How Value Investors’ Patience Has Been Tested

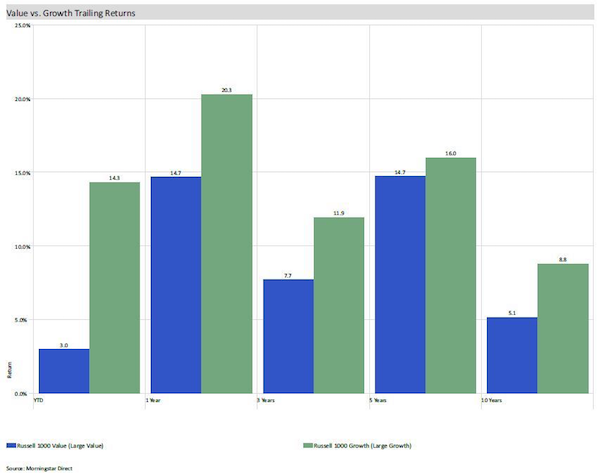

As of May 31, 2017, measured by the difference between the Russell 1000 Growth Index (growth stocks) and Russell 1000 Value Index (value stocks) - value stocks returned less than growth stocks over the past one, three, five and 10 years. Understandably, investors in value stocks are finding their patience tested. But we’ve seen this many times before, and it certainly won’t be the last time.

So, what’s a “growth” stock and what’s a “value” stock? A good example of a growth stock would be high-flying Amazon Inc., and then think of boring, old Johnson & Johnson Inc. as the value proxy. But many times, that boring, old value stock will leave the high fliers far behind. And today’s growth stocks could be tomorrow’s value stocks. Microsoft Corp. was the prototypical growth stock for decades, and is now seen as more of a slow-moving, sometimes value stock. (For more, see: The Value Investor's Handbook.)

We have exposure to both growth and value stocks in our portfolios. We do, however, tilt our portfolios in favor of value stocks. This is because of decades of academic research, analysis, testing, and real-world results illustrating that the “value premium” exists in stocks. In other words, value stocks tend to outperform growth stocks over long time periods.

A Brief Summary of Value Investing

The concept of value investing dates to at least the 1920s, when Benjamin Graham (the father of value investing) first began teaching finance at Columbia University. The fundamental principles of value investing were later solidified in the classic “Security Analysis,” first published in 1934 by Benjamin Graham and David Dodd.

Arguably the greatest investor in history, Warren Buffett, studied under Graham and is still applying his own version of value investing to this day. (For more, see: The Greatest Investors: Warren Buffett.)

The idea behind value investing is simple: Buy stocks at prices below their intrinsic value and wait patiently for their market price to reflect their true worth. Now, determining intrinsic value is beyond the scope of this article, but includes analyzing multiples such as price-to-book, price-to-earnings, free cash flow, etc. Value is not always found strictly in the hard numbers. Qualitative factors can come into play as well, like management integrity and vision.

Value investing makes sense and is somewhat intuitive, but putting it into practice is very difficult. You must be disciplined enough to stick to your guns, and possibly look out of step for long periods of time.

During the “tech boom,” as many growth stocks and technology-related firms soared in value in the mid to late 1990s, value strategies delivered positive returns but fell far behind in the relative performance race. At year-end 1999, value stocks had underperformed growth stocks dramatically for the decade. I think we all remember the ensuing “tech crash” that followed, thereby catapulting value stocks ahead of the obliterated growth stocks for many years to come.

It’s hard on the psyche to watch your value stocks get left in the dust behind growth stocks during raging bull markets. But the reward for patience and discipline can be substantial because, as we’ve seen time and time again, value stocks tend to outperform over long-term, full market cycles.

Down, But Not Out

It’s easy to question a strategy when you experience long periods of frustration. A question some may ask is, “Does value investing still work?” Just think back to that simple explanation of the strategy: To buy stocks at a discount and profit when the price catches up to intrinsic value. It’s not sexy, and can leave you feeling like an old fuddy-duddy at times, but it is a prudent strategy.

Yes, value investing still works and will have its day in the sun again. Who knows, that time may come sooner rather than later. These reversals in fortune tend to happen swiftly and without warning. Over the long, long-term my money is still on value stocks. (For more from this author, see: Why Investing in Commodities Can Be Tricky.)