Making deposits is a key part of maintaining a checking account. If you don't make deposits, your checking account will run out of money. You won't be able to make payments from it, withdraw cash from it or buy anything using your debit card. In this section, we'll explain how to get money into your checking account so things keep running smoothly.

How to Make a Deposit

There are several ways to make a deposit, whether you’re depositing a check or cash. But first, you’ll need to prepare your deposit.

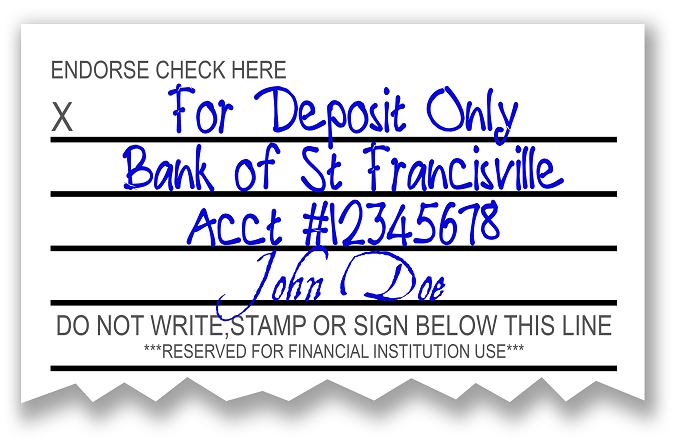

When you receive a check to deposit, flip it over. There are usually a few lines on one end of the check that say "Endorse Here." Sometimes you’ll also see “Do not write or stamp below this line” – make sure to endorse the check above that wording, as shown here. You can sign your name first, or after you put in the other information.

Endorsing a check means signing your name on the back. The bank will reject any check you try to deposit that isn't endorsed. Depending on the bank and the deposit method, you may also need to write “For deposit only” and the number of the account you are depositing the check to. If you’re depositing cash, count it up so you know how much you’re depositing.

Making Deposits in Person at a Branch

The old-fashioned way to deposit a check or cash is to visit a branch of your bank in person, wait in line and present the money to the teller along with a deposit slip, which is usually available at a stand near where the line starts. If you have a checkbook, you may also find deposit slips there. Here's a sample:

The deposit slips available at the bank will not contain any of your account information, whereas the ones that come with your checkbook will, saving you a minute compared with filling in your information on the bank’s generic deposit slip. List each check by check number and amount where indicated on the deposit slip. If you’re depositing cash, list the total amount on the line designated for cash.

When you reach the teller, you may need to swipe your ATM card and/or present your photo ID. Then the teller will deposit your money into your account and, if you wish, give you a receipt.

Making Deposits at an ATM

If you’re making a deposit at an ATM, the process for endorsing a check is the same, but you will not need to fill out a deposit slip. And while you can withdraw money from any bank’s ATM, you’ll need to use one of your own bank’s ATMs to make a deposit. If you use an online-only bank, you may be able to make deposits at certain ATMs. You can generally deposit both checks and cash at ATMs.

Insert your debit card in the machine and enter your personal identification number (PIN) to access your account. Follow the instructions on the screen to tell the system which account to deposit your money to. Then, you will usually key in the amount of your deposit. Some ATMs don’t require this step, however, because they will read your checks or count your bills when you insert them, then ask you to verify the amount before finalizing your deposit. Depending on the ATM, you will then either put your deposit in an envelope before putting it into the ATM or you will put it directly into the ATM without an envelope. Get a receipt for your deposit in case there is a problem with the way it credits to your account – this is unlikely, but it’s better to be prepared.

Making Deposits Online or by Smartphone

The most convenient and easiest way to deposit a check, once you get the hang of it, is to use your smartphone. Many banks have mobile apps that allow you to use your phone’s camera to snap a photo of the front and endorsed back of the check, type in the check amount and tell the app which account to deposit the check to. Making deposits online follows a similar process, except that you’ll need to scan your checks or transfer photos of your checks from your camera or smartphone to your computer before you can upload them. Your bank will let you know how long to keep the paper checks for. After that time has passed, you can shred them.

Making Deposits by Mail

If you can’t visit an ATM or a branch – and you don’t want to deposit your checks online or using your smartphone – you can make deposits of checks (but not cash) by mail. You’ll need to get your bank’s mailing address for deposits, endorse your check and write “for deposit only” on the back to make it more difficult for someone to cash your check if they steal it from the mail. Enclose a completed deposit slip in your envelope. Mail deposits are the slowest way to gain access to your deposits since your check has to go through the mail before it can be processed by your bank and clear.

Receiving Direct Deposits

You can also add money to your account by having your employer directly deposit your paycheck to your account, if your employer offers this payment method. This arrangement can make life easier for both you and your employer. If you are paid by direct deposit, the funds should be available to you on payday. You won’t experience the lag time that you would if you had to deposit a paper check. Some banks will waive monthly fees or offer other incentives if you have your paycheck deposited directly. Other types of payments that you can receive by direct deposit include annuity payments, dividend and interest payments, pensions, bonuses and commissions, Social Security benefits, child support payments, Veterans Administration benefits and more.

Direct deposits are conducted via automated clearing house transfer, more commonly known as an ACH transfer. This type of transaction is a way of sending money electronically. It often takes several days for the transaction to complete, but there are generally no fees involved. The sender can decide what date the payment will be available to the recipient, which is how you can get your money on payday without delay via direct deposit. To conduct an ACH transfer, you'll need to give your name, bank account routing number and account number to the company or institution you want to receive money from.

