|

|

By Richard Loth (Contact | Biography)

The return on capital employed (ROCE) ratio, expressed as a percentage, complements the return on equity (ROE) ratio by adding a company's debt liabilities, or funded debt, to equity to reflect a company's total "capital employed". This measure narrows the focus to gain a better understanding of a company's ability to generate returns from its available capital base.

By comparing Earnings Before Interest and Tax (EBIT) or net operating profit to the sum of a company's debt and equity capital, investors can get a clear picture of how the use of leverage impacts a company's profitability. Financial analysts consider the ROCE measurement to be a more comprehensive profitability indicator because it gauges management's ability to generate earnings from a company's total pool of capital.

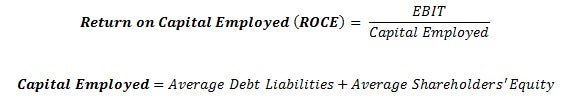

Formula:

|

Components:

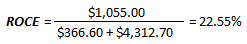

As of December 31, 2005, with amounts expressed in millions, Zimmer Holdings had operating profit of $1,055 (income statement). The company's average short-term and long-term borrowings were $366.60 and the average shareholders' equity was $4,312.70 (all the necessary figures are in the 2004 and 2005 balance sheets), the sum of which, $4,679.30 is the capital employed. By dividing, the equation gives us an ROCE of 22.55% for FY 2005.

Variations:

There are various takes on what should constitute the debt element in the ROCE equation, which can be quite confusing. Our suggestion is to stick with debt liabilities that represent interest-bearing, documented credit obligations (short-term borrowings, current portion of long-term debt, and long-term debt) as the debt capital in the formula.

Commentary:

The return on capital employed is an important measure of a company's profitability. Many investment analysts think that factoring debt into a company's total capital provides a more comprehensive evaluation of how well management is using the debt and equity it has at its disposal. Investors would be well served by focusing on ROCE as a key, if not the key, factor to gauge a company's profitability. An ROCE ratio, as a very general rule of thumb, should be at or above a company's average borrowing rate.

Unfortunately, there are a number of similar ratios to ROCE, as defined herein, that are similar in nature but calculated differently, resulting in dissimilar results. First, the acronym ROCE is sometimes used to identify Return On Common Equity, which can be confusing because that relationship is best known as the return on equity or ROE. Second, the concept behind the terms return on invested capital (ROIC) and return on investment (ROI) portends to represent "invested capital" as the source for supporting a company's assets. However, there is no consistency to what components are included in the formula for invested capital, and it is a measurement that is not commonly used in investment research reporting.

Proceed to the next chapter on Debt Ratios here.

Or, click here to return to the Financial Ratio Tutorial main menu.

-

Investing

InvestingEvaluating a Company's Capital Structure

Learn to use the composition of debt and equity to evaluate balance sheet strength. -

Investing

InvestingWal-Mart's 5 Key Financial Ratios (WMT)

Identify the five key financial ratios that fundamental analysts use to evaluate Wal-Mart's (WMT) financial position to determine if it is a good buy. -

Investing

InvestingUPS Stock: Capital Structure Analysis

Analyze UPS' capital structure to determine the relative importance of debt and equity financing. Identify the factors influencing financial leverage trends. -

Investing

InvestingHigh Return On Equity Businesses

Companies with high returns on equity usually see an increasing stock price in the future. -

Investing

InvestingAnalyzing Oracle's Debt Ratios in 2016 (ORCL, SAP)

Learn how the debt ratio, debt-to-equity ratio and debt-to-capital ratio are used to evaluate Oracle Corp.'s liabilities, equity and assets. -

Investing

InvestingHow Return On Equity Can Help You Find Profitable Stocks

It pays to invest in companies that generate profits more efficiently than their rivals. This is where ROE comes in. -

Investing

InvestingLowe's Stock: Capital Structure Analysis (LOW)

Examine Lowe's Companies' equity capitalization, debt capitalization and enterprise value to analyze trends in the retailer's capital structure.