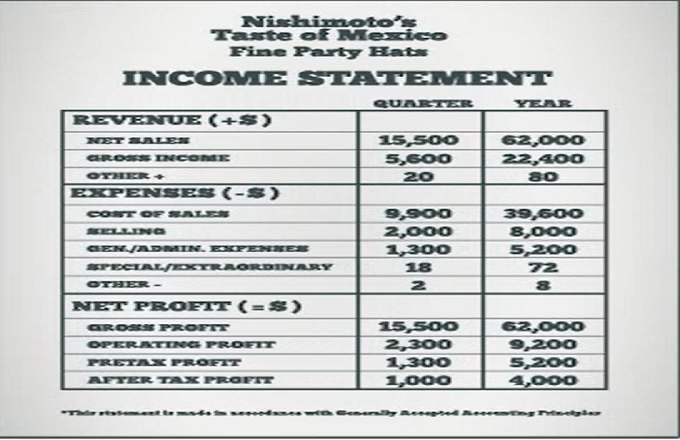

A company’s income statement includes the company’s gross, operating and net profits. All three require dividing the profit by revenue to calculate a profit margin.Gross profit is all income that remains after accounting for the cost of goods sold, such as raw materials and labor, excluding debt, taxes, operating and overhead costs, and other one-time expenditures. Gross profit reflects the percentage of each dollar of revenue retained after paying for the cost of production. Operating profit includes overhead, operating, administrative and sales expenses needed to run the business, excluding debts, taxes and other expenses, but including the amortization and depreciation of assets. Operating profit reflects the percentage of each dollar remaining after paying all necessary expenses to run the business. Net income is the bottom line. It reflects the revenue remaining after all expenses and additional income streams are accounted for, and reveals a company’s ability to turn income into profit. Money lost on basic operations weakens the gross and operating profit margins, leaving less revenue for other expenses.