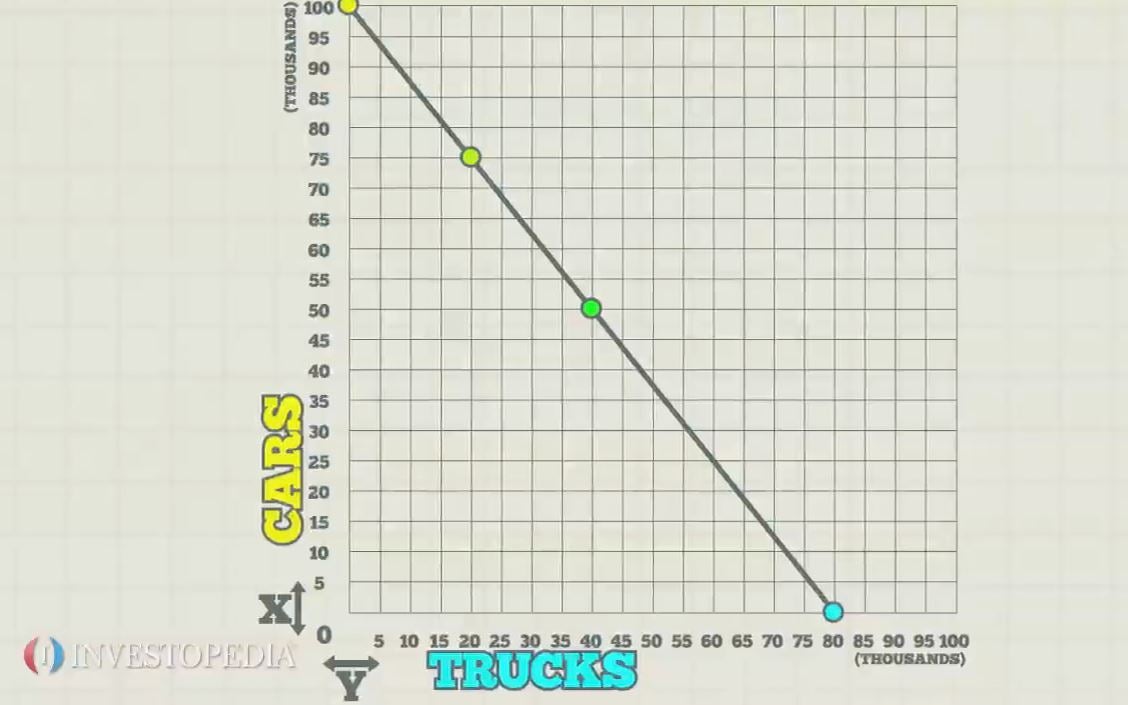

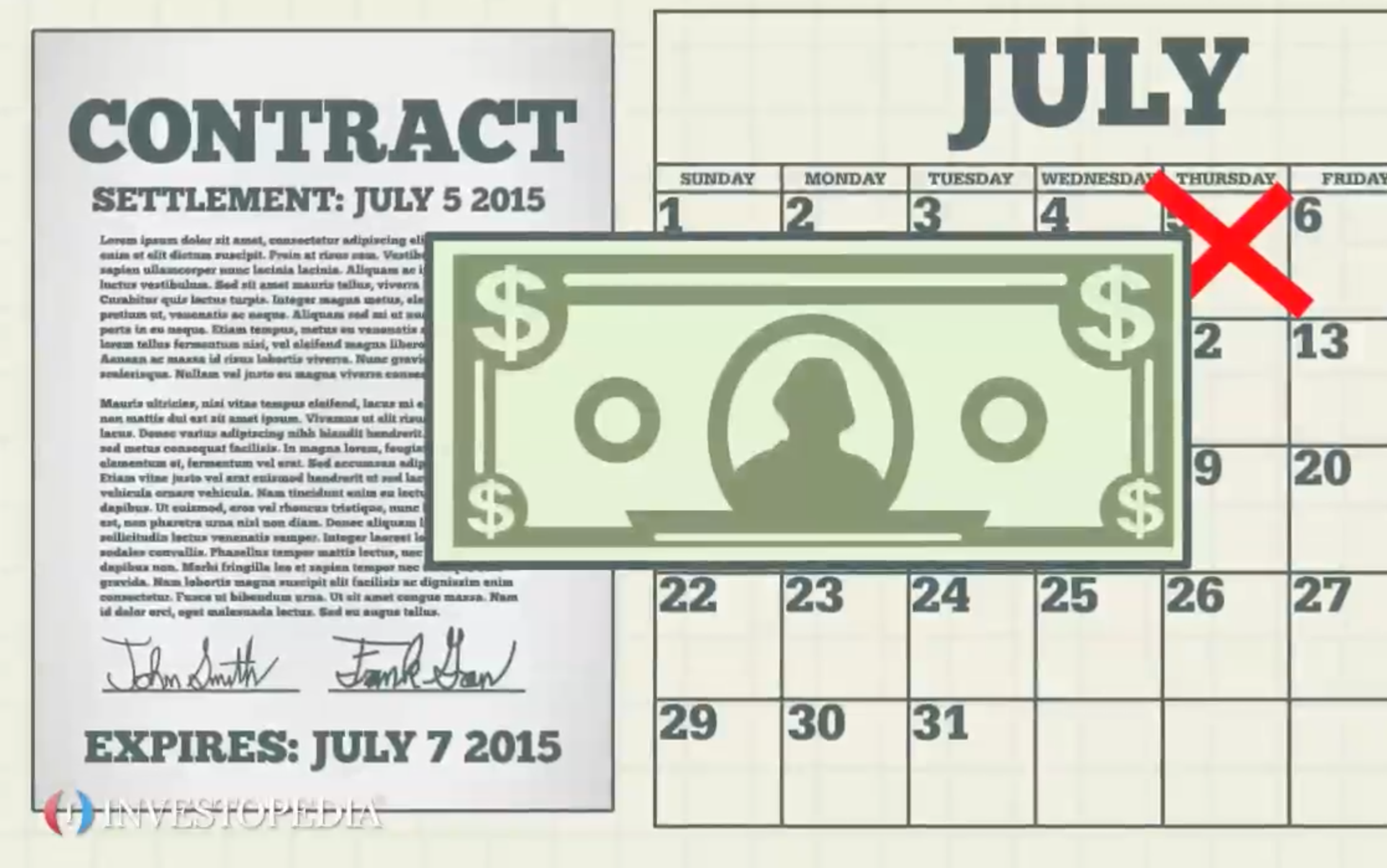

A collateralized loan obligation (CLO) is a security consisting of a pool of loans organized by maturity and risk. A CLO is very similar to a collateralized mortgage obligation, except that the underlying debt is not mortgages, but rather, different types of loans. CLO’s are usually comprised of millions of dollars of loans to privately owned businesses.The loans underlying the CLO serve as collateral securing the loan debt. These loans are arranged into different pools (called tranches) by maturity and the risk profile of the borrowers. At creation, the CLO sets a very explicit set of rules for how interest and principal payments are to be distributed among the various tranches. Investors purchase an interest in the CLO, choosing bonds according to their risk tolerance and investment needs. For instance, one tranche may represent interest and principal payments from the first two or three years of the loans underlying the CLO. This tranche would be less risky than a later tranche that represent interest and principal payments for years 12 through 15 of the underlying loans. Usually, the lead bank that made the original loans retains an interest in the CLO. It then collects interest and principal payments and distributes those payments to the various investors in the CLO. The financial crisis of 2007 and 2008 nearly ended the market for CLO’s. But the market for them has rebounded. Currently, the total value of the CLO market is in the hundreds of billions of dollars.