = (1+ i / n) ^ n – 1. In this formula, R is the effective annual interest rate, i equals the stated annual interest rate and n equals the compounding period (which is usually semiannually, monthly or daily). The focus here is the contrast between R and i. If i, the annual interest rate, is 10%, then with monthly compounding where n equals the number of months in a year (12), the effective annual interest rate is 10.471% The formula would appear as: (1+10 % / 12 ) ^ 12 – 1 = 10.471% Why bother with effective annual interest? Using the effective annual interest rate helps us understand how differently a loan or investment performs if it compounds semiannually, monthly, daily or in any other timeframe. From the previous example, if we had $1,000 in a loan or investment that compounds monthly, it would yield $104.71 of interest in one year (10.471% of $1,000), which a higher amount than if we had the same loan or investment compounded annually. Yearly compounding would only generate $100 of interest (10% of $1,000), a difference of $4.71. If the loan or investment compounded daily (n = 365) instead of monthly (n = 12), the interest for that loan or investment would then be $105.16. As a rule of thumb, the more periods (n) the investment or loan compounds, the higher the effective annual interest rate will be.