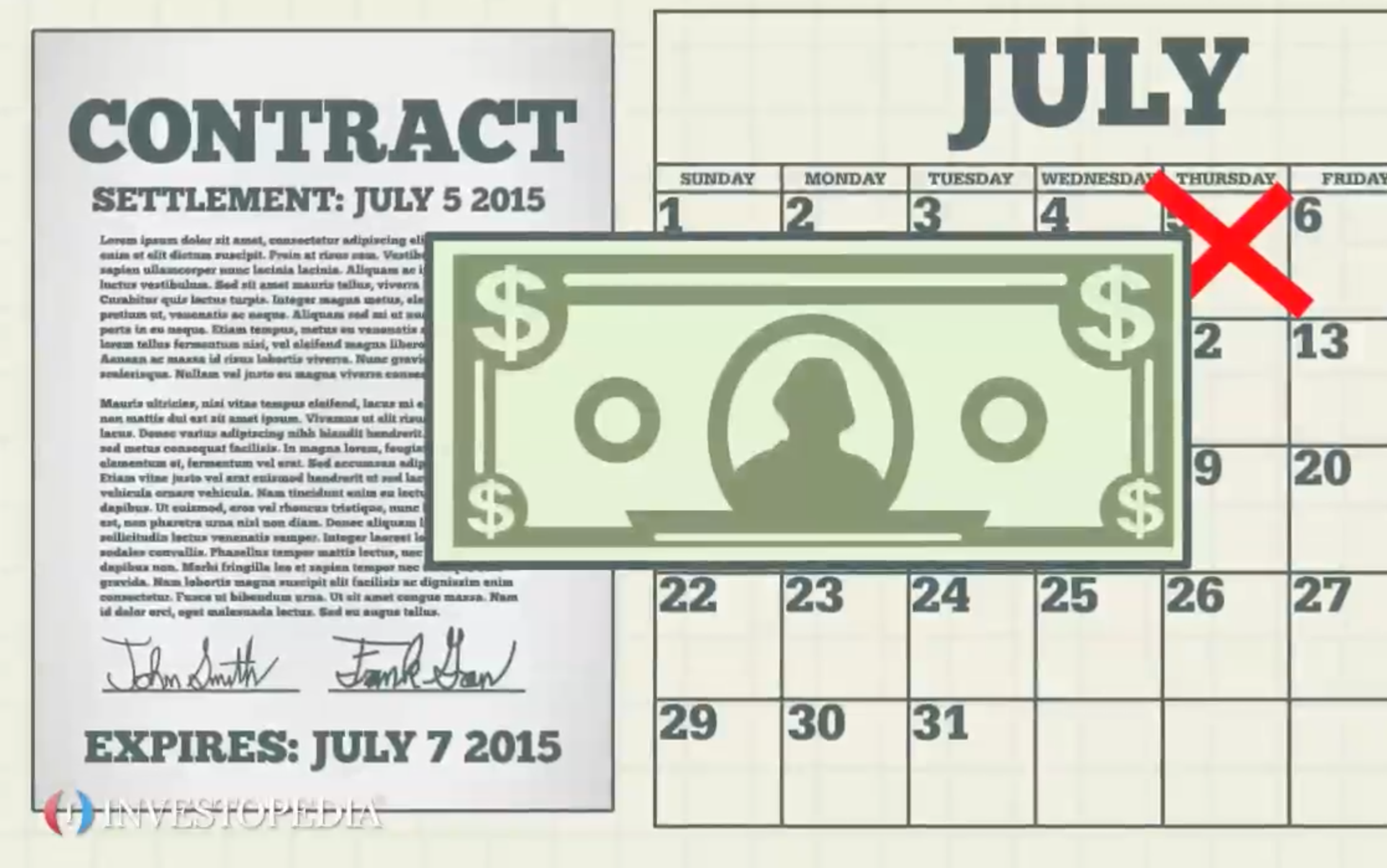

Commercial paper is a short-term debt security issued by financial companies and large corporations. The corporation promises the buyer a return, or profit, for making the loan. The return is stated as an interest rate or percentage of the loan, such as 5%.Companies sell commercial paper when they need a short-term loan to pay for such things as accounts payable and inventories. The security is generally sold at a discount, and redeemed at full value. The gain is the interest payment. Most commercial paper matures in one to six months, but some mature in up to nine months. Debt that matures in less than 270 days – the money markets -- does not require registration with the SEC. Debt maturing in more than 270 days – the capital markets -- must be registered with the SEC. Commercial paper is part of the money markets. By avoiding SEC registration, it is less costly - a major benefit for companies. By issuing commercial paper to raise short term funds, companies avoid the time and cost of applying for business loans, as well as SEC registration. Commercial paper is unsecured, meaning buyers have no claim on a company’s assets if the company fails to pay up at maturity. Therefore, only firms with good credit can successfully sell commercial paper. Commercial paper is traditionally sold in large denominations of $100,000 or more to large institutions and wealthy individuals. However, it is increasingly becoming more available to retail investors.