Legendary Fidelity investor Peter Lynch was fond of pointing out that the investor who turns over the most rocks, or does the most due diligence and research to uncover great investments, stands the best chance at winning, or making fair amount of money (that hopefully performs better than the stock market as a whole) in the stock market.

Luckily, for investors willing to roll up their sleeves and uncover those rocks, there has never been a better time to be your own stock analyst. The Internet and digital information age continue to support the creation of research and analytical tools to analyze companies, stocks, and nearly any related investment. The large investment banks and investment firms no longer control the distribution channels. These days, smaller investors can obtain just as much information online, and on an equally timely basis.

Following in this article is an extensive listing and overview of some of the most popular resources and tools to help you research and analyze stocks. Most of these resources are fully available to any investor -- either online or free of charge at your local library. Certain other services might require a subscription or related fee, but are reasonable considering the thousands of dollars that can be made by investing in equities. In our minds the free resources will get the job done, and investors could consider supplementing these resources with more specialized subscription-based ones, as they see fit.

Researching and analyzing stocks has never been easier. Below is a rather comprehensive list and detail of the most popular resources for equity research and analysis. Many of these resources are available to any investor and free of charge at the local library or online. Other services require an escalating subscription fee, depending on how interested an individual is in supplementing the free ones.

Publicly Available and Free Resources

As we mentioned, it is entirely possible to thoroughly analyze a stock utilizing free research resources. Most pros find it difficult to beat the market consistently over time, which suggests that individual investors have just as good a chance at finding undervalued investments capable of outperforming major stock market indexes.

An extremely valuable but often overlooked resource is the Securities & Exchange Commission’s (SEC) website (www.SEC.gov). By law, publicly-traded companies must file financial statements and many financial-related developments with the SEC. SEC filings on the SEC website include quarterly and annual filings, major press releases (e.g. buying another company, reducing earnings guidance), and buying and selling activity of the highest ranking executives in a company. Collectively, SEC company filings are highly useful and provide some of the best insight into the operations of underlying companies.

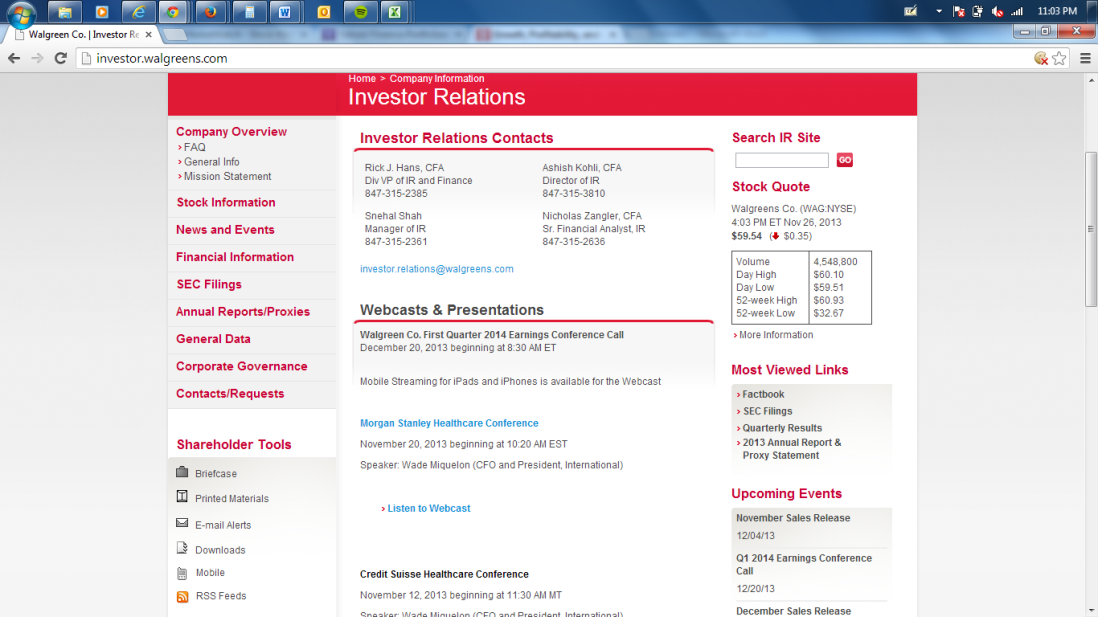

The vast majority of public companies, especially the larger ones in the mid- and large- market capitalization range (number of shares outstanding multiplied by the current stock price), provide some of the best resources to research and analyze their operations. Let’s look at Walgreens as an example. Most individuals are probably aware that Walgreens (NYSE:WAG) is one of the largest drugstore operators in the United States and maintains a website to sell the products also available at its stores. Fewer are likely aware that valuable “Company Information” is posted at the bottom of its retail site (www.walgreens.com). Under this company information is a link entitled “Investor Relations.” Again, nearly every public company will have a similar link on its website. Below is a screen shot from the Walgreens site:

Walgreens provides a detailed company overview, information about its stock and more basic general information, as well as the option to request a hard copy of its most recent reports. The more valuable links, all of which can be found on the left side of its investor relations site, include its financial information and direct links to all of its SEC filings, which we will cover in more detail below. The news and events tab for companies frequently goes unnoticed to investors and usually includes written and recorded versions of a company's presentations at investment conferences.

Popular Resources for Equity Research and Analysis: Chapter 2: The SEC Website

-

Investing

InvestingNatural Resource Investing

Learn more about ETFs and futures, two of the many investment options available to natural resource investors. -

Trading

TradingWalgreens Struggles Despite Being a Healthcare Hub

Drug store chain Walgreens appears to be a bargain given its P/E ratio of 18.07 and dividend yield of 2.45%. -

Investing

InvestingSEC Filings: Forms You Need To Know

The forms companies are required to file provide a clear view of their histories and progress. -

Investing

InvestingWalgreens Seeks a Buyer for 650 Stores (WBA)

Walgreens has hit a road block in its Rite-Aid deal, and there is no good detour option. -

Insights

InsightsUnderstanding the SEC

The SEC's triple mandate of investor protection, maintenance of orderly markets and facilitation of capital formation makes it a vital player in capital markets. -

Insights

InsightsThe SEC: A Brief History Of Regulation

The SEC has continued to make the market a safer place by learning from and adapting to new scandals and crises. -

Investing

InvestingWalgreens' Expensive Drugstore.com Experiment Ends

It's an old story: Traditional retailer buys a website in its space, then a few years later announces that it has closed said website. Usually this closure follows a period of optimism during ... -

Taxes

TaxesTax Tips For First-Time Filers

Here is a quick rundown on what you need to know if you're filing your taxes for the first time. -

Investing

InvestingNatural Resources ETF: IGE or GNR?

Explore a comparison between IGE and GNR, and learn about the differences between the two ETFs, and their top holdings and sector allocations. -

Investing

InvestingWhat Does the SEC Suspension of Bitcoin Investment Products Mean?

In September, the SEC suspended trades related to bitcoin and ethereum. What does this signal for the cryptocurrency industry more broadly?