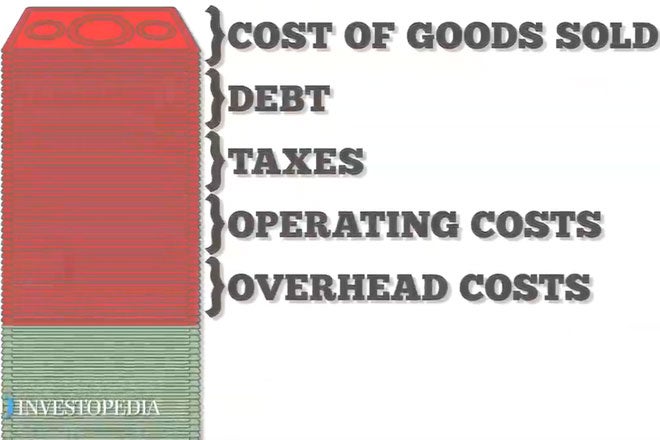

Net income and profit both deal with positive cash flow, but there are important differences between the two concepts.Net income, also called net profit, is an income statement’s bottom line. It’s the figure that most comprehensively reflects a business’s profitability. Net income accounts for every dime that flows in and out of a company. It includes expenses for product manufacturing, operations, debt payments and other obligations, as well as additional income streams from subsidiary holdings, asset sales, and other considerations. Profit is the revenue that remains after expenses are paid, and it can refer to a number of figures at a number of levels. For example, gross profit is revenue less the cost of goods sold. Operating profit is revenue minus the cost of goods sold and operating expenses. Companies calculate profit at different stages to see which expenses take the biggest bite out of the bottom line.