Easily confused with the currency pair EUR/USD or euro FX futures, eurodollars have nothing to do with Europe’s single currency that was launched in 1999. Rather, eurodollars are time deposits denominated in U.S. dollars and held at banks outside the United States. A time deposit is simply an interest-yielding bank deposit with a specified date of maturity.

As a result of being outside U.S. borders, eurodollars are outside the jurisdiction of the Federal Reserve and subject to a lower level of regulation. As eurodollars are not subject to U.S. banking regulations, the higher level of risk to investors is reflected in higher interest rates.

The name eurodollars was derived from the fact that initially dollar-denominated deposits were largely held in European banks. At first these deposits were known as eurobank dollars. However, U.S. dollar–denominated deposits are now held in financial centers across the globe and still referred to as eurodollars.

Similarly (and also confusingly), the term eurocurrency is used to describe currency deposited in a bank that is not located in the home country where the currency was issued. For example, Japanese yen deposited at a bank in Brazil would be defined as eurocurrency.

History of Eurodollars

After the conclusion of World War II, the quantity of U.S. dollar deposits held outside the United States greatly increased. Contributing factors included the increased level of imports to the United States and economic aid to Europe as a result of the Marshall Plan.

The eurodollar market traces its origins to the Cold War era of the 1950s. During this period, the Soviet Union started to move its dollar-denominated revenue, derived from selling commodities such as crude oil, out of U.S. banks. This was done to prevent the United States from being able to freeze its assets. Since then, eurodollars have become one of the largest short-term money markets in the world and their interest rates have emerged as a benchmark for corporate funding.

Eurodollar Futures

The eurodollar futures contract was launched in 1981 by the Chicago Mercantile Exchange (CME), marking the first cash-settled futures contract. On expiration, the seller of cash-settled futures contracts can transfer the associated cash position rather than making a delivery of the underlying asset.

Eurodollar futures were initially traded on the upper floor of the Chicago Mercantile Exchange in its largest pit, which accommodated as many as 1,500 traders and clerks. However, the majority of eurodollar futures trading now takes place electronically.

The underlying instrument in eurodollar futures is a eurodollar time deposit, having a principal value of $1 million with a three-month maturity.

The “open outcry” eurodollar contract symbol (i.e. used on trading floors, where orders are communicated by shouts and hand signals) is ED and the electronic contract symbol is GE. Electronic trading of eurodollar futures takes place on the CME Globex electronic trading platform, Sunday through Friday, 6 p.m. to 5 p.m. EST. The expiration months are March, June, September and December, as with other financial futures contracts. The tick size (minimum fluctuation) is one-quarter of one basis point (0.0025 = $6.25 per contract) in the nearest expiring contract month and one-half of one basis point (0.005 = $12.50 per contract) in all other contract months. The leverage used in futures allows one contract to be traded with margin of about $1,000.

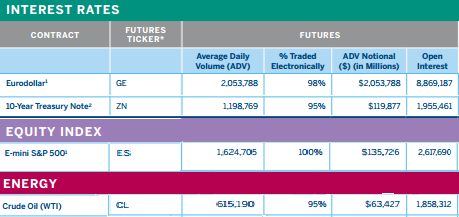

Eurodollars have grown to be the leading contract offered on the CME in terms of average daily volume and open interest (the total number of open contracts). As of February 2018, eurodollars far surpassed E-Mini S&P 500 futures (an electronically traded futures contract one-fifth the size of the standard S&P 500 futures contract), crude oil futures and 10-Year Treasury Note futures in average daily trading volume and open interest.

LIBOR and Eurodollars

The price of eurodollar futures reflects the interest rate offered on U.S. dollar–denominated deposits held in banks outside the United States. More specifically, the price reflects the market gauge of the 3-month U.S. dollar LIBOR (London Interbank Offered Rate) interest rate anticipated on the settlement date of the contract. LIBOR is a benchmark for short-term interest rates at which banks can borrow funds in the London interbank market. Eurodollar futures are a LIBOR-based derivative, reflecting the London Interbank Offered Rate for a 3-month $1 million offshore deposit.

Eurodollar futures prices are expressed numerically using 100 minus the implied 3-month U.S. dollar LIBOR interest rate. In this way, a eurodollar futures price of $96.00 reflects an implied settlement interest rate of 4%.

