|

In November 1910, a group of six men met at the Jekyll Island Club off the coast of Georgia to secretly discuss their concerns about the banking system in the U.S. Like many Americans at the time, they were worried about the potential for financial panics, which had disrupted economic activity periodically throughout the previous century – and just three years earlier during the Bank Panic of 1907. (To read more, see The Banking System: Bank Crises and Panics.)

The men also believed that antiquated arrangements hindered the nation’s financial and economic progress – U.S. banks, for example, couldn’t operate overseas. To address these (and other) concerns, the group wrote a plan to reform the nation’s banking system. Their plan ultimately became the foundation for the Federal Reserve System. (For related reading, see How the Federal Reserve Was Formed.)

Three years after that clandestine meeting – on Dec. 23, 1913 – President Woodrow Wilson signed into law the Federal Reserve Act, and the Federal Reserve System was born. Today, the Federal Reserve “sets the nation’s monetary policy, supervises and regulates banking institutions, maintains the stability of the financial system and provides financial services to depository institutions, the U.S. government and foreign official institutions.” (For related reading, see A Look at Fiscal and Monetary Policy.)

Three Key Federal Reserve Entities

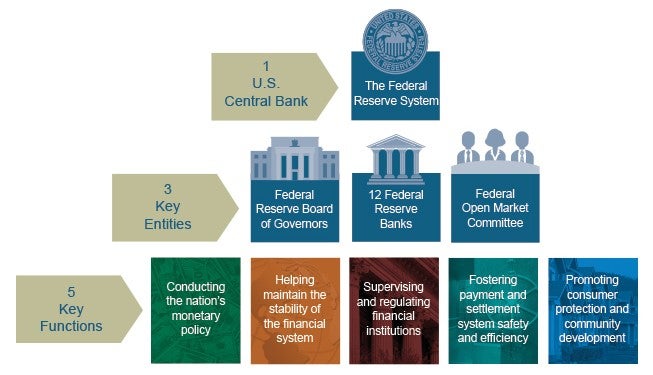

The Federal Reserve System is the central bank of the United States. It’s composed of three key entities, including a Board of Governors, 12 Federal Reserve Banks and the Federal Open Market Committee.

Source: The Federal Reserve System.

Board of Governors

The Federal Reserve Board of Governors is a central, independent governmental agency in Washington, D.C. The president of the United States appoints the seven members of the Board, who are then confirmed by the U.S. Senate. The full term for any Board member is 14 years; members who have served a full term can’t be reappointed. The president also appoints two of the Board members to serve as chair and vice chair of the Board. They each serve a four-year term and can be reappointed to the position. Previous chairs of the Board include Jerome Powell (nominated by President Trump on Nov. 2, 2017), Janet Yellen, Ben Bernanke and Alan Greenspan – the first (and only) person to have been appointed to five consecutive terms as the Fed’s chair. (For related reading, see Who is Jerome Powell? and What are the Federal Reserve Chairman’s Responsibilities?)

12 Federal Reserve Banks

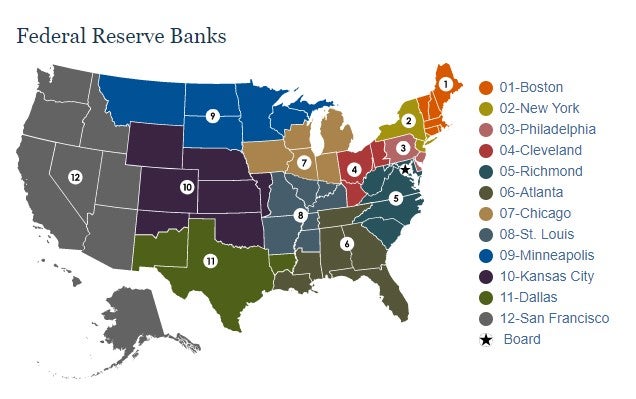

The 12 Federal Reserve Banks act as the operating arms of the Federal Reserve System. They are named after the locations of their headquarters: Atlanta, Boston, Chicago, Cleveland, Dallas, Kansas City, Minneapolis, New York, Philadelphia, Richmond, San Francisco and St. Louis. Each bank serves a specific district, as shown in the following map.

Source: The Federal Reserve System.

These banks operate independently, but under the supervision of the Board of Governors. Each of the 12 Reserve Banks is separately incorporated and has a board of directors that consists of nine members. Each bank president contributes to the monetary policy discussion by serving on the Federal Open Market Committee.

The Reserve Banks carry out the core functions of the Federal Reserve by:

- Supervising and examining state member banks.

- Lending to depository institutions to ensure liquidity in the financial system.

- Providing key financial services and serving as a bank for the U.S. Treasury.

- Examining certain financial institutions to ensure and enforce compliance with consumer protection and fair lending laws.

The Reserve Banks are considered quasi-governmental – or “legally private but functionally public” – because they are “owned” by commercial banks in their region (e.g., banks that hold stock in their Federal Reserve Bank), but serve public goals. An important distinction to make is that, while these member banks are considered “owners” of the Fed, they don’t have many of the usual rights of stockholders. Member banks, for example, are required to hold 6% of their capital as stock in their Reserve Bank – but, by law, their dividend return on this investment is fixed at 6%. About 34% of the commercial banks in the U.S. are members of the Federal Reserve System. All nationally chartered banks are required to be members, and state-chartered banks may choose to do so.

The Reserve Banks aren’t directly supported by tax dollars. Instead, they are primarily financed by interest earned on the Fed’s portfolio of income-producing government securities, plus interest on loans to depository institutions. Any excess earnings must be transferred to the U.S. Treasury. During 2008, for example, the income of the Reserve Banks amounted to about $35.5 billion, of which $31.7 billion – or 89% – was transferred to the U.S. Treasury.

Federal Open Market Committee

The System also includes the Federal Open Market Committee, better known as the FOMC. This is the policy-making branch of the Federal Reserve. Traditionally, the chair of the Board is also selected to serve as the chair of the FOMC. The voting members of the FOMC are the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York and the presidents of four other Reserve Banks who serve on a one-year rotating basis. All Reserve Bank presidents participate in FOMC policy discussions whether they are voting members or not. The FOMC is the part of the Fed that makes the important decisions on interest rates and other monetary policies – which is why they get the most attention in the media.

The Federal Reserve: Duties

-

Insights

InsightsWhat Do the Federal Reserve Banks Do?

These 12 regional banks are involved with four general tasks: formulate monetary policy, supervise financial institutions, facilitate government policy and provide payment services. -

Insights

InsightsThe Federal Reserve Chairman's Responsibilities

The chairman of the Federal Reserve Board has many duties including testifying before Congress and as acting as chair of the FOMC. -

Insights

InsightsHow the Federal Reserve Manages Money Supply

The Federal Reserve was created to help reduce the injuries inflicted during the slumps and was given some powerful tools to affect the supply of money. -

Investing

InvestingThe Treasury and the Federal Reserve

Find out how these two agencies create policies to manage the economy and keep it on an even keel. -

Insights

InsightsA Brief History of U.S. Banking Regulation

From the establishment of the First Bank of the United States to Dodd-Frank, American banking regulation has followed the path of a swinging pendulum.