Now that we’ve looked at value and growth investing, we can explore a hybrid stock-picking system that combines theories from both schools: growth at a reasonable price – or GARP. GARP investors look for companies that are somewhat undervalued (a feature of value investing) with solid sustainable growth potential (a tenet of growth investing) – an approach that attempts to avoid the extremes of either value or growth investing.

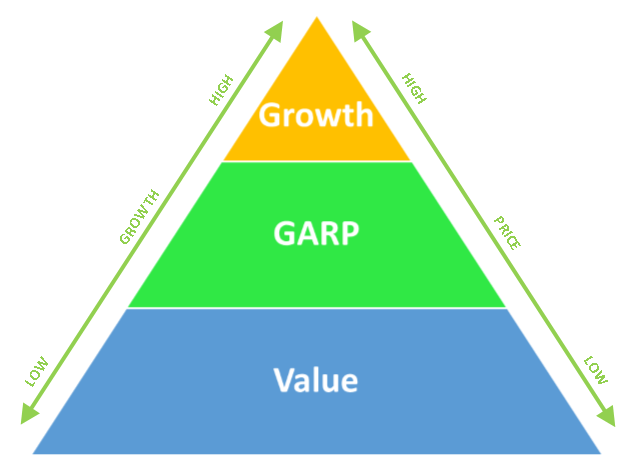

The diagram below shows the preferred levels of price and growth for growth, GARP and value investors; note that GARP is nestled in between value and growth:

GARP Stocks – Not a “GARP-y” Portfolio

It’s worth noting that GARP investors do not simply hold portfolios with equal amounts of value and growth stocks that somehow average out be “GARP-y.” Instead, GARPers identify stocks on an individual basis and select those that have neither purely value nor purely growth characteristics, but a combination of the two. That’s not to say that GARP investors wouldn’t also have growth and value stocks in their portfolios as part of an overall investment strategy – it just wouldn’t be part of a GARP strategy.

What to Look For

Because GARP investors straddle the gap between value and growth investors, they use metrics from both schools to find appropriate investments.

Value Metrics

GARP investors and value investors both pay close attention to a company’s present valuation, and both use the P/E ratio – the amount investors are willing to pay per dollar of earnings for a given company – to do so. In general, a low P/E can be a signal that a company is currently undervalued, or that it’s doing well compared to its past trends.

GARP investors generally aim for P/E ratios that are somewhat higher than what value investors look for, but well below the extremely high P/E ratios typically sought by growth investors. Keep in mind that – like many metrics – P/E should only be used to compare companies within the same sector. Comparing companies across different sectors can be misleading due to the various ways companies earn money – and the different timing for earning that money.

Another value metric used by both types of investors is the price-to-book (P/B) ratio, which compares a stock’s market value to its book value. It’s calculated by dividing the current closing price by the latest quarter’s book value per share. Value and GARP investors both look for a P/B that falls below the industry average.

Growth Metrics

Like growth investors, GARPers are interested in a company’s growth prospects: where the company will be in the next five to 10 years. Both types of investors look for positive earnings numbers over the past few years, plus positive earnings estimates for the next few years. Unlike growth investors, however, GARP investors steer clear of companies with extremely high growth estimates (e.g., those in the 25% to 50% range) because these investments are viewed as too risky. Instead, GARPers focus on more conservative earnings growth rates in the 10% to 20% range.

Like growth investors, GARPers are also interested in a company’s PEG ratio, a metric that gauges the balance between a stock’s growth potential and its value. Here's how it works.

The PEG Ratio

The PEG ratio may very well be the most important metric to any GARP investor, as it basically gauges the balance between a stock's growth potential and its value. (If you're unfamiliar with the PEG ratio, see: How the PEG Ratio Can Help Investors.)GARP investors require a PEG no higher than 1 and, in most cases, closer to 0.5. A PEG of less than 1 implies that, at present, the stock's price is lower than it should be given its earnings growth. To the GARP investor, a PEG below 1 indicates that a stock is undervalued and warrants further analysis.

PEG at Work

Say the TSJ Sports Conglomerate, a fictional company, is trading at 19 times earnings (P/E = 19) and has earnings growing at 30%. From this you can calculate that the TSJ has a PEG of 0.63 (19/30=0.63), which is pretty good by GARP standards.Now let's compare the TSJ to Cory's Tequila Co (CTC), which is trading at 11 times earnings (P/E = 11) and has earnings growth of 20%. Its PEG equals 0.55. The GARPer's interest would be aroused by the TSJ, but CTC would look even more attractive. Although it has slower growth compared to TSJ, CTC currently has a better price given its growth potential. In other words, CTC has slower growth, but TSJ's faster growth is more overpriced. As you can see, the GARP investor seeks solid growth, but also demands that this growth be valued at a reasonable price. Hey, the name does make sense!

When GARP Wins – and When It Doesn't

Because a GARP strategy employs principles from both value and growth investing, the returns that GARPers see during certain market phases are often different than the returns strictly value or growth investors would see at those times. For instance, in a raging bull market the returns from a growth strategy are often unbeatable: In the dotcom boom of the mid- to late-1990s, for example, neither the value investor nor the GARPer could compete. However, when the market does turn, a GARPer is less likely to suffer than the growth investor.

In short, the GARP strategy not only fuses growth and value stock-picking criteria, but also experiences a combination of their types of returns: A value investor will do better in bearish conditions; a growth investor will do exceptionally well in a raging bull market; and a GARPer will be rewarded with more consistent and predictable returns.

GARP might sound like the perfect strategy, but combining growth and value investing isn't as easy as it sounds. If you don't master both strategies, you could find yourself buying mediocre rather than good GARP stocks. But as many great investors such as Peter Lynch have proved, the returns are definitely worth the time it takes to learn the GARP techniques.

Stock-Picking Strategies: Income Investing

-

Investing

InvestingHow to Invest Your Excess Cash in Undervalued Securities

Learn how even small investors can shoot for substantial capital gains by starting to invest their excess cash in undervalued securities. -

Investing

InvestingSXC Health Solutions Corp. (USA) Among the Nasdaq's Biggest Movers

The market is having a bad day so far: the Nasdaq is trading down 0.3%; the S&P 500 has declined 0.4%; and the Dow has slipped 0.5%. The Nasdaq Composite Index is a capitalization-weighted index, ... -

Investing

Investing4 Investment Strategies To Learn Before Trading

The best thing about investing strategies is they’re flexible. -

Investing

InvestingCan Investors Trust The P/E Ratio?

The P/E ratio is one of the most popular stock market ratios, but it has some serious flaws that investors should know about. -

Investing

InvestingUnderstanding The P/E Ratio

Learn what the price/earnings ratio really means and how you should use it to value companies. -

Investing

InvestingStrategies of Legendary Value Investor

In this article, we'll look at some value investing techniques that legendary investors like Warren Buffett have used to identify undervalued companies.