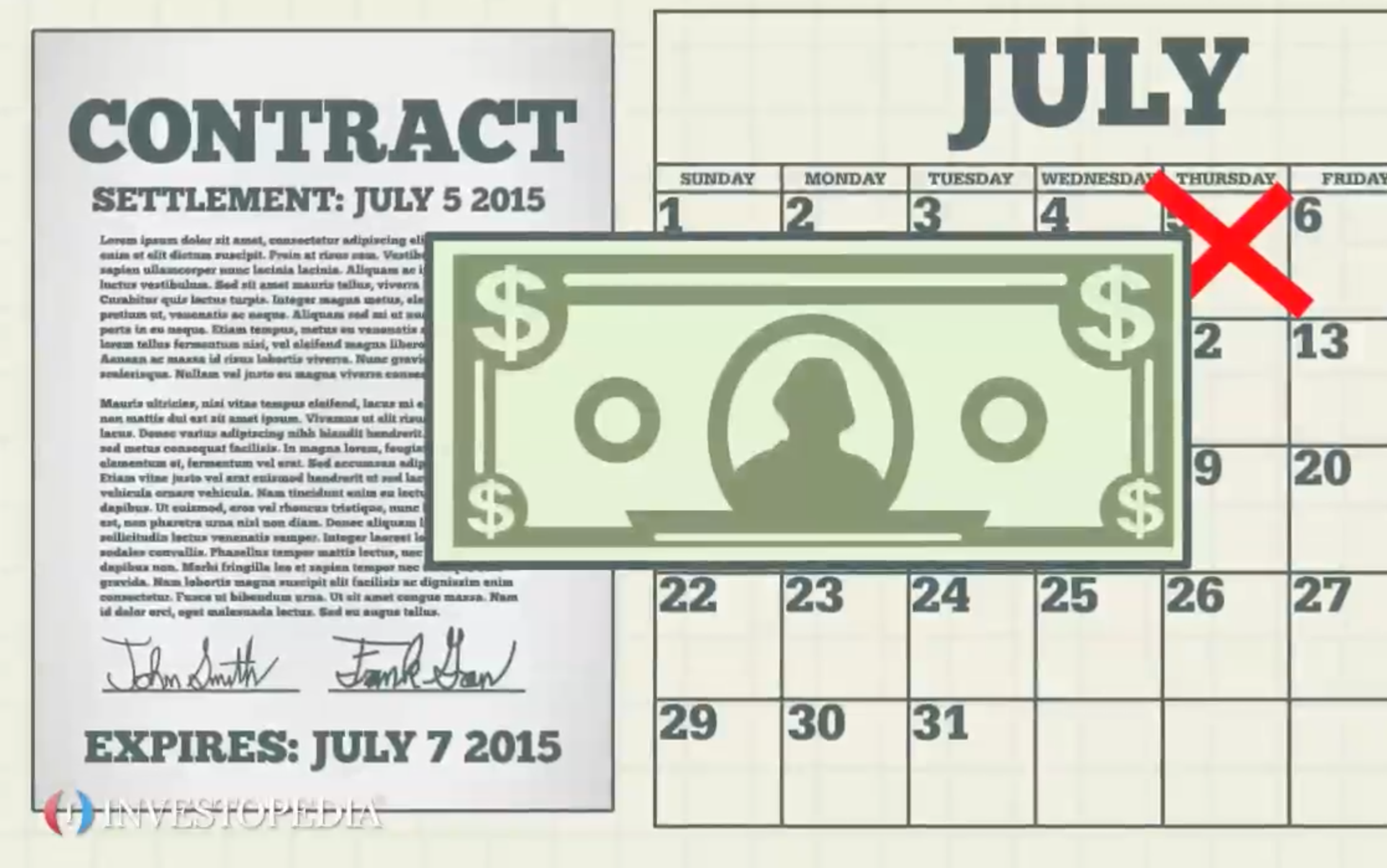

A clearing house is a third-party agency or separate entity that acts as a go-between for buyers and sellers in financial markets. The term is most often associated with commodity and futures markets. The clearing house is responsible for settling the exchange member’s trade accounts, maintaining margin accounts and collecting money. The clearing house also oversees delivery and reports trading data.Juanita sells 100 shares of ABC stock for $5,000 on an exchange. Darrel buys 100 shares of ABC stock for $5,000 on the same exchange. Darrel and Juanita never meet or know they were parties to the same transaction. Instead, the exchange’s clearing house collects $5,000 from Darrel’s account and places it into Juanita’s account. At the same time, the clearing house makes sure the 100 shares of ABC are registered in Darrel’s name. The clearing house also makes sure the trade information is reported to both parties and to the exchange. Clearing houses make financial markets stable and efficient. With millions of trades every day, it would be very difficult for each buyer and seller to contact one another and settle the transaction on their own. However, a clearing house takes on significant risk. For instance, when the clearing house buys the ABC stock from Juanita for $5,000, it expects that Darrel will immediately pay his $5,000. But if Darrel does not have $5,000 in his account, the clearing house is out $5,000. The risk increases when people trade on margin. To mitigate this risk, clearing houses require the exchange members to maintain minimum account balances.