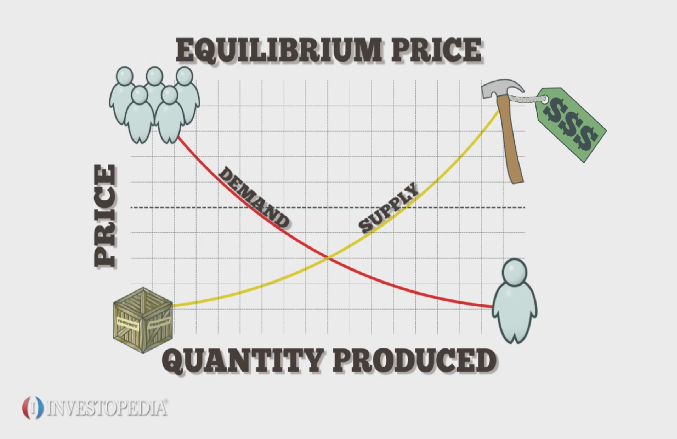

Deadweight loss is a concept used in economics that describes the loss to society as a result of market inefficiencies. Markets are inefficient when supply and demand are out of equilibrium, and thus the price for a good is not set to where the supply and demand curves intersect. Government policies sometimes create deadweight loss. For instance, rent controls and other types of price ceilings create more demand for a product than producers are willing to create at the artificially lower price. This results in shortages. Price floors, such as minimum wage laws, create a surplus when the equilibrium price is below the floor. Companies hire fewer workers when they have to pay higher prices for those workers than the market-based equilibrium price. Taxes also create deadweight loss because the total price for a good, which includes tax, may be higher than the equilibrium price consumers are willing to pay. For instance, on a graph where quantity is on the X-axis and price is on the Y-axis, the demand for widgets slopes downward from left to right. The supply for widgets slopes upward from left to right. Where the two curves cross is the equilibrium market price. If the government imposes a tax on each widget produced, the supply curve shifts up along the demand curve. The new curve crosses the demand curve at a higher price (because of the tax), but at a lower quantity. Thus there are fewer widgets produced than would have been produced without the tax.