Not to be confused with maturity – which is how long a fixed-income investment lasts – bond duration measures how long it takes, in years, for an investor to be repaid the bond’s price by the bond’s total cash flows.

Using duration, you can estimate how much a bond’s price is likely to rise or fall if interest rates change (the bond’s price sensitivity), and it can be thought of as a measurement of interest rate risk. Remember that interest rates and bond prices move in opposite directions: When interest rates rise, bond prices fall, and vice versa. As maturity increases, duration also increases and the bond’s price becomes more sensitive to interest rate changes.

For each of the two basic types of bonds the duration is the following:

Zero-Coupon Bond. Duration is equal to its time to maturity.

Plain Vanilla Bond. Duration will always be less than its time to maturity.

In general, the higher the duration, the more a bond's price will drop as interest rates rise (and the greater the interest rate risk). As a general rule, for every 1% change in interest rates (increase or decrease), a bond’s price will change approximately 1% in the opposite direction, for every year of duration. If a bond has a duration of five years and interest rates increase 1%, the bond’s price will drop by approximately 5% (1% X 5 years). Likewise, if interest rates fall by 1%, the same bond’s price will increase by about 5% (1% X 5 years).

Here’s an example: Assume you want to buy a 15-year bond that yields 6% for $1,000, or a 10-year bond that yields 3% for $1,000. You think interest rates are going to rise over the next three years, so you’ll consider selling the bond before it matures.

If you held the 15-year bond to maturity, you’d get $60 each year and would receive the $1,000 after 15 years. If you held the 10-year bond to maturity, on the other hand, you’d get $30 each year and would receive the $1,000 after 10 years.

If you buy the 10-year bond, you would only lose 7% (-10% + 3%) if interest rates rise by 1%. The 15-year bond would lose 9% (-15% + 6%) if rates rose the same amount. As such, you’d probably buy the 10-year bond based on the fact that you anticipate rising interest rates.

Factors that Affect Duration

Certain factors can affect a bond’s duration, including:

- Time to maturity. The longer the maturity, the higher the duration, and the greater the interest rate risk. Consider two bonds that each yield 5% and cost $1,000, but have different maturities. A bond that matures faster – say, in one year – would repay its true cost faster than a bond that matures in 10 years. Consequently, the shorter-maturity bond would have a lower duration and less risk.

- Coupon rate. A bond’s coupon rate is a key factor in calculation duration. If we have two bonds that are identical with the exception on their coupon rates, the bond with the higher coupon rate will pay back its original costs faster than the bond with a lower yield. The higher the coupon rate, the lower the duration, and the lower the interest rate risk.

Macaulay Duration

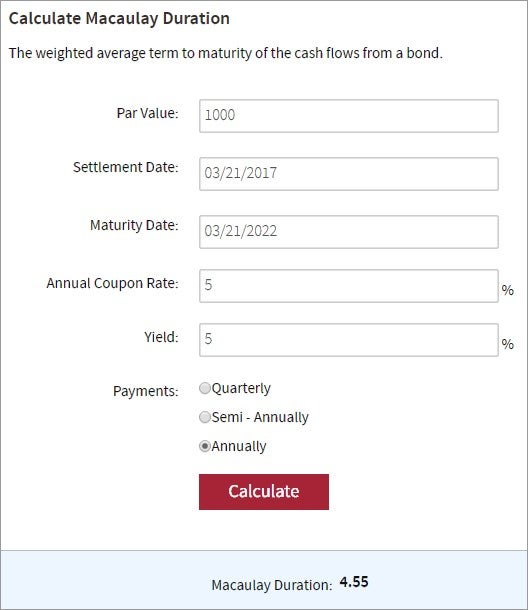

A commonly used method to calculate duration is the Macaulay duration, developed by Frederick Macaulay in 1938. Because the formula is complicated and time consuming, most investors use calculators to do the math. A good one is Investopedia’s Macaulay Duration Calculator. To determine duration, enter the par value, settlement date, maturity date, annual coupon rate and yield, and select the payment frequency.

Using the calculator, let’s assume we have a five-year bond with a par value of $1,000 and a coupon rate of 5%. The coupon is paid annually, and the interest rate (yield) is 5%. The calculator shows that the Macaulay duration of the bond equals 4.55 years.

