Many options traders rely on the "Greeks" to evaluate option positions and to determine option sensitivity. The Greeks are a collection of statistical values that measure the risk involved in an options contract in relation to certain underlying variables. Popular Greeks include Delta, Vega, Gamma and Theta. Rho is another value you may encounter (click here for an explanation).

Δ Delta – Sensitivity to Underlying's Price

Delta, the most popular options Greek, measures an option's price sensitivity relative to changes in the price of the underlying asset, and is the number of points that an option's price is expected to move for each one-point change in the underlying. Delta is important because it provides an indication of how the option's value will change with respect to price fluctuations in the underlying instrument, assuming all other variables remain the same.

Delta is typically shown as a numerical value between 0.0 and 1.0 for call options and 0.0 and -1.0 for put options. In other words, options Delta will always be positive for calls and negative for puts. Call options that are out-of-the-money will have Delta values approaching 0.0; in-the-money call options will have Delta values that are close to 1.0. It should be noted that Delta values can also be represented as whole numbers between 0.0 and 100 for call options and 0.0 to -100 for put options, rather than using decimals.

ν Vega – Sensitivity to Underlying's Volatility

Vega measures an option's sensitivity to changes in the volatility of the underlying, and represents the amount that an option's price changes in response to a 1% change in volatility of the underlying market. The more time that there is until expiration, the more impact increased volatility will have on the option's price.

Because increased volatility implies that the underlying instrument is more likely to experience extreme values, a rise in volatility will correspondingly increase the value of an option. Conversely, a decrease in volatility will negatively affect the value of the option.

(Editor's note: Greek-language nerds will point out that there is no actual Greek letter named vega. There are various theories about how this symbol, which resembles the Greek letter nu, found its way into stock-trading lingo.)

Γ Gamma – Sensitivity to Delta

Gamma measures the sensitivity of Delta in response to price changes in the underlying instrument and indicates how Delta will change relative to each one-point price change in the underlying. Since Delta values change at different rates, Gamma is used to measure and analyze Delta. Gamma is used to determine how stable an option's Delta is: Higher Gamma values indicate that Delta could change dramatically in response to even small movements in the underlying's price.

Gamma is higher for options that are at-the-money and lower for options that are in- and out-of-the-money. Gamma values are generally smaller the further away from the date of expiration; options with longer expirations are less sensitive to Delta changes. As expiration approaches, Gamma values are typically larger, as Delta changes have more impact.

Θ Theta – Sensitivity to Time Decay

Theta measures the time decay of an option – the theoretical dollar amount that an option loses every day as time passes, assuming the price and volatility of the underlying remain the same. Theta increases when options are at-the-money, and decreases when options are in- and out-of-the money. Long calls and long puts will usually have negative Theta; short calls and short puts will have positive Theta. By comparison, an instrument's whose value is not eroded by time, such as a stock, would have zero Theta.

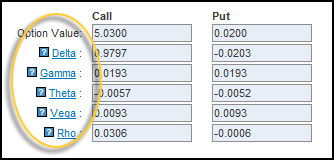

Trading and analysis platforms, as well as online calculators, provide options traders with current Greek values for any options contract. Figure 12, for example, shows the Delta, Gamma, Theta, Vega and Rho values for both call and put options. These values will change as other variables, such as strike price, change.

|

| Figure 12: The Greeks |

For more on this, read the tutorial Options Greeks.

Options Pricing: Conclusion

-

Trading

TradingThe Ins and Outs of Selling Options

Selling options can seem intimidating, but with these tips you can enter the market with confidence. -

Trading

TradingThe Basics Of Option Price

Learn how options are priced, what causes changes in the price, and pitfalls to avoid when trading options. -

Trading

TradingHow and Why Interest Rates Affect Options

The Fed is expected to change interest rates soon. We explain how a change in interest rates impacts option valuations. -

Trading

TradingThe Importance of Time Value in Options Trading

Move beyond simply buying calls and puts, and learn how to turn time-value decay into potential profits.