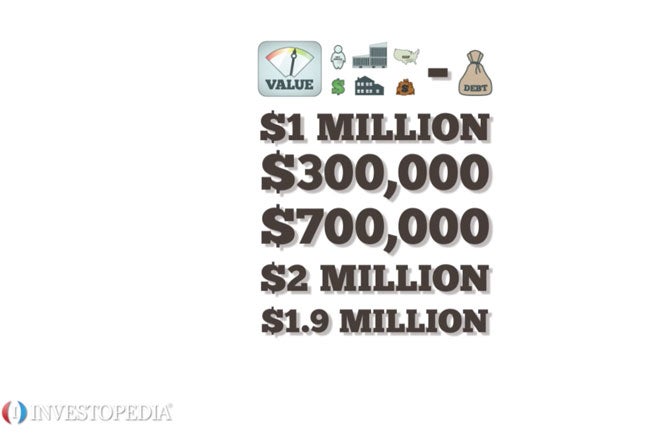

A privately held company is owned by its founder, management or a group of private investors. A public company has sold a portion of itself to the public through an initial public offering of the company’s stock. Shareholders can claim a part of the company’s assets and profits.A big difference between private and public companies involves public disclosure. A public U.S. company trades on a stock exchange and must file quarterly earnings reports with the SEC that are accessible to shareholders and the public. Private companies do not trade on an exchange. They are not required to disclose their financial information or file disclosure statements with the SEC. Public companies have the advantage of raising capital by selling stock or issuing bonds. Private companies don’t have that luxury. When they need capital, private companies turn to private funding, which can boost the cost of capital or limit expansion. Contrary to popular belief, many of the biggest companies are privately held. Check out the list of largest private companies at Forbes.com.