Investopedia’s Macaulay Duration Calculator determines the bond in our example has a duration of 4.55 years.

There are other ways to calculate duration:

- Modified duration. A modified version of the Macaulay model that accounts for changing interest rates. Use Investopedia’s Modified Duration Calculator.

- Effective duration. A method that uses binomial trees to calculate the option-adjusted spread.

- Key-rate duration. This method calculates the spot durations of each of the 11 “key” maturities along a spot rate curve. These include the three-month, and one, two, three, five, seven, 10, 15, 20, 25 and 30-year portions of the curve.

Duration and Bond Price Volatility

The following factors determine how sensitive a bond’s price is to interest rate changes:

High Duration

In general, bonds with a long duration have a higher price fluctuation than bonds with a short duration.

Coupon Rate and Term to Maturity

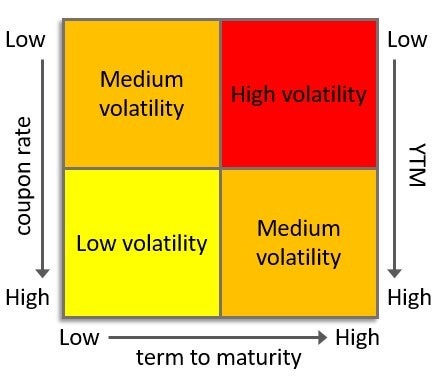

If term to maturity and a bond’s price remain constant, we’ll see an inverse relationship between the coupon and volatility:

- the higher the coupon, the lower the volatility

- the lower the coupon, the higher the volatility

As a result, if you want to invest in a bond with minimal interest rate risk, a good choice would be a bond with high coupon payments and a short term to maturity. If you think interest rates will decline, a good bet would be a bond with low coupon payments and a long term to maturity, since these factors would magnify the bond’s price increase.

Yield to Maturity

The sensitivity of a bond’s price to interest rate changes also depends on its yield to maturity (YTM). YTM is affected by the bond’s credit rating, so bonds with poor credit ratings will have higher yields than those with better ratings. As a result, bonds with poor credit ratings typically have lower price volatility than bonds with excellent ratings.

These factors work for and against each other, and affect the degree to which bond prices change in response to prevailing interest rate changes, as demonstrated in the following chart:

Duration principles to remember:

- Changes in the value of a bond are inversely related to changes in the rate of return.

- Long-term bonds have greater interest rate risk than short-term bonds.

- As the bond coupon increases, its duration decreases and the bond becomes less sensitive to interest rate changes.

- As interest rates increase, duration decreases and the bond becomes less sensitive to future rate changes.

Advanced Bond Concepts: Convexity

-

Financial Advisor

Financial AdvisorWhy Bondholders Should Manage Duration Risk

Bonds and bond funds are fixed-income investments, but their duration, combined with changes to interest rates, can lead to price fluctuations. -

Investing

InvestingWhy You Should Avoid Fixating on Bond Duration

Financial advisors and their clients should then focus on a bond fund’s portfolio rather than relying on any single metric like duration. -

Investing

InvestingHow Rising Interest Rates and Inflation Affect Bonds

Understand bonds better with these four basic factors. -

Financial Advisor

Financial AdvisorHow Rising Rates Impact Bond Mutual Funds

The interest rate increase by the Fed was one of the most widely anticipated in history. Here's what it means for bond mutual funds. -

Investing

InvestingThe Basics Of Bond Duration

Duration tells investors the length of time it will take a bond's cash flows to repay the investor the price he or she paid for the bond. A bond's duration is stated as a number of years and ... -

Investing

InvestingInvesting in Bonds: 5 Mistakes to Avoid in Today's Market

Investors need to understand the five mistakes involving interest rate risk, credit risk, complex bonds, markups and inflation to avoid in the bond market. -

Investing

InvestingHow To Evaluate Bond Performance

Learn about how investors should evaluate bond performance. See how the maturity of a bond can impact its exposure to interest rate risk. -

Investing

InvestingComparing Yield To Maturity And The Coupon Rate

Investors base investing decisions and strategies on yield to maturity more so than coupon rates. -

Investing

Investing5 Fixed Income Plays After the Fed Rate Increase

Learn about various ways that you can adjust a fixed income investment portfolio to mitigate the potential negative effect of rising interest rates.