Transferring Funds Electronically from Another Account

ACH transfers can also be used to transfer money between financial institutions. For example, if you have a checking account with a particular bank and a brokerage account with a particular investment company, you can use ACH transfer to send money from your checking account to your investment account (or vice versa).

Here's another example of how you might deposit money to your account electronically: Suppose you have a PayPal account connected to an eBay seller account, which you use to earn money by selling toys, clothes and other items from your home that you no longer want. You might prefer to conduct all your banking activities from your primary checking account, so you first need to transfer the money you’ve earned from your PayPal account to your bank. You can do this online through the PayPal website or through the PayPal mobile app by providing your banking information.

You can deposit money to your bank account after receiving money from friends, family or people you work for through an online payment service like Venmo, PayPal or Popmoney. Once the money is in that account, you can then transfer the money to your checking account. Sometimes there is a fee associated with these transactions.

Funds Availability

Banks place holds on customers' deposits to protect themselves from fraud. It’s not that they are suspicious of you in particular; that’s just their general policy. When you look up your bank account balance at the ATM or online after making a deposit, you may see a difference between your account balance and your available balance. This lets you know that a deposit you've made hasn't cleared yet. It's extremely important to be aware of how your bank's deposit hold policy works so that you don't get penalized for trying to make a payment with money you don't yet have access to. The bank's hold policy will always apply to business days, not calendar days. A business day is any day that is not a Saturday, Sunday or federal holiday.

How long you'll have to wait to access deposited funds varies. According to the U.S. Treasury's Office of the Comptroller of the Currency, a bank has some flexibility in the hold times it imposes on deposits: It can make them available immediately, or it can delay deposit availability up to the maximum length of time prescribed by law under federal regulation CC. There may also be cutoff times, which vary by bank, that affect when your deposited funds will become available. For example, a bank might state that deposits must be received by 9:00 p.m. ET for same-day credit, and funds will generally be available the next business day. The account agreement you receive when you open a checking account will explain your bank's rules on deposit holds, but here are some general guidelines.

- When you are a new customer who has had an account with the bank for 30 or fewer calendar days, the bank is allowed to hold your deposits longer under the Expedited Funds Availability Act.

- Larger deposits, especially those over $5,000, usually take longer to credit to your account than smaller deposits. Banks can hold deposits in excess of $5,000 for up to five business days and sometimes longer.

- Cash deposits are generally available by the next business day. Cash may not be available immediately even if deposited with a teller.

- Government checks deposited via teller will be available no later than the next business day.

- Direct deposits become fully available to you the next business day following the deposit. (That’s why you might see your paycheck in your account late on Thursday night—so you can access the money on payday, on Friday, instead of having to wait until Monday.)

The U.S. Treasury's Comptroller of the Currency has more details on the rules regarding the availability of deposits on its website, Answers About Funds Availability.

Federal Deposit Insurance: Spread Out Your Money to Be Safe

Federal deposit insurance protects consumers' bank account balances up to a certain amount as long as they're at a legitimate bank that is a member of the Federal Deposit Insurance Corporation (FDIC). According to the FDIC, since its creation in 1933, “no depositor has ever lost even one penny of FDIC-insured funds."

Under legislation passed during the financial crisis of 2008, FDIC insurance protection was expanded from $100,000 to $250,000 per depositor across all accounts of the same category. If the amount of money you keep in bank accounts exceeds current federal deposit insurance limits, you'll need to do some planning so that if a bank fails, all of your money will be protected, not just the first $250,000. There's nothing wrong with doing this – it's perfectly legal. If your account balance exceeds FDIC-insured limits and you want to make sure all your money will be safe, visit the FDIC's website for more information. Ally Bank also has a helpful page explaining how you could achieve $2 million in FDIC coverage at the same bank by using a variety of accounts. You can also, of course, keep your money in more than one bank to spread your risk.

In the next section, you'll learn how you can use ATMs and debit cards to access the funds in your checking account.

Banking: Debit Cards and ATMs

-

Personal Finance

Personal FinanceWhere to Put Your Cash: Call Deposit vs. Time Deposit Accounts

Time deposit accounts and call deposit accounts allow customers to earn higher interest in exchange for less access to their cash. -

Personal Finance

Personal FinanceThe Complete Guide to Checking Accounts

Here is the A to Z of checking accounts: types of accounts, basics on check writing, debit cards, overdraft protection and much more. -

Tech

Tech5 Useless Financial Products That Will Disappear Soon

Bank deposit slip: what's that? Everyday tools of our financial life that went from indispensable to obsolete. -

Personal Finance

Personal FinanceBank Account Tips For Young People

If you’re just getting started with managing your own bank account, these tips will show you how to do it right. -

Investing

InvestingBest 2016 IRA Promotions (ETFC, BAC)

Here are some of the best IRA promotions of 2016, with significant bonuses for large deposits. -

Personal Finance

Personal Finance10 Bank Promotions That Pay You to Open an Account

Find out which banks are running cash promotions and will pay you just for opening a new account. -

Personal Finance

Personal FinanceYour Second Chance at Checking

If you've made a few banking mistakes in the past, several banks offer "second chance" checking accounts that overlook your history. -

Personal Finance

Personal FinanceThe History of the FDIC

Find out why this corporation was developed and how it protects depositors from bank failure. -

Personal Finance

Personal FinanceHow to Break up With Your Bank

Find out how to easily switch banks, whether traditional or internet, to help you secure lower fees, higher interest rates, and better customer service.