Use a market order to guarantee a fill. A market order is the fastest and most reliable way to get in out of a trade, and is appropriate if getting filled is more important than getting a certain price.

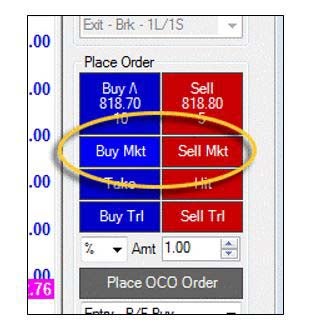

A market order is the most basic type of trade order. It’s an order to buy or sell at the best available current price. Most order entry interfaces – including trading apps – have handy "buy" and "sell" buttons to make these orders quick and easy. As long as there is adequate liquidity, this type of order is executed immediately.

The primary advantage to using a market order is that you’re guaranteed to get the trade filled: If you absolutely need to get in or out of a trade, a market order is your best bet. The downside, however, is that market orders don’t guarantee price or allow for any precision in order entry, which can lead to costly slippage. You can limit losses from slippage by using market orders only on instruments that trade with good liquidity.

A market order is the most basic type of trade order. Order entry interfaces usually have “buy” and “sell” buttons to make these orders quick and easy. Image created with TradeStation.

Typically, a market order to buy is filled at the ask price, and a market order to sell is filled at the bid price. Keep in mind that the last-traded price isn’t automatically the price at which a market order will be executed. This is especially true in fast-moving or thinly traded markets. (For more, see The Basics of the Bid-Ask Spread.)

Here’s an example. Say you place a market order to go long 1000 shares of stock ABC when the best offer price is currently $20.00 per share. If other orders in the queue are executed before your trade order, the market order may fill at a higher price. It’s also possible for parts of the order to execute at different prices. In this example, half of the order might execute at the best offer price and the other could fill at a higher price. A market order does not guarantee price – it only guarantees a fill.

Introduction To Order Types: Limit Orders

-

Investing

InvestingThe Basics of Trading a Stock: Know Your Orders

Taking control of your portfolio means knowing what orders to use when buying or selling stocks. -

Trading

TradingUnderstanding order execution

Find out the various ways in which a broker can fill an order, which can affect costs. -

Trading

TradingHow To Place Orders With A Forex Broker

Learn how to set each type of stop and limit when trading currencies. -

Investing

InvestingNarrow Your Range With Stop-Limit Orders

With stop-limit orders, buyers protect themselves from prices too high for their tastes.