Credit card terms can differ widely, depending on the type of card and your credit rating. Read the fine print carefully before you sign up. Note also that there may be a range of rates quoted; the best rate isn't necessarily the one you will be offered.

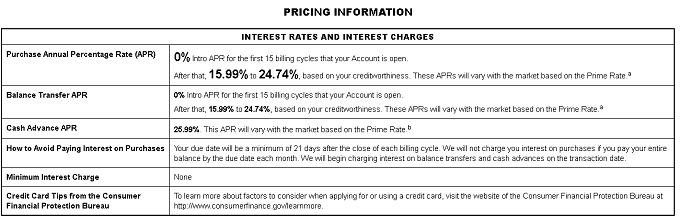

The first section of the agreement will contain a table similar to the one below, laying out the card’s introductory APR (if any), regular purchase APR, balance transfer APR, cash advance APR, due date and grace period, and minimum interest charge (also called minimum finance charge).

Source: Chase.com

The second section of the cardholder agreement will contain a table similar to the one below laying out the card’s annual membership fee, balance transfer fee, cash advance fee, foreign transaction fee, late payment fee, over-the-limit fee, returned payment fee and return check fee.

RELATED: 8 Considerations for Using Your Credit Card Abroad

Source: Chase.com

Below these two tables, you’ll find the fine print about other key details:

– how your balance will be calculated

– how your payments will be allocated

– how your interest rate will be determined

– what you’re authorizing the issuer to do when you apply (e.g., check your credit reports, contact you)

– the size of credit line you may qualify for

– balance transfer options (See Transferring Credit Card Balances to a New Card)

– details on rewards programs and special features (e.g., cash back, free credit score, card freeze)

Reading Credit Card Agreements

Do you need to read the whole agreement? If you’ve never read a credit card agreement before, it’s a good idea to. It’s the best way to avoid ugly surprises later. If you’re reading the agreement and you realize that you don’t really understand what it’s saying about how your interest rate will be determined, for example, you can research that further before you apply (or make sure to never carry a balance). If you’re already familiar with credit cards, you should still read the two charts at the top to make sure you understand the fees and interest associated with this particular card.

Here are five easy ways to obtain the agreement for a particular card.

1. If you’re applying for a new card online, you can find a link to the agreement on the application page.

2. When you receive a new card in the mail, a copy of the agreement will be enclosed.

3. If you already have the card, you can log into your account online, then look for a link to download the agreement; if you can’t find a link, just email customer service to request a copy of your agreement.

4. If you don’t use the Internet to manage your credit cards, you can call the number on the back of your card to ask customer service to mail you a copy of your agreement.

5. Finally, the Consumer Financial Protection Bureau has compiled a database of credit card agreements on its website.

(If you’re not sure that owning a credit card is right for you, learn about the alternative in How to Live Without a Credit Card.)

Credit Card Consumer Rights

The Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act) was passed after the financial crisis of 2008 to make credit card approvals, agreements and pricing fairer and easier to understand for consumers. Here are the key rights you need to know about.

Interest Rate Protections

– Credit card issuers can’t increase your interest rate for future transactions without providing 45 days written notice.

– Credit card issuers can’t increase your interest rate during the first year after you open your account unless a promotional rate expires or the interest rate underlying the card’s variable rate (such as LIBOR or the prime rate) goes up.

– Your interest rate on existing balances can’t go up unless you have missed two consecutive monthly payments and received 45 days written notice.

– If the card issuer increases your interest rate for existing balances or new transactions, it must review your account at least once every six months to determine if a rate decrease is warranted.

Fee Protections

Late fees and overlimit fees are limited to $25 for the first offense and $35 for each subsequent offense within the next six months.

Overlimit fees are prohibited unless the consumer opts in.

The card issuer can’t require you to pay fees in excess of 25% of the card’s total initial credit line within the first year of opening your account, with the exception of penalty fees.

Payment Protections

Payments must be due on the same day each month.

Statements must be mailed or delivered at least 21 days before your due date.

Payments exceeding the minimum must be applied to your balances from highest interest rate to lowest.

Monthly statements must show the full costs associated with various payment options, such as only making the minimum payment and being late on the minimum payment. (See How is the minimum payment on a credit card calculated?)

Card Approval Protections

Card issuers must evaluate a consumer’s ability to pay before issuing a card or increasing a credit line.

Stay-at-home spouses and partners can be issued cards based on household income even if they don’t have their own income.

Students younger than 21 must be able to independently pay charges on a card – or have a cosigner – to receive approval.

We’ll talk about credit card fraud protection in section 6 when we discuss the pros of using a credit card.

In the next section, we’ll discuss the different types of credit cards you can choose, if you qualify.

Credit Cards: Types to Choose From

-

Personal Finance

Personal Finance7 Factors For Comparing Credit Cards

It's good to find a credit card that fits your lifestyle, but read the fine print to make sure you're not overpaying for the benefits. -

Personal Finance

Personal Finance10 Considerations For Using Your Credit Card Abroad

Credit cards can be the best item you pack when traveling, just make sure that you are taking the right card that suits your needs. -

Small Business

Small BusinessHow to Use Small Business Credit Cards

A small business credit card can be a convenient way to increase your company's purchasing power, enabling access to a revolving line of credit. -

Personal Finance

Personal Finance10 Reasons To Use Your Credit Card

There's a surprising credit card strategy you should employ as a consumer ... use your card for everything (or almost). -

Personal Finance

Personal FinanceBest Credit Cards For 2015

The best credit card for you depends on your financial goals. Our choices for the best cards in 4 different categories. -

Personal Finance

Personal FinanceHow To Get Your First Credit Card

Here's a rundown of how you can go about getting your first credit card. -

Personal Finance

Personal Finance4 Best Credit Cards for 2018

If you have good credit, card companies are competing for your business. Here are some of this year's best deals and credit cards you should look at. -

Personal Finance

Personal Finance5 Credit Card Myths Hurting Your Financial Future

It's important to understand the facts versus myths about credit cards and use them in a way that won't hurt your financial future. -

Personal Finance

Personal FinanceCredit Cards For People With Bad Credit

Yes, you can get a credit card and start repairing your credit history. But brace yourself for low credit limits, sky-high interest and staggering fees.