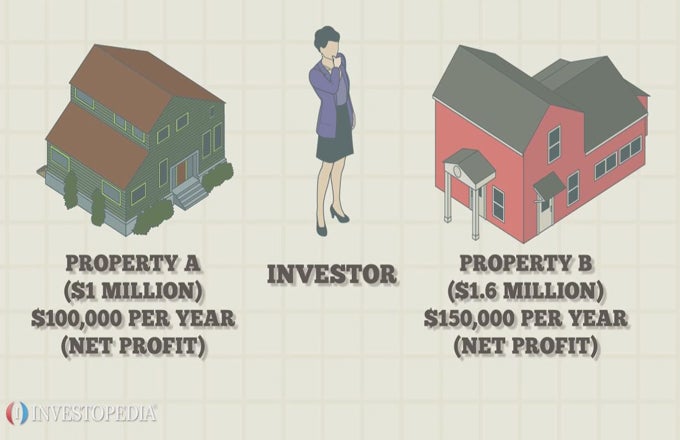

Capital budgeting is a planning process used by companies to evaluate which large projects to invest in, and how to finance them. It is sometimes called “investment appraisal.”The type of projects analyzed in capital budgeting include such major investments as building a new plant, buying new machinery, developing a new product or buying another company. Such large-scale projects are also called capital expenditures. Capital budgeting involves thorough financial analysis of each potential project. Typically, the company first estimates all expected future costs and revenue for each project. Then they discount these expected future cash flows to their net present value, using an appropriate discount rate. Most companies have a minimum rate of return that they must earn to justify making an investment. This is called a hurdle rate, and is often chosen as the discount rate. The company then compares each project’s results and typically chooses the project that offers the highest potential profit. SuperCom wants to enter the solar panel business. It uses capital budgeting to compare manufacturing its own solar panels against buying a company that already makes panels. It finds that developing the product will take five years to break even, and will produce an internal rate of return of 10%. Buying a company that already makes panels will pay back costs in four years, but will generate only a 5% rate of return. From this capital budgeting analysis, Supercom’s managers choose to develop the product themselves.