For example, if an investor buys one eurodollar futures contract at $96.00 and the price rises to $96.02, this corresponds to a lower implied settlement of LIBOR at 3.98%. The buyer of the futures contract will have made $50. (1 basis point, 0.01, is equal to $25 per contract, then a move of 0.02 equals a change of $50 per contract.)

Hedging with Eurodollar Futures

Eurodollar futures provide an effective means for companies and banks to secure an interest rate for money it plans to borrow or lend in the future. The eurodollar contract is used to hedge against yield curve changes over multiple years into the future.

For example: Say a company knows in September that it will need to borrow $8 million in December to make a purchase. Recall that each eurodollar futures contract represents a $1 million time deposit with a three-month maturity. The company can hedge against an adverse move in interest rates during that three-month period by short selling eight December eurodollar futures contracts, representing the $8 million needed for the purchase.

The price of eurodollar futures reflects the anticipated London Interbank Offered Rate (LIBOR) at the time of settlement, in this case, December. By short selling the December contract, the company profits from upward movement in interest rates, reflected in correspondingly lower December eurodollar futures prices.

Let’s assume that on Sept. 1, the December eurodollar futures contract price was exactly $96.00, implying an interest rate of 4.0%, and that at the expiry in December, the final closing price is $95.00, reflecting a higher interest rate of 5.0%. If the company had sold eight December eurodollar contracts at $96.00 in September, it would have profited by 100 basis points (100 x $25 = $2,500) on eight contracts, equaling $20,000 ($2,500 x 8) when it covered the short position.

In this way, the company was able to offset the rise in interest rates, effectively locking in the anticipated LIBOR for December as it was reflected in the price of the December eurodollar contract at the time it made the short sale in September.

Speculating with Eurodollar Futures

As an interest rate product, the policy decisions of the U.S. Federal Reserve have a major impact on the price of eurodollar futures. Volatility in this market is normally seen around important Federal Open Market Committee (FOMC) announcements and economic releases that could influence Federal Reserve monetary policy.

A change in Federal Reserve policy toward lowering or raising interest rates can take place over a period of years. Eurodollar futures are impacted by these major trends in monetary policy.

The long-term trending qualities of eurodollar futures make the contract an appealing choice for traders using trend-following strategies. Consider the following chart between 2000 and 2007, where the eurodollar trended upward for 15 consecutive months and later trended lower for 27 consecutive months.

Figure 1: Eurodollars have historically shown long periods of trending price movement between long periods of trading sideways.

The high levels of liquidity along with relatively low levels of intraday volatility (i.e. within one day) create an opportunity for traders using a “market making” style of trading. Traders using this non-directional strategy (neither bullish nor bearish) place orders on the bid and the offer simultaneously, attempting to capture the spread. More sophisticated strategies such as arbitrage and spreading against other contracts are also used by traders in the eurodollar futures market.

Eurodollars are used in the TED spread, which is used as an indicator of credit risk. The TED spread is the price difference between interest rates on three-month futures contracts for U.S. Treasuries and three-month contracts for eurodollars with the same expiration months. TED is an acronym using T-Bill and ED, the symbol for the eurodollar futures contract. An increase or decrease in the TED spread reflects sentiment on the default risk level of interbank loans.

The Bottom Line

Eurodollars are often overlooked by retail traders who tend to gravitate toward futures contracts that offer more short-term volatility, such as the E-mini S&P or crude oil. However, the deep level of liquidity and long-term trending qualities of the eurodollar market present interesting opportunities for small and large futures traders alike.

:max_bytes(150000):strip_icc()/business_building_153697270-5bfc2b9846e0fb0083c07d69.jpg)

:max_bytes(150000):strip_icc()/options-lrg-5bfc2b1f4cedfd0026c10437.jpg)

:max_bytes(150000):strip_icc()/131616451-5bfc2b96c9e77c00263065da.jpg)

:max_bytes(150000):strip_icc()/shutterstock_67023106-5bfc2b9846e0fb005144dd87.jpg)

:max_bytes(150000):strip_icc()/bonds-lrg-3-5bfc2b23c9e77c00519a93a4.jpg)