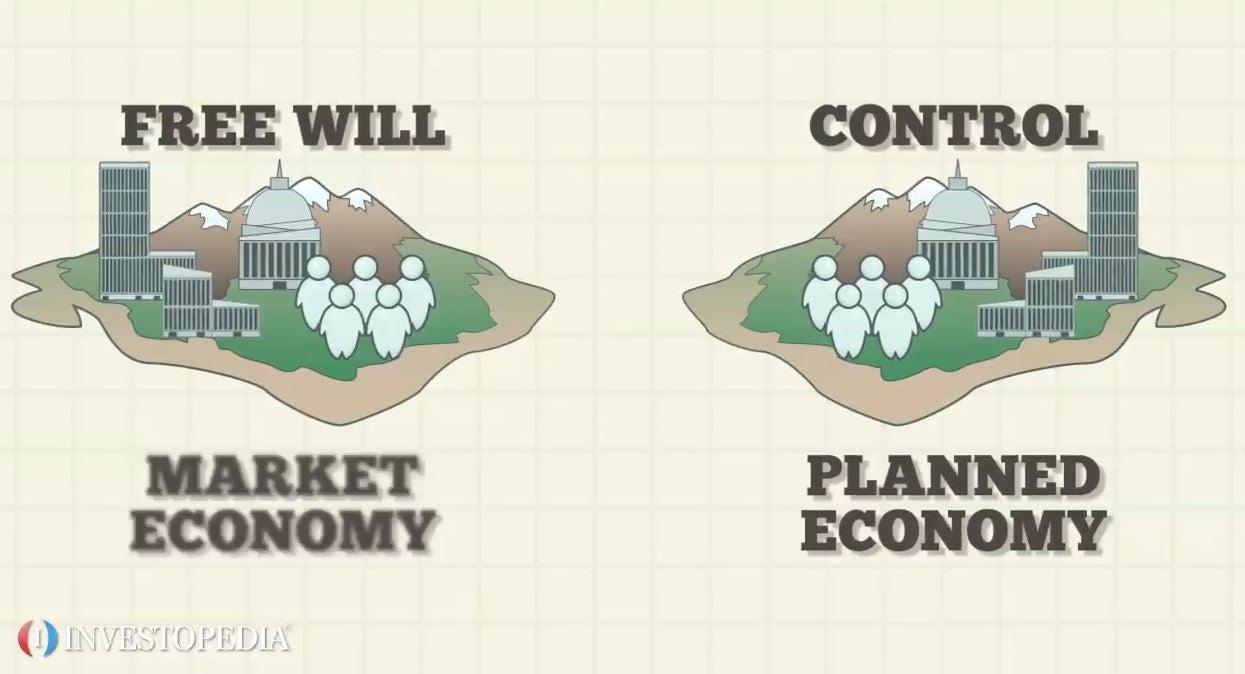

Capital markets channel savings and investments between suppliers of capital, such as retail investors and institutional investors, to users of capital like businesses, governments and individuals. They do this by selling financial products like equity and debt securities. Equity securities, also called stocks, are ownership shares in an organization. Debt securities, such as bonds, are interest-bearing IOUs.Capital markets include primary markets and secondary markets. In primary markets, new stock and bond issues are directly allocated to institutions, businesses or individual investors. In secondary markets, existing securities are traded in organized and often regulated markets like the NYSE or NASDAQ. Capital markets are concentrated in financial centers such as New York, London, Singapore and Hong Kong. Because capital markets move money from people who have it, to organizations that need it for productive uses, they are critical to the effective functioning of a modern economy. TV-Tech is a start-up company and is looking for investors to fund their new product, a combination TV & Watch device. Alice, a venture capitalist, believes this new company will be a great success and decides to buy 20% of the start-up directly from the founders. This transaction, because it lacks a regulated market, would take place in the primary market. If TV-Tech then goes public and is listed in an exchange like the NYSE or the NASDAQ, then buying and selling shares of TV-Tech from its original investors would take place in the secondary market.