A credit card can simply be a more convenient way to pay for purchases and a means for postponing payment. But these days, some cards can do more – from giving you discounts on travel to kicking back a little cash for the money you spend. Some cards also offer extra warranties on the products you buy and other perks. Consider your lifestyle (do you travel a lot?) and how you spend money (do you pay off your balance every month? use cash advances?) when you choose your card.

Learn about the options below and see which might be the best fit for you.

Secured Credit Cards

Secured credit cards are for consumers with no credit or poor credit. They require you to deposit an amount equal to your credit line with the bank that issues your credit card. If you don’t pay your balance, the card issuer can use your deposit to cover it. If you do pay your balance on time each month, you’ll improve your credit score.

The catch is that the credit card issuer must actually report your payments to the top three credit bureaus for your card use to improve your credit score and build up your credit history. Along with reporting your payments to credit bureaus, the best secured credit cards have no annual fee, cash back rewards and automatic account reviews to upgrade you to an unsecured card after several months. (Can't get a credit card without a credit history, and can't get a history without a card? Learn how to break the Catch-22 in How to Establish a Credit History.)

Travel Rewards Credit Cards

Travel rewards credit cards give you frequent flier miles, hotel points or generic travel points for each purchase you make using your cards. Additional benefits may include free checked luggage, free companion airfare, free hotel stays, air travel and hotel upgrades, and free airport lounge access. If a travel rewards card appeals to you, look for one with easy redemption features such as no blackout dates or the ability to pay with a combination of cash and points. (Learn more in How Do Travel Rewards Cards Work?)

Cash Back Credit Cards

Cash back credit cards return a percentage of each purchase amount to you as cash. Cash can be redeemed as a statement credit, check or direct deposit to your bank. Here are some of the ways you might earn cash back:

– 1% back on all purchases

– 5% back on all purchases in specified categories that change each quarter plus 1% back on all other purchases

– 3% back on groceries, 2% back on gas and 1% back on everything else

– 2% back on all purchases as long as you redeem your cash back to an account with the same bank that issued your credit card

– 1% back on all purchases, plus an additional 1% back when you pay your statement in full and on time

Many cards require you to accumulate a minimum amount of cash back, such as $20, before you can redeem it. Also, cards that offer higher levels of cash back may only offer it up to a certain purchase limit. For example, your 3% back on groceries may only apply to your first $300 in grocery purchases per month; after that, you may earn 1% on any additional grocery purchases.

(Not sure whether cash back or travel rewards would be the best choice for you? Read How to Effectively Compare Credit Card Rewards and Credit Card Rewards: Cash Back vs. Airline Miles. And keep in mind that you don’t have to choose just one credit card.)

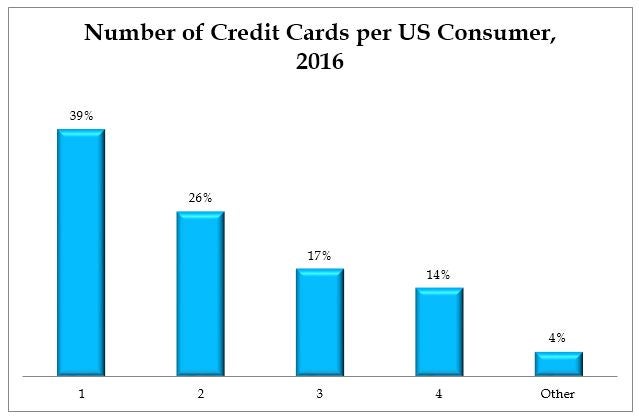

Source: TSYS 2016 U.S. Consumer Payment Study, p. 10.

Points Credit Cards

Points cards award you with a certain number of points per dollar spent. As with cash back cards, you may earn more points in some spending categories than others. Points can be redeemed for cash back, gift cards, travel and other rewards. Different rewards have different point values. You might be able to redeem 5,000 points for a $50 gift card or $40 cash back or $62.50 in air travel, for example.

Every points card has a unique rewards program. Before you apply, think about how quickly you’ll accumulate points based on your typical spending habits and how much value you’ll receive when you redeem those points. (For related reading, see Amex vs. Chase vs. Citi: Who Has the Best Rewards Points?, How Much Do You Need to Spend to Earn Credit Card Points? and How to Maximize Chase Ultimate Rewards.)

Single-Store Credit Cards

Many retail stores offer their own credit cards that come with benefits, such as a significant discount off your first purchase when you use the card and ongoing rewards and coupons that you can redeem for future discounts. For example, Target offers a credit card that gives consumers 5% off all their Target purchases at the register and free shipping on all Target.com purchases. The Amazon store card offers $40 off your first purchase and access to exclusive promotional financing offers, such as 0% interest for 12 months on purchases of $599 or more. Store credit cards may not be worth it unless you do a large percentage of your shopping at a single store. (Learn more in Store Credit Cards: Do The Incentives Pay Off? and The Best Retail Store Credit Cards.)

Store-Branded Credit Cards You Can Use Everywhere

Some stores offer credit cards that provide exclusive deals at that store but that you can use anywhere to earn points or cash back. Those rewards may be worth more when you redeem them at the store. The TJX Rewards Credit Card is a prime example. It’s a MasterCard that rewards consumers with 10% off your first in-store or online purchase, 5 points per $1 spent at stores in the TJX family (TJ Maxx, Home Goods, Marshalls and Sierra Trading Post) and 1 point per $1 spent at all other stores. Redeem 1,000 points for $10 off at TJX stores. (For related reading, see How to Make Credit Card Rewards Worth It.)

