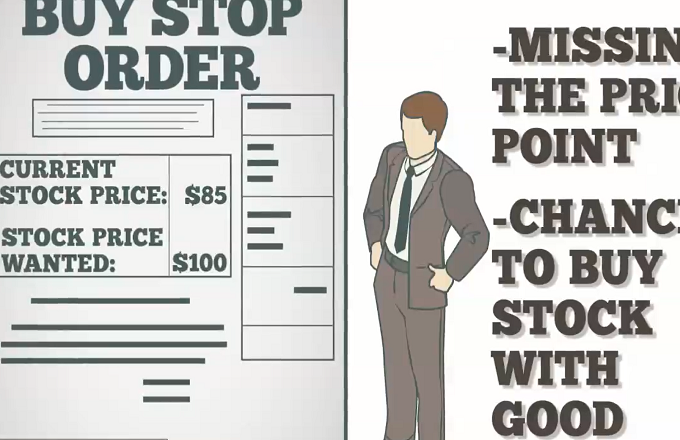

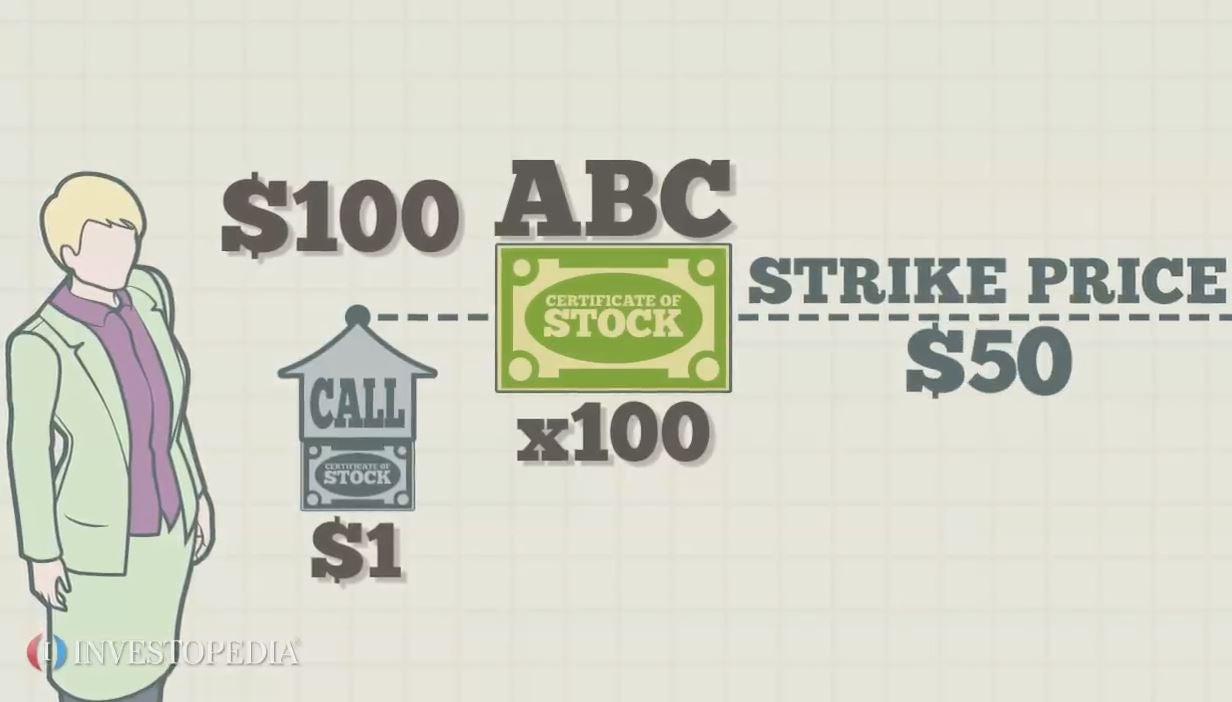

A buy limit order happens when an investor places an order to purchase a security at or below a set price. The buy limit order allows a purchaser to limit the amount she is willing to pay for a security. Brokers usually charge more for buy limit orders than they do for market orders.For instance, Mary wants to buy ABC stock, but does not want to pay more than $45 a share. Currently, ABC stock trades at $49 a share. Mary places a buy limit order with her broker to purchase ABC at $45. If ABC stock drops to $45 or below, then Mary’s order will be triggered and she will own the stock. If ABC stock never drops to $45 or below, then Mary’s order will never be triggered. There are risks to using a buy limit order. Assume Mary placed her $45 buy limit order when ABC stock was trading at $49. Then ABC stock drops to $46. Mary’s order does not trigger. After that, ABC shares climbs to $100 per share. Mary missed out on $54 of profit by not placing a market order and buying ABC shares at $46. Finally, buy limit orders are considered “day orders,” which means they expire at the end of the trading day. The exception to this is when the buy limit order is placed as GTC, meaning “good ‘til cancelled.”