The biggest drawback of store-branded cards – whether you can use them everywhere or not – is that they encourage you to shop more and spend more than you might otherwise because of those enticing rewards. They also tend to have lower credit limits than general purpose credit cards. If you spend more than 20% of your credit limit on the card, your credit score could suffer. (If more than one of these options sounds appealing, you might be wondering, Will having several credit cards hurt my credit score? and How Many Credit Cards Should You Have?)

Sign-Up Bonus Credit Cards

Many credit cards these days come up with sign-up bonuses. They can be as small as 10% off your first purchase or as large as several hundred dollars’ worth of cash back or airfare. The best sign-up bonuses are reserved for consumers with very good to excellent credit and usually require you to spend a certain amount within your first three months of opening your account to earn the bonus. Some cards have annual fees, but the annual fee is often waived the first year or is more than offset by the sign-up bonus. (For more, see Credit Cards: Should You Ever Pay An Annual Fee?)

Sign-up bonuses can be a great perk for those who don’t carry a balance and whose normal spending habits allow them to meet the spending requirements to earn the bonus. Most major issuers have sign-up bonuses, but Chase usually leads the pack with the number and size of its sign-up bonuses. (Learn more in Make Money Off Credit Card Sign-Up Bonuses.)

Low Introductory APR Credit Cards

If you have very good to excellent credit, you have a good chance at being approved for a card with a low introductory APR. For example, you might be able to make purchases for 9 months, 12 months, 15 months, 18 months or even 21 months with no interest. Once the card’s introductory rate ends, you’ll pay the regular interest rate on any balance you haven’t paid off, so you must be careful to avoid charging more than you can afford if you want to avoid paying interest.

The other catch with these cards is that you can lose your introductory rate if you’re more than 60 days late on your minimum payment. If that happens, you will incur a much higher penalty rate on your balance and your credit score will suffer.

Deferred Interest Credit Cards

If you’ve ever been to a home improvement or furniture store, you’ve probably come across a deferred interest credit card. These cards seem similar to 0% introductory rate cards on the surface, but there’s an important difference: While you might not have to make any payments for 12 months on purchases over $500 (or whatever terms the card offers), if you haven’t paid off that balance before the 12 months is up, you will not only owe interest on your remaining balance going forward, you’ll also be charged deferred interest on that amount retroactively from the date of your purchase.

Low Purchase APR Credit Cards

While we hope you’ll never go into credit card debt, if it does happen, you can limit the damage by making your purchases on a card with a 0% introductory rate or relatively low regular interest rate. The average credit card interest rate as of the third quarter of 2017 was 13.08% for all accounts and 14.87% for accounts carrying a balance, and the best rate you can hope to find that isn’t an introductory rate will usually fall around those averages if you have very good to excellent credit (a credit score of 740–850). If you need to use a credit card as an emergency fund while you work on building up your cash reserves, a low-rate card isn’t the worst option.

Balance Transfer Credit Cards

If you’ve run into some expensive bad luck, such as getting laid off or getting sick, that’s caused you to go into credit card debt and you’re trying to turn things around, you may be able to transfer your high-interest credit card debt to a lower-interest card with a balance transfer. You’ll need good credit to be approved. The best option out there is a 0% balance transfer offer; the second-best option is to transfer your balance to a card with a lower interest rate than what you’re currently paying. There’s generally a balance transfer fee of 3% of the amount transferred, so make sure you’ll come out ahead on the lower interest rate even after paying that fee. (Learn more in 0% Balance Transfers: Who Really Benefits?, The Pros and Cons of Balance Transfers and Alternatives to Balance Transfers.)

In the next section, we’ll teach you about how credit card interest works and how to make credit card payments.

Credit Cards: Making Payments

-

Personal Finance

Personal Finance10 Reasons To Use Your Credit Card

There's a surprising credit card strategy you should employ as a consumer ... use your card for everything (or almost). -

Personal Finance

Personal Finance4 Best Credit Cards for 2018

If you have good credit, card companies are competing for your business. Here are some of this year's best deals and credit cards you should look at. -

Personal Finance

Personal FinanceCredit Card or Cash: Which To Use?

Credit cards are more convenient to use than cash, but they're not always the best choice. Here is why you should and shouldn't pay with a credit card. -

Personal Finance

Personal Finance3 New Types Of Credit Cards To Look For

These three types of credit cards are becoming popular with customers looking to pay less fees and build up their credit scores. -

Personal Finance

Personal FinanceStore Credit Cards: Do The Incentives Pay Off?

Check out the pros and cons behind store credit cards; they might actually help you save money. -

Personal Finance

Personal FinanceBest Credit Card Features For Students

Students should look for credit cards that charge no annual fees, have a low introductory interest rate and offer rewards or money. -

Personal Finance

Personal Finance7 Factors For Comparing Credit Cards

It's good to find a credit card that fits your lifestyle, but read the fine print to make sure you're not overpaying for the benefits. -

Personal Finance

Personal FinanceWhy More Millennials Need Credit Cards

Here's why more Millennials should have credit cards – even though a majority don’t. -

Personal Finance

Personal FinanceTop 5 Ways To Make Your Credit Card Work For You

The best investors know that either they work for their money or their money works for them.